We have taken considerable on-line criticism (and even insults) for our probability calculations that point to a decline in gold prices for the medium-term. Despite the push-back from the gold-bug-perma-bulls, the picture is still pointing to a decline in gold prices, and as long as the FED continues to favor a tightening stance, the path of least resistance for gold will be down.

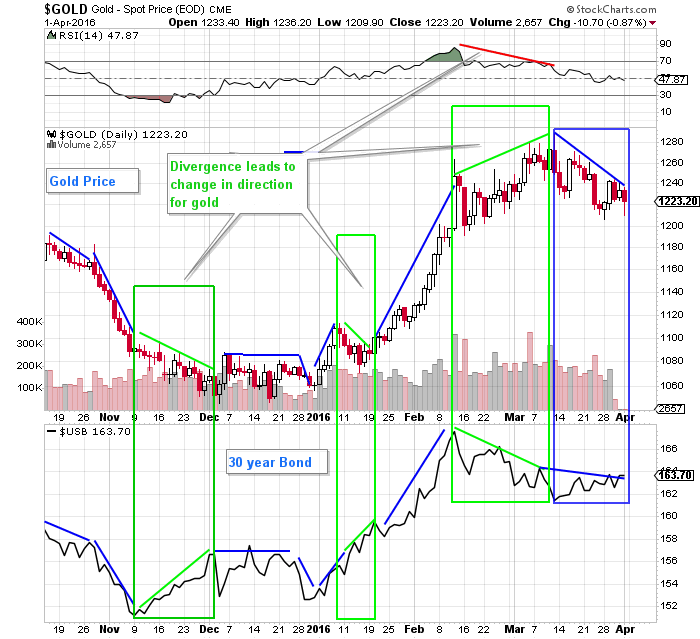

The chart below, demonstrates the synchronised move between gold and the 30-year bond (blue rectangle).

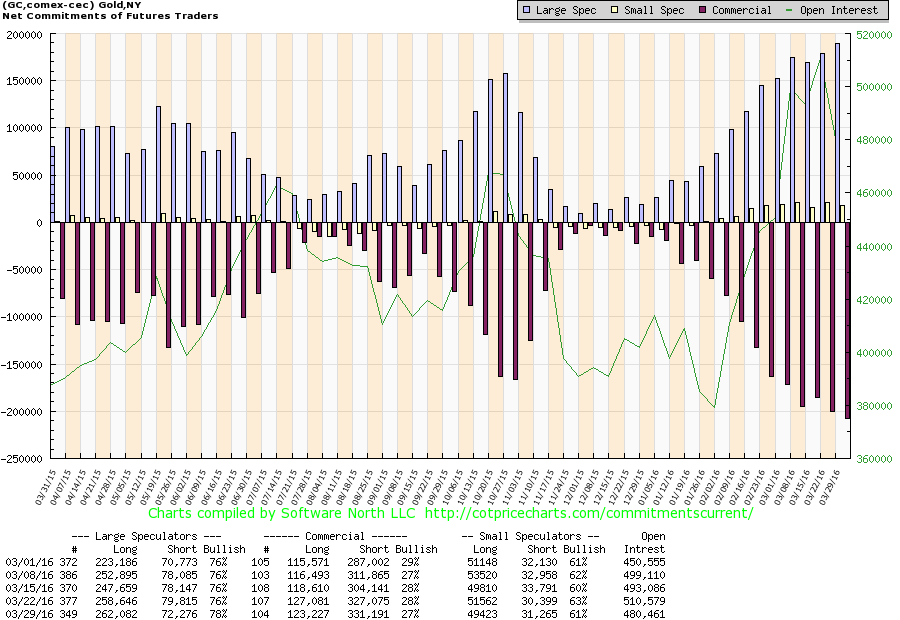

Below is a comparison of the gold price with the commitment of traders. Notice the continued high short interest of the commercial traders which indicates their expectation of a future price drop. We remind readers that commercial traders are usually correct.

Notice how speculators, both small and large are more heavily committed to the long side than at anytime in the previous twelve months. They are usually wrong, and this time isn’t likely to be any different.

The long play in gold is too crowded and the exits are narrow; bulls will pay dearly to get out in a panic.

ANG Traders

Join us at www.angtraders.com and replicate our trades and profits.

Read more by ANGTraders