The Position Remains the Same

- Gold is a patient spec long here with great risk-reward

- Gold is a reversal on a stop out

- Stocks offer worse risk reward, but shouldn't have to wait long

Updates

Gold is nowhere. And historically, sideways is bearish for Gold. China is back from holiday, but their economy is in bad shape. No savior in the east. However, the copper crushing on lack of presumed Chinese demand without Gold and Silver following suit is a good thing.

Long Gold with Reversal Potential

Original Gold Reports

October 9th: Long above $1250 with $1300 Target- here's why (link)

We are suspicious of V-shaped bottoms in Gold but honor the technicals and acknowledge our own subjectivity. Our personal preferred trade is to Sell the $1200-$1250- $1300 butterfly, with the objective it will go out worthless. The assumption is we will not be at $1250 in 30 days. Limited risk, limited reward. Set it and forget it

October 6th: Rickards: The Endgame is Inflation, I Focus on the Endgame (link)

...the week ended on some good news for Gold. We got a non-confirmation on the RSI. We had hoped for this in our previous post today. This means a long trade is safe to put on right now with a stop out of 1242 print or a 1248 settle. From an oversold position, if $1250 holds, a rally to $1300 before selling back off is not unreasonable.

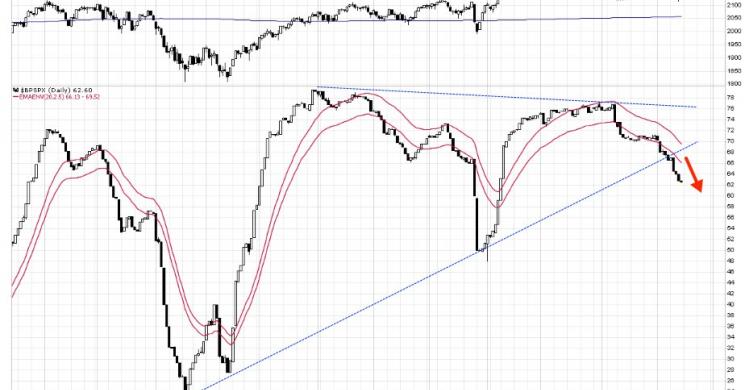

Short ES- looking better

-consider selling here with 2047 stop loss and 2092 target

-unhedged puts might be the easiest play 10 delta 30-90 days out

Previous Reports

This looks compelling

It Started with this Chart

1- the Fed is more likely to raise rates now that Hillary seems a lock. (Sick right?)

2- Double inside weeks frequently resolve lower within 4 weeks (today was end of week 1)

Read more by Soren K.Group