2015 closed out with some disappointing economic data: Chicago Purchasing Managers Index fell to 42.7 in December from 48.7 in November (a number below 50.0 denotes a contraction in manufacturing activity), the lowest reading since July 2009: The Order Backlogs Index dropped 17.2 points to 29.4 which is the lowest level since May 2009 and the steepest monthly decline since March 1951. We wonder what the FED makes of these numbers. What do they think these statistics predict about inflation and future rate hikes?

As we have opined recently, a good Non-Farm Payroll (NFP) number (or two) is not a sufficient reason to raise rates. The FED has a dual mandate to lower unemployment, and to maintain a 2% inflation rate. It is starting to look increasingly obvious that they are not fulfilling their second mandate. At the time of the December rate hike, inflation was at 1.5% and the only assumption we could make at the time was that the FED was expecting inflation to rise significantly in the near future. The latest Chicago PMI number is a very strong indication that inflation is NOT going to increase any time soon and that the FED has hiked rates prematurely.

If inflation doesn’t increase, then the FED will find itself in an embarrassing situation; they will have to backtrack on the rate hike and perhaps even reintroduce Quantitative Easing. That would be a not-too-subtle admission that FED monetary policy alone has been unable to nurse the economy back to health

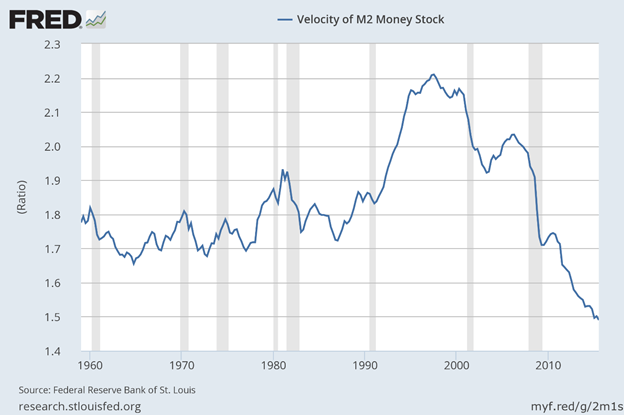

One glance at the graph below and it should be obvious why we don't have inflation; money is not moving.

Fiscal policy has been absent for the most part, and in its place we’ve had a big dose of wishful thinking with the expectation that low interest rates would encourage corporate America to invest and rescue the economy. That, of course, has not happened. Corporations have not made the required investments in education, healthcare, transportation, and civil engineering projects that would lay the foundation for a vibrant economy.

The only entity capable of investing in this infrastructure is the Government, and since it has spent all of its allowance on bailing out the banksters, and since they are politically unable to increase taxation, the investments have not materialized. 2016, being an election year, may bring some badly needed fiscal spending. We are hoping.

As far as gold is concerned, the reduced expectations of further rate hikes has helped stall the fall in prices. Our Price Modelling System has moved from negative to neutral on gold so we will continue to watch from the bench.

The S&P 500 finished the year essentially flat (-0.6%), while our portfolio was up 17.6%. We are proud to report that we had 29 winning trades out of 31, that is a 94% success rate.

Our System continues to register a neutral reading on the S&P 500, so we will continue to hold our long positions and study what happens during the first week of trading in the new year.

We wish our subscribers a very happy, healthy, and wealthy New Year!

Regards,

ANG Traders www.angtraders.com info@angtraders.com

Read more by MarketSlant Editor