COT: Silver Shorts Cover, Gold Specs Add:

-by Doug P.

Silver

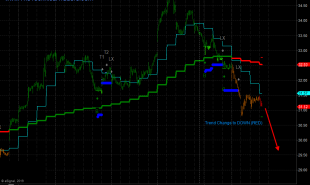

- Large Speculators: the volumes are light, but the ratio is worth mentioning. Those covering shorts accounted for 2805 contracts while those getting long were a mere 835. This obviously smacks of short-covering rally. More so because it happened on the heels of the Brexit vote, and after Gold rallied. Almost like some fund had bigger things to worry about. And then after that, took care of their Silver exposure.

- Small Specs: accounted for 1759 lots of short covering, while adding no longs

- Commercials: added 6100 shorts while adding 835 longs.

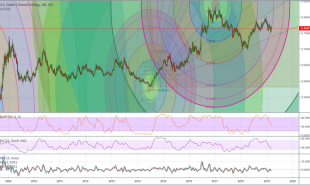

Silver Weekly Chart with Open Interest

Silver Comments:

- Open Interest: up in a rally is generally bullish. Up near all time highs is not- Neutral

- Speculators: were covering shorts. This was not a greed fueled rally, more of a fear based one. - Slightly Bullish

- Commercials: their sell/buy ratio was 6 to 1. Whereas the Commercial open interest is 3 to 1. Commercials are leaning into this- Bearish

What does it mean?

- We just ended the first half of the year. This is not insignficant as funds have to report to investors, and could have been the main driver behind Silver's late-to-the-party but hogging-the-dance-floor behaviour. End of Q2, End of 1st half. Short funds closing trades. Maybe a fund blew up. Wouldn't be the first time.

- If you look at open interest and see that longs and shorts are at an extreme, it should give you pause. But when fresh money is investing in the market, traders often see slow stochastics bounce off 100% for weeks. That indicator is meaningless when it does that because it has not digested the fresh money: The "New Normal" so to speak.

- the report does not have the 3 biggest days in it.

- Bill Cinton bought some Silver for AG Loretta Lynch's grandkids?- Doug P.

If this trend continued for the rest of the week, then we have a bonafide short squeeze. We dont neccesarily see anyone forcing a squeeze yet. That doesn't mean they didn't. The market is not as transparent as people would have you believe.

But we'd speculate that funds with losses in other areas started to liquidate their silver shorts after their bigger issues were alleviated. And as a percentage of their caputal at risk werent' as price sensitive as they were in need of reducing margin. They could have had a Gold/ Silver spread on. Again just speculating. But if we were long Gold and short silver, and the position worked for us right after brexit, we'd be inclined to lift our short position in the hopes of driving Gold higher and generating sell liquidity.

For us, the technicals are bullish. Cash Flows are bullish as both large and small specs are covering. The bear side is commercials are not afraid. . Sounds like pull backs above 1800 can be bought. That is not a recommendation. That is a risk reward. If you are trading, think for yourself. Open interest went up 5700 contracts, new sellers on the commercial side. We call that "weak hands to strong hands behavior". It means the funds covered shorts, while their deeperpocketed commercial players sold into the rally. So bullish now bearish later. One source we trust actively in Silver for 30 years said "this smells like the beginning". That said, we both laugh at how we sold our stock positions in 2009. So take it for what it's worth.

Even Though the COT report comes out on Jul1, its is accurate through Tuesday June 28th. So the biggest 3 day move Silver has had in some time is not reflected in the report here.

Kitco Gold Survey Says Gold to Keep Gains

Silver COT Report: Futures

Large Speculators

Commercial

Long

Short

Spreading

Long

Short

107,555

23,894

22,274

56,671

151,872

613

-2,805

3,948

835

6,100

Traders

100

54

40

41

45

Small Speculators

Open Interest

Total

Long

Short

211,396

Long

Short

24,896

13,356

186,500

198,040

382

-1,465

5,778

5,396

7,243

non reportable positions

Positions as of:

162

124

Tuesday, June 28, 2016

© SilverSeek.com

Silver COT Report: Futures & Options Combined

Large Speculators

Commercial

Long

Short

Spreading

Long

Short

108,256

22,439

35,322

62,686

160,651

1,803

-1,903

-1,571

-1,149

4,315

Traders

109

56

61

49

47

Small Speculators

Open Interest

Total

Long

Short

232,748

Long

Short

26,484

14,335

206,264

218,413

-1

-1,759

-918

-917

841

non reportable positions

Positions as of:

184

144

Tuesday, June 28, 2016

© SilverS

FULL REPORT

Traders' Commitments

This report, from the Commodity Futures Trading Commission, is updated weekly and released on Friday afternoon. The CFTC requires any person or firm trading a certain number of contracts to report that trading. The number of contracts that triggers the reporting requirement varies by commodity. A commercial hedger is a large trader who also deals in the commodity on a cash basis. A large speculator is a non-commercial trader who has no dealings in the underlying commodity. The number of contracts traded by small traders is derived by subtracting the positions of larger traders and commercial hedgers from the total of all positions.

June 28, 2016

Number of Contracts and Changes from Previous Week

Contract/Category

Long

Long Chg.

Short

Short Chg.

Copper

Large Speculator

53,692

-10,147

73,506

-23,259

Commercial Hedger

83,357

-12,428

60,873

-427

Small Trader

12,651

-3,357

15,321

-2,246

Corn

Large Speculator

440,231

-69,546

151,116

-29,776

Commercial Hedger

598,307

-46,460

811,251

-70,154

Small Trader

121,930

-2,431

198,101

-18,507

Crude Oil

Large Speculator

510,395

-4,832

206,156

9,524

Commercial Hedger

600,141

12,646

907,925

2,849

Small Trader

91,896

1,661

88,351

-2,898

Eurodollars

Large Speculator

1,296,697

15,604

1,292,758

-170,656

Commercial Hedger

5,863,473

-101,995

5,558,485

92,312

Small Trader

793,623

-7,848

1,102,550

-15,895

Gold

Large Speculator

373,128

14,303

71,208

5,112

Commercial Hedger

127,169

7,387

453,490

21,571

Small Trader

49,131

1,620

24,730

-3,373

Live Cattle

Large Speculator

85,326

-1,863

69,935

725

Commercial Hedger

100,695

546

108,663

-2,180

Small Trader

25,451

-793

32,874

-655

S & P 500

Large Speculator

9,077

457

7,415

2,780

Commercial Hedger

45,138

18,032

35,055

1,351

Small Trader

29,044

64

40,789

14,422

S & P 500 (E-Mini)

Large Speculator

506,355

-3,618

444,424

-10,729

Commercial Hedger

2,016,153

128,523

2,090,478

143,281

Small Trader

346,324

42,789

333,930

35,142

Silver (Comex)

Large Speculator

107,555

613

23,894

-2,805

Commercial Hedger

56,671

835

151,872

6,100

Small Trader

24,896

382

13,356

-1,465

Soybeans

Large Speculator

311,052

-6,014

58,978

-15,605

Commercial Hedger

321,970

-47,525

530,615

-42,059

Small Trader

54,499

-6,129

97,928

-2,004

Sugar (No. 11)

Large Speculator

346,059

-3,666

32,988

579

Commercial Hedger

363,089

-29,723

729,596

-37,518

Small Trader

89,395

-5,007

35,959

-1,457

T-Bonds (Chicago)

Large Speculator

137,609

-36,302

71,606

1,166

Commercial Hedger

247,044

9,407

333,923

-28,140

Small Trader

155,085

-1,523

134,209

-1,444

Wheat (Chicago)

Large Speculator

107,849

-10,107

177,677

8,515

Commercial Hedger

186,836

-12,026

121,397

-30,197

Small Trader

46,049

2,296

41,660

1,845

Yen

Large Speculator

85,493

6,095

25,743

-1,359

Commercial Hedger

30,249

-201

88,316

1,324

Small Trader

25,006

-7,005

26,689

-1,076

All data as of latest Tuesday. Table Courtey Barron's

- Soren K.

Read more by Soren K.Group