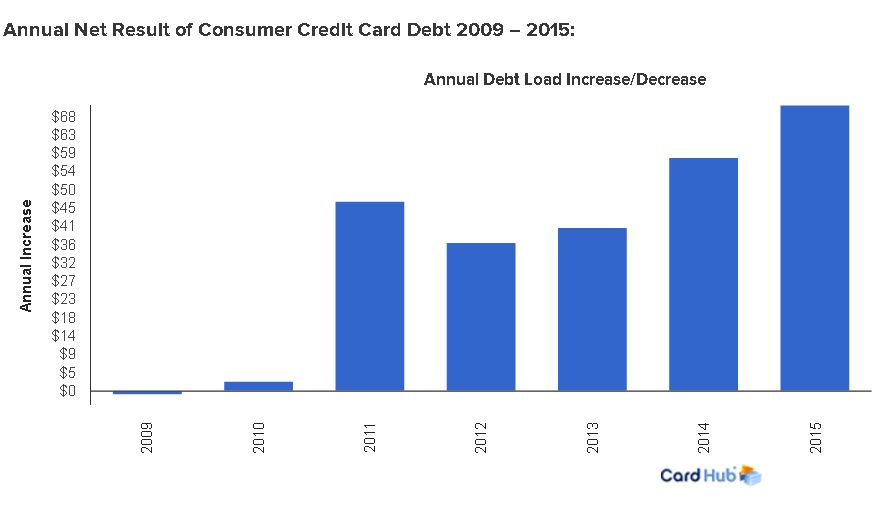

The much anticipated retail sales figures for April are out and to the relief of the stock market and the Federal Reserve they were better than expected. The April report showed retail sales increased 1.3%, well above expectations for a 0.3% decline. Core sales was also much stronger than expected rising 0.8%, beating expectations for a 0.6% increase. I have mixed feelings about this data because I think we are putting way too much pressure on the American consumer. Domestic demand has been one of the few bright spots of the U.S. economy and the central bank hoping that this will be enough to drive growth this year. They think that if consumers can do the heavy lifting then they can start normalizing interest rates. That is why there was so much riding on today’s number. If retails sales were weaker than expected or even in line with the gloomy outlook then it is obvious that this bright spot is starting to dim and that leads to bigger questions about the health of the U.S. economy. However, I question whether consumer spending is sustainable to drive growth. The reality is that there are only so many TV’s, vehicles, couches, washer and dryers that a person can own. And a major question that needs to be answered is how people are paying for this. Earlier this year, Cardhub.com released a report about consumer debt in 2015. According to the website’s research the average consumer owns almost $8,000 on their credit cards. Last year, total credit card debt soared to more than $70 billion, a 24% increase from 2014.

“We are now perilously close to a tipping point at which balances become unsustainable and delinquency rates skyrocket, which could lead to a considerable constriction in credit availability. All of this has us wondering: Is 2016 the next 2008 for credit markets,” the website said in its report. This is just credit card debt, what about car loan and mortgages? The U.S. saw record car sales in 2015 as people bought more than 17.4 million vehicles and there are expectations that this year could even surpass last year. We can’t live on credit forever and the economy is going to be in tough shape when the bill is finally presented, especially if the Federal Reserve gets its way and starts increasing interest rates.

Yes interest rates won't go very high but it will be enough for cosnumers to see a difference in their monthly credit card statement. I just hope its not enough to cause massive defaults.

Read more by Just_another_wiseguy