This overlooked play offers defense, explosive growth potential, and liquidity for when Britain actually exits the EU...

Investors who live in a "five-day" world have a mighty short collective memory. In the markets, 38 days might as well be 100 years.

Certainly no one in the financial media is looking back to June 24, 2016, anymore. As you'll see, that could be a costly mistake.

Of course, that's the day after the United Kingdom's historic European Union membership referendum ended in a shock "Leave" result; the day that saw global markets plunge by more than 5% in most cases, wiping out trillions in wealth, and sending the pound sterling to multi-decade lows.

Michael A. RobinsonThen again, since U.S. markets have gone on a historic rocket ride in the weeks since, with all indexes repeatedly crushing record highs, it's understandable that investors have "forgotten" the Brexit's initial shock and moved on.

Now that might be okay… if only for the fact that Britain hasn't actually done anything yet. The real Brexit – the day the UK grabs its bags and steps out of the EU's door – is yet to come, and there are ominous signs that things could get downright ugly as that day approaches. It has the potential to make the Brexit vote shock look tame by comparison.

That means there's plenty of time (and upside) left in this "high-tech gold" defense maneuver I'm about to show you…

Of Grexit, Brexit, Bitcoin, and Blockchains

Despite its proven value as a currency, Bitcoin just isn't getting much love in the mainstream investing world, here or in Europe.

But there are concrete signs that state of affairs is changing in Europe. That's largely down to two events.

One was the Brexit vote.

You see, as the vote drew closer and "Leave" versus "Remain" options appeared to be in a statistical dead heat, gold jumped 3% in a week.

That was exciting, and a great development, but it was totally expected. British and European investors with massive exposure to sterling were making a run to safety.

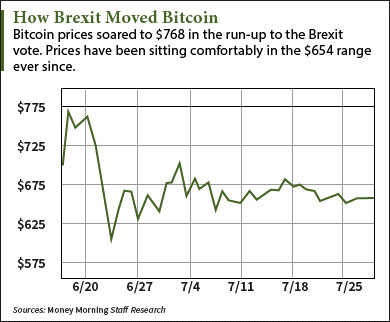

But gold wasn't all they were buying… At the time of the vote, massive amounts of cash began to boost Bitcoin's value, sending it soaring nearly 9% to around $768.

Gold owners looked good, Bitcoin owners looked even better, but Britons who kept their holdings in sterling wound up looking close to 8% poorer.

Investors, analysts, and politicians who once threw shade on Bitcoin's prospects are starting to change their tune, in a bid to catch up to the visionaries who always had a grasp on the cryptocurrency's true potential.

Bitcoin is fast becoming more than a viable safe haven for computer users and privacy activists, in part because it's got a proven history of delivering during times of European instability and volatility.

Here's what I mean…

The "Grexit" First Clued Investors In to Bitcoin's Value

Last summer, during the "Grexit" saga, Greeks suffered under tight capital controls which saw them limited to just €60 per day in cash withdrawals. Alternative currencies – especially Bitcoin – and bartering naturally flourished in such an environment. At the time, in 2015, the turmoil surrounding the Greek debt crisis sent Bitcoin on its best 18-month run to date.

Some Greeks interviewed by Reuters went so far as to credit Bitcoin with saving them from going hungry or broke. That's not likely to happen in the UK, among the top tier global economies, but that reliability and liquidity helped "set the stage" for Bitcoin's outstanding Brexit performance.

And so the renegade currency is entering the European mainstream, comfortably. As of right now, more than 200,000 Bitcoin transactions are made each and every day.

There's a lot more ahead.

Much More on Money Morning...

Read more by MarketSlant Editor