Summary:

The timing of the Fed and BOJ releases is ominous and a potential FUBAR situation. For this reason we think an event of coordinated action is in the works. As to action itself, we think it is going to be opposite day with the Fed tightening if the BOJ eases. The reverse is highly improbable. but the timing is important and could "tell" us what comes next.

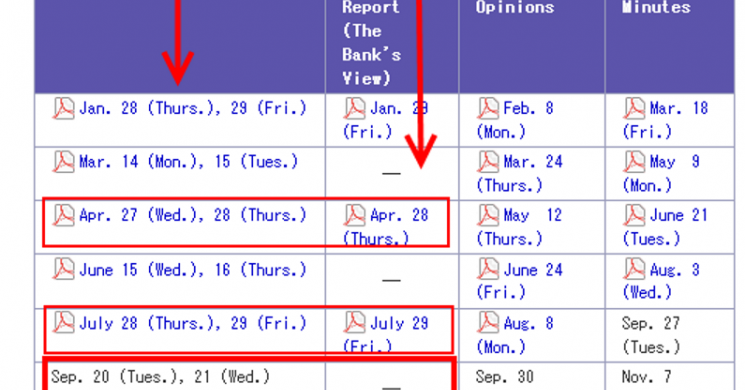

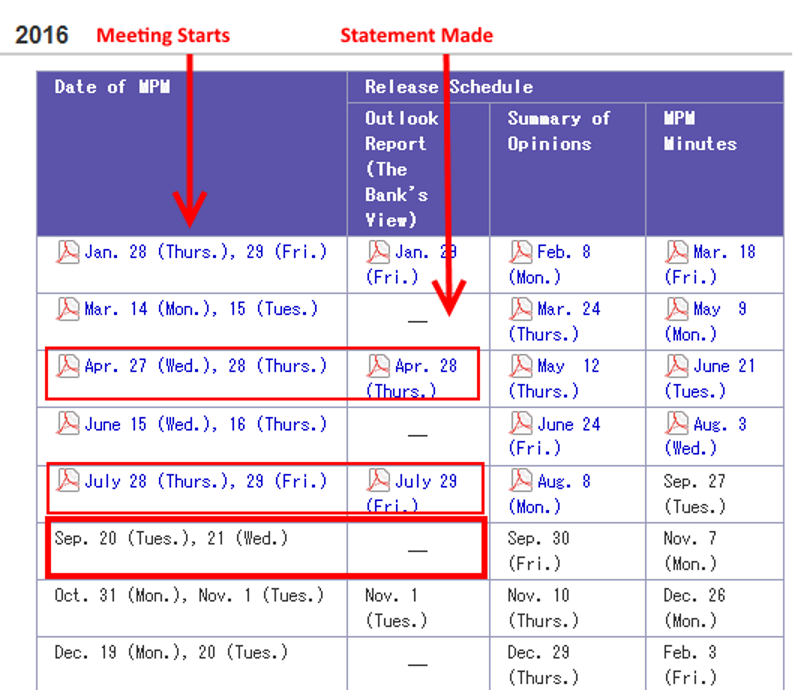

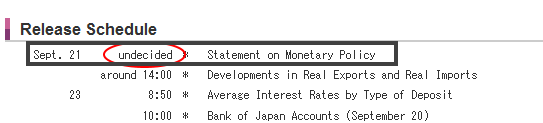

From the BOJ Website: The meeting starts Tuesday. Statement Should be Wednesday.

Why it Matters To Gold

In this increased world of coordinated Central Bank Action the timing matters more. Potential scenarios offer violent differences in market reactions. If the BOJ announces it is lowering rates BEFORE the US makes its announcement, Gold could spike and dump in an hour's time. Momentum buyers in Gold and Stocks could get killed.

Our Assumptions:

- The US Fed wants to hike but cannot justify it yet

- the BOJ needs to ease but has concerns about its banks in a flat yield curve

Stagflation: Why It's Back in 5 Charts

Mapping out the Times

The BOJ Announcement may happen before the Fed Announcement

Historically, when Fed and BOJ meetings are this close, the BOJ defers making its announcement until after the US Fed does in some sort of coordinated deference. However, given the narrow window described below that may not happen. And it may just suit them all fine.

From the BOJ Web Site

- BOJ may have a surprise easing announcement pre long weekend

- Last time BOJ announced before US Fed was 10/14 when the BOJ surprised with a QE announcement

- which makes total sense, as Big Brother FED can measure its own reactions after the BOJ move

BOJ Date Release Will Likely not hit until Wednesday according to CNBC

"The Bank of Japan starts a two-day meeting Tuesday with any policy announcement not expected to reach investors until after markets close in Tokyo Wednesday.

The following two days leading to the weekend are holidays in Japan leading one analyst to speculate that this could be the perfect time for the central bank to announce market-sensitive changes."

Thursday and Friday are holidays in Japan. This makes the BOJ announcement window even narrower.

Speculation: If the BOJ has a surprise for the markets, this is a good time to do it. Something like a straight rate cut without a JGB buy back. There is precedent in their Oct 2015 action.

- They have bullets to lower rates- from minus 10 to minus 30 basis points if they want (JPM)

- They can't buy too many more JGBs- they own 40% now, and a steeper yield curve protects the banks somewhat

- They could do nothing and state they are prepared to act to ease if warranted- keep their powder dry ( h/t Peter Hug)

- If mkts believe, then Yen stable.- don't think so

- If disbelief, then Yen soars and the prophecy is self fulfilling

- combined with a Fed hike, helps yen, but kills markets

If #3 above happens that makes it more likely for a Fed hike if the Yen buys what the BOJ sells it

Potential Scenarios and Their Effect on Gold

- Gold Trampled- BOJ makes Surprise Easing Announcement Before US Fed has Announced

- Global Stocks and Gold Rally

- US Fed tightens rates in their own announcement- this is perfect cover for their desire to hike

- Stocks get whipped lower in US

- Gold gets hammered from weaker yen/stronger dollar moves

- Gold Soars: Fed Announces first, does not tighten

- Fed Does not Raise Rates

- Gold, Stocks rally

- BOJ Eases- Stocks rally

- Gold remains firm despite the Weaker Yen/USD- because that means the EU is next to ease, and Fed will tighten in Dec, but just so it can release its own QE Kraken later

- Gold Softer: Fed announces a tightening

- Current long fund exposure has already been paired- A dip to buy especially if the BOJ eases.

- Any tightening now is just to reload their gun

- BOJ should ease then

- IF BOJ does not ease, then you have a recipe for disaster in markets

- Gold Stronger: Fed does nothing, BOJ eases

- Fed shows that its hands are tied even with need to reload its gun incase of crisis

- December hike potential increases keeping a lid on Gold rally

Other Scenarios exist, but these are the most volatile.

Fed Crazy to Hike Unless BOJ does a QE First - AnalysisTechnical Brief: Gold, Silver, and the Fed EffectPC has Turned the NFL into a JokeIRAs:The Mechanics of Wealth Confiscation Unfolds

Good Luck

Read more by Soren K.Group