Markets continue to digest yesterday’s release of the Federal Open Market Committee (FOMC) minutes but some analysts are wondering if markets have misinterpreted the data and may be overestimating Fed tightening this year.

“The markets are realizing that the hawks on the FOMC now have quite a bit of ammunition,” said the authors of popular newsletter the Daily Shot.

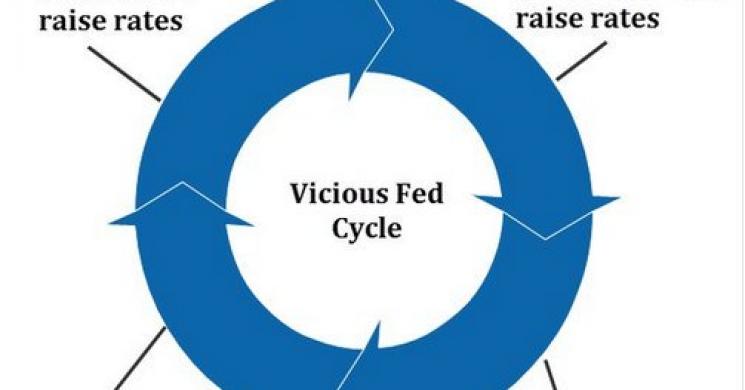

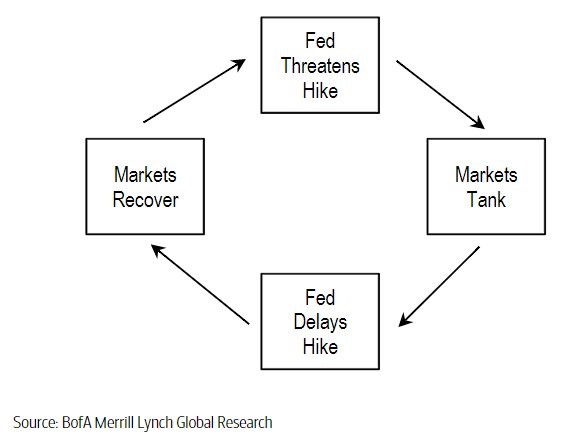

“But haven't we been here before? Will the threat of a more aggressive rate hike trajectory tighten US financial conditions, forcing the Fed to pause? Or is it different this time?” they questioned.

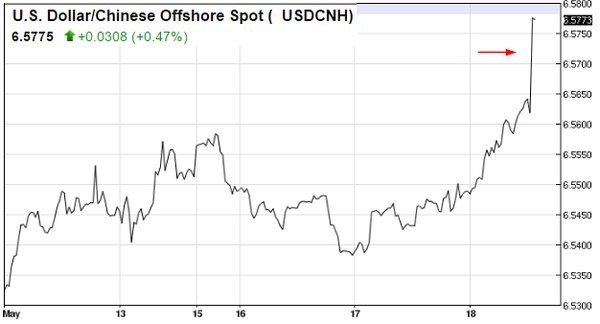

In response to the minutes, the U.S. dollar rallied (the dollar-yen broke through 110), while treasuries and gold sold off.

“One of the more troubling currency moves in response to the FOMC minutes was the drop in the offshore yuan. Are the markets ready for more RMB depreciation and capital outflows from China?” the authors noted.

So were the latest FOMC minutes just noise?

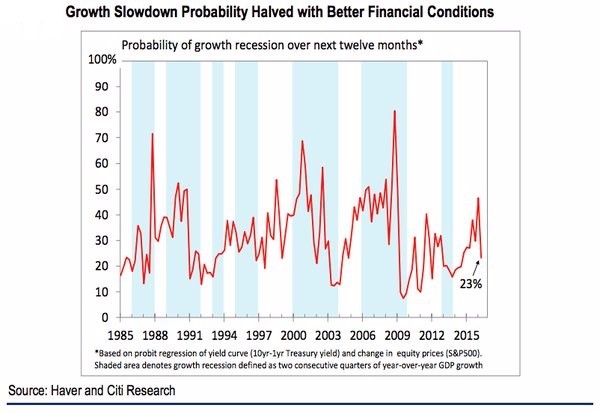

Check out the chart the authors highlighted below, nothing that the “economic slowdown probability” is moving higher again as “financial conditions tighten.”

Regardless of whether or not the Fed will raise rates in June or not, all this FED talk has got me thinking of one song...

Read more by Wall St. Whisperer