“Total political crap.”

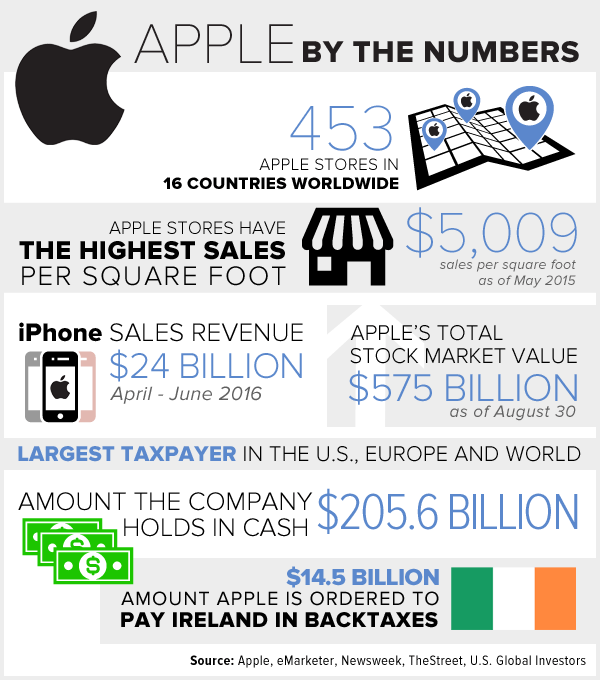

That’s how Apple CEO Tim Cook described the European Commission’s ruling that the iPhone maker must pay 13 billion euros ($14.5 billion), plus interest, in back taxes to Ireland, its longtime European host. Meanwhile, the island-nation is being accused of giving Apple an “illegal” sweetheart deal in exchange for jobs.

Political crap, indeed. I hate to say it, but I told you so.

June’s Brexit referendum, I’ve argued, was about so much more than immigration. U.K. citizens and businesses are fed up with mountains of rules and regulations from unelected bureaucrats in Brussels, controlled by French and German socialists, that trample on basic personal freedom. There are ludicrous laws on the books legislating everything from the kind of lightbulbs you can use to the wattage of your vacuum cleaner to the curve and length of your bananas and cucumbers to the color of your olives.

Now, Ireland is learning a similarly hard lesson on Brussels’ policies of envy.

It’s a plotline that should be reserved for the Theater of the Absurd: Party A is forced by Party B to pay Party C, in a transaction that neither Party A nor Party C had a hand in creating.

Apple insists it has no outstanding taxes. “We never asked for, nor did we receive, special deals,” Tim Cook wrote in an open letter last week. And yet an authoritarian, nontransparent “Commissioner of Competition” is ordering the company to shell out an arbitrarily exorbitant amount to the government of Ireland—which doesn’t even want Apple’s money.

And why would it? As you might imagine, Ireland fears risking a stain on its tax advantaged status that has succeeded in attracting hundreds of billions in foreign direct investment.

Eurocrats Envious of Ireland’s Competitive Advantage and America’s Ingenuity

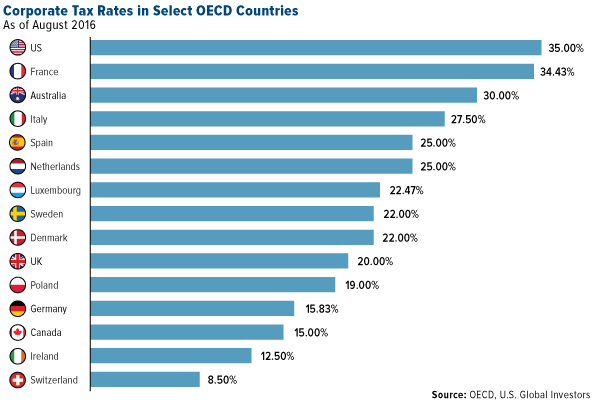

Over the last 50 years, the country has carved out a reputation as a prime destination for multinationals seeking a competitive corporate tax rate. At 12.5 percent, Ireland’s rate is much more attractive than the U.S. rate, 35 percent, one of the highest in the world. (Other countries with similarly high rates include Argentina, Brazil and Venezuela—not exactly model examples of business-friendly regimes.)

Consider what Ireland has achieved: PricewaterhouseCoopers (PwC) ranks it “the most effective country in the EU in which to pay business taxes.” For five years in a row, the country has topped IBM’s Global Location Trends report for its “continued ability to attract high-value investment projects in key areas.” The most recent IMD World Competitiveness Yearbook names Ireland first in the world for “investment incentives” and “financial skills.” According to the World Economic Forum, it’s the fastest growing European economy (followed by Romania, which I wrote about in July). The list goes on.

For these reasons and more, nine out of the top 10 global information and communications technology (ICT) companies have locations in Ireland, not to mention nine out of the top 10 global pharmaceutical companies and nine out of the top 10 global software companies, according to Ireland’s Industrial Development Agency.

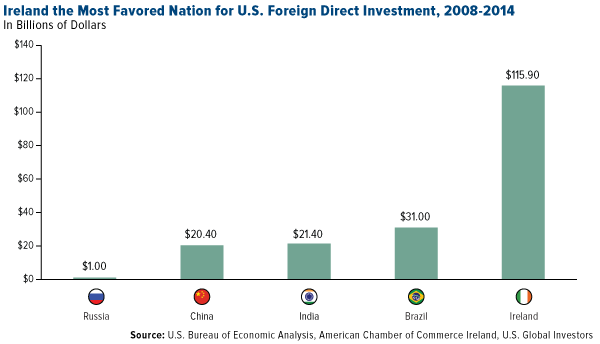

The country’s relationship with American-based companies has been particularly beneficial to its economy and workforce. U.S. companies account for three quarters of Ireland’s inward investment, which totaled nearly $116 billion in the years from 2008 to 2014. That’s more than U.S. investment in the four BRIC countries combined over the same period. About a fifth of all private sector jobs in Ireland are in some way linked to American multinationals. Apple alone employs 6,000 Irish citizens, most of them in Cork, where Steve Jobs originally opened an Apple factory in 1980.

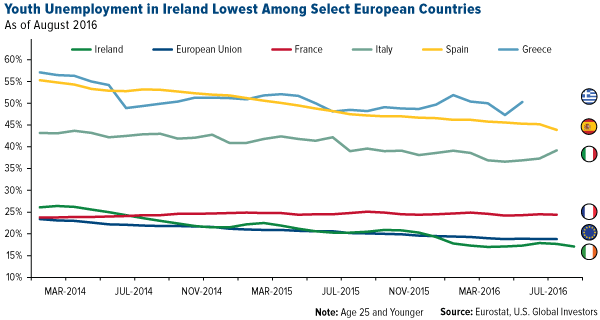

Thanks to low corporate taxes that attract big multinationals, youth unemployment in Ireland is today among the lowest in the EU. Restrictive, labyrinthine labor laws elsewhere in the 28-member bloc have immobilized the jobs market, especially for young people, many of whom have little choice but to seek work abroad. In May, the Financial Times reported that the number of EU nationals working in the U.K. had climbed to 2.1 million, accounting for close to 7 percent of its workforce—a new high.

Both Apple and Ireland vow to appeal the European Commission’s ruling, a process that will likely take years.

Next Up: Irexit?

The real question now is whether the Apple incident will motivate Ireland to follow the U.K.’s lead and pursue its own “Irexit” from the European Union. In June, I asked if we’re nearing the end of the EU experiment. If officials continue to oppose competition and restrict member states from conducting business on their own terms, entrepreneurial countries such as Ireland will increasingly feel the pressure to file for divorce.

Remember, Britain will soon be free to do what it pleases to attract foreign investment—possibly away from Ireland. London already sees an opening with Apple following the tax ruling. On Tuesday, Prime Minister Theresa May’s spokesman said the tech giant is welcome to relocate to the U.K. if things don’t work out between Ireland and the EU.

This would be a high price for Ireland to pay to retain its EU membership status.

Apple Just the Beginning

American multinationals are likewise in a difficult position, as they face mounting pressure from EU regulators and tax officials. Europe doesn’t have its own versions of Apple, Facebook and others, so its only course of action is to legislate them into being noncompetitive.

I previously shared with you the European Commission’s proposal to require streaming services such as Netflix and Amazon Prime Video to meet a content quota. Under the plan, at least 20 percent of all programs offered in their libraries would need to be produced in Europe.

Like Apple, Starbucks was ordered in October 2015 to pay up to $33 million in back taxes to the Netherlands, a ruling the Dutch government has already appealed. McDonald’s and Amazon’s tax arrangements in Luxembourg are also being scrutinized, and Google could be added to the list.

Speaking of Google, its Madrid office was raided in June by Spanish tax inspectors, who are accusing the search giant of tax avoidance.

In yet another case, Google and Facebook could both end up having to pay licensing fees to European newspapers, magazines and other publications every time their content ends up in their search results.

WhatsApp, the most-used messaging app in the world, and its parent company, Facebook, are both currently being investigated by EU privacy regulators.

This is just a sampling of what American companies must put up with in order to do business in Europe.

The question stands: Instead of attacking American innovation and ingenuity, why don’t Europeans develop their own competitive alternatives?

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. None of the securities mentioned in the article were held by any accounts managed by U.S. Global Investors as of 6/30/2016.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission ("SEC"). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Read more by Frank Holmes