5 Things To Keep in Mind About Energy Now

Our additions in italics- Soren K.

- Product prices had lagged crude because of high inventories.- that is now reversing

- Record US Crude Exports are being partially offset by increased Canadian flow- The overhang isn't going away

- Underestimating the quantity of Shale Oil may happen based on how markets handled the Nat Gas Shale growth- this could go both ways

- For now, technological efficiencies may have peaked in shale oil production- Moore's law of computing stalls?

- Wind and Solar are catching up to Nat Gas in capacity additions.- not to mention coal is back in play, like it or not.

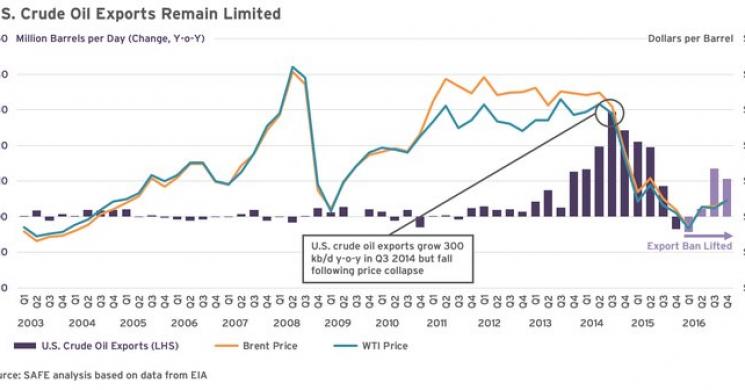

First, A Reminder of US Oil Export Increases

US crude oil exports surge in 2017 #OOTT pic.twitter.com/YfmJpFn0OY

— Punter (@chigrl) February 22, 2017

follow @chigrl for energy analysis with a healthy sense of irony- Soren K.

Pass the Parcel

Via Matt Smith and clipperdata.com

Crude prices are selling off today as gasoline holds up relatively better, as refiners playing 'pass the parcel' of bearishness betwixt the two. As refiners make economic run cuts due to lower profit margins, gasoline inventories are set to drop going forward amid lower supply....while crude inventories are set to continue to swell. Hark, here are five things to consider in oil and energy markets today:

1- Refinery runs are being reduced in response to high inventories

2- Canadian and Domestic Pipeline Flows are increasing US supply and partially offsetting the inventory decreases from exports

US waterborne crude imports this month are above both last year and February 2015, although lagging 2014's level by nearly 400,000 bpd. This lag makes sense given that domestic production and pipeline flows from Canada combined were about 10.5mn bpd in February 2014, while they have been around 12.5mn bpd for 2015, 2016, and now 2017 too. The question is, will the decline steepness of 2017 waterborne import continue, putting non pipeline imports lower than 2015 and adding ot the concept of decreased dependency on ME oil or not?

3- The Nat Gas shale Boom continually downplayed the long term effects as manifested in its term structure.

Shale Crude may follow the same "denial" or perhaps it will overcompensate the other way. One factor is exit liquidity in speculative pricing. Another difference is the greater weather based seasonality in Nat Gas demand as reflected in its sine curve term structure.

Our client's parent fund had a huge short position in 2007.That client got squeezed out in 2008. We then lived through this over-priced deferred market, absolutely dying to short Nat Gas 2008- 2012 futures but could not.

We did not do so because of 1-weather 2- exit liquidity; as our client had shown were serious risks andwas not happy with our idea. We should have just bought puts, but we didn't This is less of an issue in Shale Oil we feel. There may be more efficiency in long term pricing than there was in Nat Gas is our observation

4- Cost of Production Reductions may have peaked for Now

We'd not put too much emphasis on this yet. However, if specs are overloaded one way of the other, this would trigger a puke if a 2nd year of break even rises happened.

5- Nat Gas has Competition in Wind and Solar now.

Not to mention decreased regulation risk in coal again.

Even though natural gas will continue to see capacity additions over the next two years, wind power - and particularly solar - are set to continue to lead the charge in the coming years. Total installation of solar power last year was up a whopping 95 percent on the year prior, led by the build-out of large solar arrays (as opposed to rooftop panels). While this trend of nearly doubling is not set to persist, total installed solar capacity is set to reach 105 gigawatts by 2021, up from ~38 gigawatts now.

Matt Smith deciphers and distills what is most relevant across the energy complex into cohesive and pithy knowledge you can use. The belly laugh is a bonus.

Subscribe for Email updates HERE

Read more by Soren K.Group