Wall Street Banker:

"There is no logic. Bankers are pulling shit out of their ass saying they can hike Anyone who can count to ten knows higher US rates equals recession and sovereign insolvency. Raise rates and you'll need to do QE simultaneously ie BOJ, ECB buys UST's along with their own bonds!

It's so insane, but it's all about stability. Marc Faber today: The State will own all assets. It will monetize EVERYTHING.

Nobody alive has ever navigated waters like these... when Paul Singer and Ray Dalio say they're scared they aren't kidding."

submitted by Soren K.

Summary

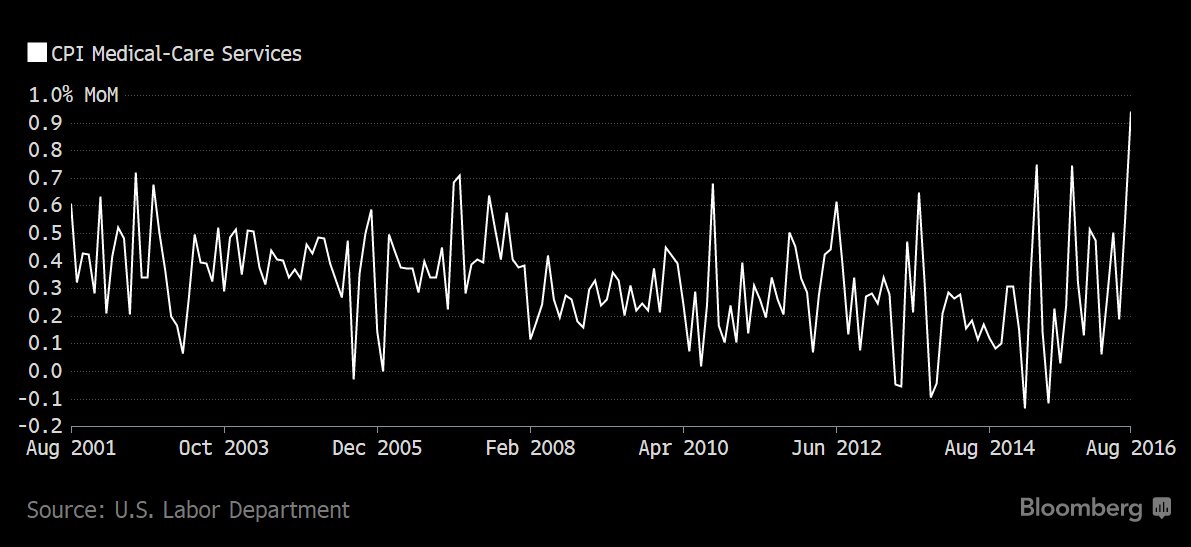

Written by Vince Lanci CPI came out today. Rents rose as did health care. It was the biggest monthly cost hike for medical services since 1990. Key measures showed inflation close to 2% in August. What follows is a description of the drivers behind the emerging stagflation and ultimately we feel inflation. We believe that the Fed will not be able to control the Inflation Genie when it is finally loose. Central Bankers should be careful for what they wish. It has taken them 10 years to stem deflation, if they even have. Why do they think they can stop the monetary pendulum in any less time when it finally swings towards inflation?

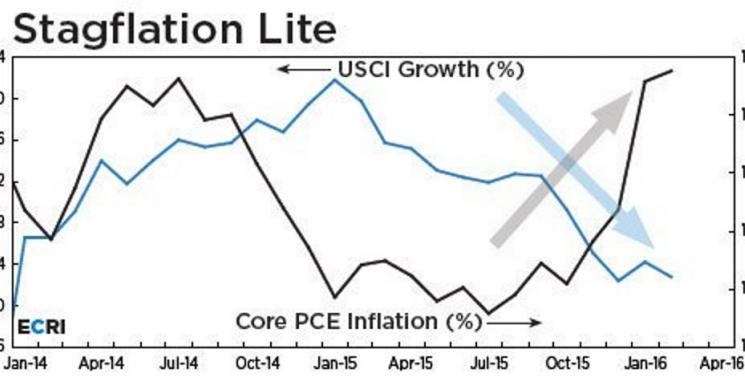

Chart 1: Things Start to Get Expensive for Consumers- also note the volatility increase. That means the Fed is losing control of the inflation genie

- The great central planning experiment is not working. In fact, it has awoken Stagflation.

It's Baaaaack

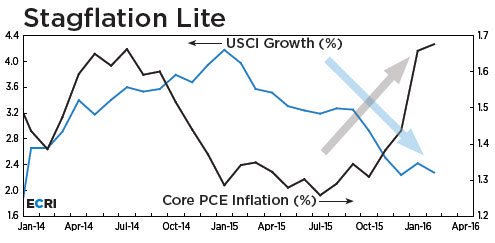

Chart 2: "Lite" is a Cute Way of Putting it.

Implications For Gold

Stagflation is traditionally not good for Precious Metals. But we feel that stagflation will not last. The Fed must prove itself right. And to do that it MUST get the economy moving again. And it will figure some way to make people spend. QE4, Helicopter Money, the permanent monetization of our debt. It does not matter how. People cling to their ideas, and the Fed Academics will act accordingly to make themselves right. Stagflation must give way to inflation. The alternative is a total monetary deflationary collapse. Look at it this way. If you are a Fed Banker, and your goal is economic growth with a touch of inflation but you only get stagflation, what do you do next? There is no way the Fed is satisfied with the inflation part without the economic growth part. They will ignore all unintended consequences to prove themselves correct. We will have either complete inflationary capitulation (Fed success) or a deflationary collapse (Fed failure). In both cases Gold is one asset that protects you.

- Buying Power in inflationary times

- Store of Value in Deflationary Confidence Collapse

Recco read Jim Rickards' book "The Death of Money" for more on this concept

- Just In case you forgot the Central Banking plan to "help" us.

Central Banking's Academic Fantasy

- Print money and buy assets

- Money ends up in the consumer's hands

- Consumers would spend and Employers would hire

- Banks would lend

- Global demand would surge

Central Banks Act on Their Fantasy

- Print Money, Then Go Shopping

Chart 3: USA Prints and Buys Stuff

Chart 4: ECB also likes to shop on credit

Chart 5: The BOJ plays catch up nicely

Chart 6: China Goes to the mall too (we miscounted)

h/t Bryan Rich of Forbes for charts

- Step One Complete. Now to kick back and watch as steps 2 through 5 take hold, right?

Why Isn't The Economy Responding As Central Bankers Hoped?

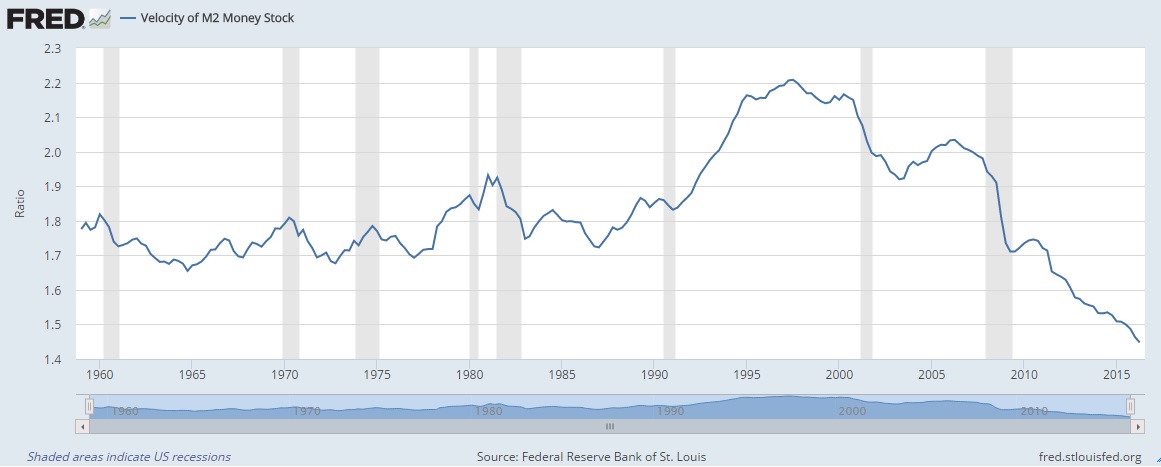

The Velocity of Money is at historic lows.

Money supply may be high, but banks are stuffing it in their mattresses to cover for mismarked assets. Consumers are using any money they have to lessen their own debts. And consumers have not gotten loans other than on credit cards. Who can afford a house now that Banks are demanding real down payments and that borrowers not be fry cooks at McDonalds?- Thus rents rise.

- Remember, the part of the Plan where people spend, and make Banks lend? About that..

People Aren't Spending: Because we are in uncharted territory. Noone has seen this before, ever. If a consumer is told he will have to PAY to keep his money in a bank, he does not act rationally. And if he is not working, he just piles on debt.

Banks Aren't Lending: They used the money given them to shore up their fraudulent balance sheets in our opinion. They had been marking their assets to MYTH (defaulted mortgages, etc) for so long, the Fed money was a bailout for them. Plus they were less likely to lend even when occasionally asked. People were borrowing money to survive, not to grow enterprises.

Bottom line: We get growth and inflation when people are confident about their financial future, jobs, earning potential … and competing for things, buying today, thinking prices might be higher, or the widget might be gone tomorrow. It’s been the opposite for the past eight years.

Negative Rates Might Be Deflationary for Now

In the end, Evil Spock acted rationally, In real life we doubt that would have happened

The Fed is Wrong About Human Behavior

People Aren't Rational

Academics are Academic

NIRP/ZIRP Is Unprecedented and Reactions to it Cannot Be predicted

Noone has experienced NIRP before.The public becomes a deer in headlights. Fight, Flight, or Freeze in psychological terms. Reason does not win when confronted with Emotion until the trigger for the emotional response has been repeated enough so the intellect can not feel under attack. Joe Sixpack counter intuitively stockpiles MORE cash in a NIRP environment. He freezes!

What does that even mean?

We are saying that what the Fed thought about consumer behavior was wrong

The Fed:

"People being charged to keep their money in the bank will just spend it instead"

The Fed assumes people react rationally to new experiences.These Bankers are in their own academic bubble. Their assumption of a rational consumer does not necessarily work when something unprecedented happens. People FREEZE.

NIRP and Emotion vs Rationality or "The Fed Needs to Get Out More"

Let's remove other factors and focus instead on emotional vs cognitive reactions in unprecedented situations. Say for a moment that our consumer is gainfully employed and has no debt.

What will he do if bank money market rates go to zero or below?

- Fed: He will spend

- US: How can you possibly know?

Proof: Emotional vs. Rational Reactions in Unprecedented and therefore stressful situations

- A Cobra is under a glass bell jar on a table

- You COGNITIVELY know the glass is impenetrable and this has been demonstrated to you.

- You are asked to put your hand on the glass knowing the Cobra cannot bite you

- The Cobra strikes at the glass and your hand pulls back

Give it a name: Emotion, Lizard Brain, fight-flight-freeze, or the Limbic System.The rational brain loses to the emotional side when confronted with unprecedented experiences.

I have personally tested this, forcing myself not just to KNOW that something cannot harm me, but to FEEL it as well.To train myself to be unafraid of something. By the 5th try, I could keep my "hand on the glass". But the lesson was learned. Emotion trumps cognition given new experiences. That must be conquered in order to evolve. The Fed does not get that stuff.

Brief Digression on Technology as a disincentive to spend: Anyone who has noticed TV prices going down sees why it is better to defer getting that new television. By the way, prices will continue to drop as companies now must dump their inventory to make way for the next generation of "Smart TV's." So guess what? That massive flat screen you just bought for $200 is worth less in 2 weeks. Because the new status will be the "Smart TV". And your daughter will make you get one.

Terminal Velocity

No money, 5 TV's and a Bank that Won't Loan me Money to Buy a Home (Okay, 7 charts)

Good Luck

- GM: The Gold-Silver Spread Gets its Shot and the View From FedLand

- HFT Spoofing Mechanics in Gold and Silver- Part 1 of 3

- Daily Digest for 15 Sept

- Spoofing: Banks Take it Upstairs- Part 2 of 3

Read more by Soren K.Group