Source: Clive Maund for Streetwise Reports 10/19/2018

Technical analyst Clive Maund charts a small-cap oil and gas company with a play in Oklahoma's SCOOP region that he sees as a strong buy.

With a market crash drawing closer the only sector we will generally be buying at this time is the precious metals sector, which is about the only sector that has not participated in the "everything bubble," and is extremely unpopular and beaten down, and has demonstrated that it will behave in a counter-cyclical manner, i.e., go up when the market tanks. The oil sector is expected to go down with the market, for the obvious reason that a recession/depression reduces the demand for oil.

However, as ever, there are exceptions, and BNK Petroleum Inc. (BKX:TSX;BNKPF:OTCQX) is one of them, for the fundamental reason that Exxon is taking an interest in it, and technically it is very cheap and showing signs that it will soon take off higher. An important tactical consideration is that due to the proximity of a strong and clearly defined support level, we can set a close stop to get us out for a minor loss in the event of it being whacked by a sudden plunge in the broad market.

On the 6-month chart for BNK we can see that, following a quite heavy reaction from May through late July, the stock has tracked sideways in a narrow range, marking out what now looks like a Triple Bottom base pattern, which fits within a much larger base that we will soon look at on the 10-year chart. An interesting point to observe is how this presumed base pattern has formed at the low of a sharp high volume intraday spike lower back in June. The duration of this range has allowed time for the 50-day moving average to drop down close to the price and for downside momentum to drop out, as shown by the MACD indicator gradually working its way back up to the 0 line, which are usually necessary preconditions for a rally.

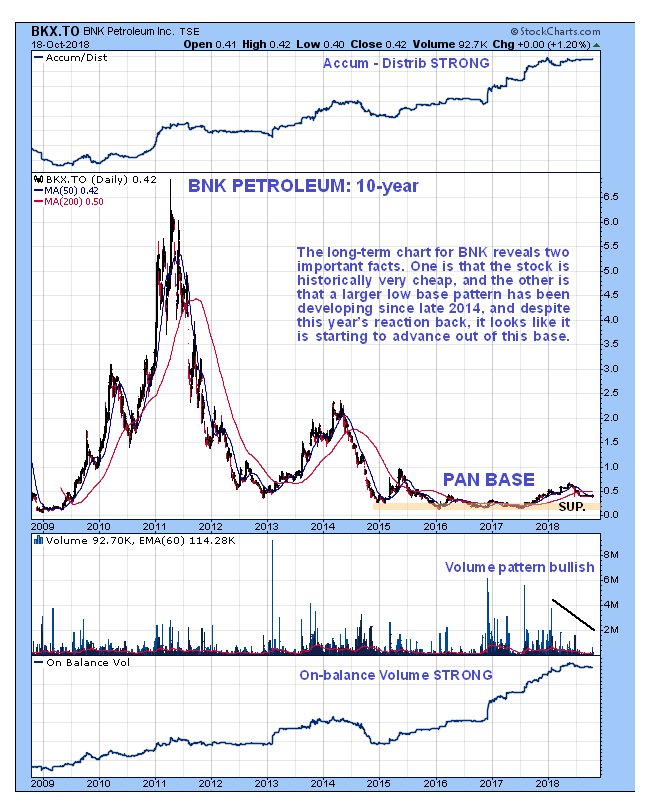

The volume pattern is bullish and of particular interest is the larger white candles that have formed over the past several days at the support, accompanied by a big build-up in upside volume that has driven the Accumulation line sharply higher so that it is at new highs – this is viewed as a quite strongly bullish development that is likely to lead to an advance and upside breakout. Thus, with the price still close to the lower boundary of the range, we are believed to be at a good point to buy here, especially as we can strictly limit downside risk and protect against the impact of a market crash by placing a stop just beneath the recent intraday lows, say at C$0.378.

The long-term chart is illuminating and reveals two important points. One is that BNK is historically very cheap: it got as high as about C$6.80 in 2011. The other is that a giant low Pan base has been forming in the stock since late 2014, or for nearly four years now, and with the rally from mid-2017 through May of this year on good volume, it is showing sings that it is getting ready to break out of it.

The conclusion is that BNK Petroleum is a strong buy here, and it is a relatively low risk play because the proximity of an important support level means that a relatively close stop may be set to limit loss in the event that the trade doesn't work out. Despite there being 232.7 million shares in issue, the stock trades in hopelessly light volumes on the US OTC market, where it should be avoided, for this reason.

BNK Petroleum website.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Read what other experts are saying about:

[NLINSERT]

Disclosure: 1) Clive Maund: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. CliveMaund.com disclosures below. I determined which companies would be included in this article based on my research and understanding of the sector. 2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: BNK Petroleum. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with BNK Petroleum. Please click here for more information. 3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. 4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of BNK Petroleum, a company mentioned in this article.

Charts provided by the author.

CliveMaund.com Disclosure: The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.

Read more by MarketSlant Editor