Ruminations on Gold by Soren K.

Enda Glynn's original headline and analysis is below. Feel free to skip to it if you are looking for technicals. We had to change the headline for fear the post would look like click bait. For we are jaded Gold people.

Bitter Gold Traders

But Enda's enthusiasm is genuine. And that pisses us off. As veterans of so many failed formations in Gold we are a bit cynical. Maybe it is us. Perhaps it is we that are the problem. To be a Gold bull over the last 20 years is to be demoralized constantly. Not unlike living with a narcissist idiot or a Jehovah witness that won't take an aspirin. They cannot get it but we keep thinking they will someday and we stick around, hoping for Gold's enemies to take that aspirin. But it never comes. It never will.

We are the idiots for believing someday that Gold's price will reflect its true value. The idiots that control Gold's price will never let it reflect its true value. And that is because they aren't idiots. Just an unholy alliance of globalist academics, coin operated politicians, and financial hucksters looking to make a commission. Gold is just too hard to brand for them to make a profit. And so, we are the idiots. I can live with that.

As to the title's second half: I began "trading" commodity futures in 1987 as an intern on a Lehman Brother's retail equity desk. I've been witness to every commodity scandal from the Sumitomo Copper play, to the MG Oil trade, to the Ashanti 1999 Gold squeeze, various Oil and NG plays and everything in between having anything to do with Energy or Metals. And let's not forget Tyson Foods' payoff to Hillary Clinton with the "Winners to HRC / Losers to Tyson" account split. My firm at the time handled some of that flow. And the "I" pronoun is a composite of 4 people contributing to this missive to stop trading metals.

Price is Not Value

Price is the boat in the water. Value is the anchor dropped and sitting on the ocean floor. The rope between anchor and boat are its volatility. The waves are price moving events. Gold is not volatile, its rope is not long from boat to anchor. But Gold is in a tiny, private ocean where some spoiled kid can make waves any time he wants to and push the price as far away as he can from the value. All he has to do is tell a producer client to sell, or turn on his stop-fishing algorithm - Fay Dress

The Cross of Gold

Some examples Gold investors have had to battle over the last 50 years include:

- Blatant Manipulation - Not just down, but up as well. Manipulation destroys a market's integrity and thus causes all but the deepest pocketed and the most connected to play. You'd have to be an idiot (or a nethical person who can resist temptation) to NOT manipulate a market that can be cornered with $1Trillion when your bank already manipulates LiBoR and Bonds.

- Market Structure - disincentivizes long ownership via collateral requirements, and other things like asymmetric access and information in a globally traded product.

- Contract Size - The contract itself is too big for participation by the regular public. It should be traded in grams, not 1000's of ounces. This causes longs to be overly leveraged as specs and makes true investors unable to afford delivery. Remember how long it took to get Stocks/ Bonds to eliminate fractional prices? That was to protect their franchises via keeping tick increments large. Contract size does the same thing

- Old Boys Network- the concentration of power is in too few hands. Producers who are represented (and fleeced) by their bankers, accounting rules, rehypothecation for example

- Stupid Money - Funds used to trading FX and bond markets are poorly educated on the propensity of Gold's liquidity gaps on exit time. Thus they create the volatility that kills themselves by trying to use stop losses on huge unfillable positions. Druckenmiller and Soros make money in Gold by happily giving up 1% on exit trades, and they are the smart ones. Its not always a spoof

- Western "Investment" Philosophy- we are trained to chase rising asset prices because of disingenuous marketers. We are now collectively Giffen good longs who buy on fear of "missing out"

- Retail as Exit Strategy - the use of retail investors to offload positions via "buy recommendations" using so called research as marketing materials.

- Government Backstop - at the extreme; government intervention to stop Buffet taking delivery of Silver in 1997, the Hunt brothers being forced to liquidate by COMEX members and producers (the shorts) who asked for Gov't intervention. The deal that Greenspan cut with Rubin to loan US Gold for GS carry trades in 1993-ish

- Press Bashing - Find me an article where Gold is in the headline in a positive way by the mainstream press. And make sure it doesn't have the word BUT after the compliment.

- The Inherent Conflict of Interest in Broker- Dealers - Metals players can act as Principal, Agency, recommender, and more without being in violation of any Regulatory laws. That is a license to steal

Maybe it is us, but why do we keep insisting Gold is a store of value when so many aspects of the market are stacked against it? Why do we even look at the daily prices? That only makes us vulnerable to salesmen saying: "Buy GLD on CNBC"

The Late Bill Hicks makes our point about Marketers for us

Gold Has intrinsic Value, But Value and Price are not the Same thing

We know Gold is the best, truest store of value on earth when it is in our hands because it does not rust, it is inert, it cannot be synthesized, and because of its malleability and ductile characteristics as well as its conductivity, if it were to ever be cheaper than copper, it would be completely consumed for those characteristics.

We also know Gold futures and GLD are the worst trading vehicle on earth for us because of its liquidity gaps, homogeneous players, contract size, and susceptibility to manipulation. We trade it going in withoureyes open. You should not trade it at all. Stop trading Gold. Buy a Gold mine instead if you believe the price will go up.

To paraphrase Peter Lynch:

Price is the boat in the water. Value is the anchor dropped and sitting on the ocean floor. The rope between anchor and boat are its volatility. The waves are events. Gold is not volatile, its rope is not longfrom boat to anchor. But Gold is in a tiny, private ocean where some kid can make waves any time he wants to push the price as far away as he can from the value

Idiots Rule

Gold fund traders, with few exceptions are the sheeple; that keep getting fleeced. And in the process they run over the public's feeble attempts to protect its own wealth.

Why does anyone trade Gold from the long side if they've no intention or resources to take delivery? What is the point of marketing an asset that is supposed to be bought on dips as a store of wealth and thus a hedge for fiat debasement, as something that should instead be chased in rallies?

Brokers do not have investors, they have traders. As a one time student of Graham & Dodd's Securities Analysis, and a protege of a CFA who drilled me on value versus price, I find it stupid to tell someone to INVEST in something because it has gone up. To buy it because "The train is leaving the station" . These are not investment recommendations.

When you buy a stock with a PE of 20, you are buying a company that is expected to take 20 years to make back the money you invested. That is an important corollary of understanding PE. Investment means buying with money you do not need for a long period of time. Anything less than a 5 year time horizon is not an investment in a business, it is a speculation on a stock. Gold is a hedge for all your investment risk and should be held indefinitely

Gold is money. Silver is Not

It may not be government accepted currency, but it is money. And it is the last thing left competing with paper money on earth. That is incentive enough to do everything in a governments power to dissuade investment in it.

Cryptos are NOT MONEY. They are a currency and well suited as a transfer of wealth from one medium to another. But they are not money yet. And wont be accepted as money until governments and Banks can co-opt their use for "our benefit and protection".

Silver is not money for the same reason Gold is money. Silver is used industrially, is "consumed", and its supply is more readily grown if needed. Gold is not consumed or destroyed

Gold will continue to be money until one of 2 things happens

- An industrial use is found for it which will make it consumed, destroyed or irrecoverable. This will drive up the price and make it no longer a stable reflection of buying power

- Gold is Synthesized - in which case its value is related to the cost of making it.

That is a paraphrase of Peter Bernstein's great book A Primer on Money, Banking, and Gold

BlockChain is Key to complete Monetization

The question is, if Gold is money, and the world will not allow it to be currency, what happens to it? This is where the blockchain phenomenon comes in. Imagine instant delivery of quantities less than 100 ounces? Imagine the cost savings dealer would enjoy and thus be able to sell gold in small increments like coins or grams with instant payment and delivery verification? Imagine banks without credit departments and offices that play the float on your money.

Gold may never be a government approved currency again. But it will continue to be money, and technologies like blockchain will make it more valuable as the pipeline between buyer and seller are made more secure.

In the meantime, stop trading Gold. Own it and keep the percentage you have as part of your portfolio stable whether that be 1, 5 of 10% .Stop playing the paper trading game. Think like China, buy to store wealth, not create it. Buy dips, not rallies.

But if you trade it as we do, keep your eyes open to the forces that influence it.

Fuck the price. Focus on the value. Use price to buy undervalued and sell overvalued. Keep its weighting constant in your overall portfolio. But stop trading it because some salesman told you to.

That said, here is Enda's EW analysis which is still spot on. And obviously Enda has not been demoralized yet!

Now if you will excuse us, we have to put in our buy order at $1231 for a day trade...

"Bullish signals keep on coming in GOLD"

by Enda Glynn of BullWaves.org

Written July 25th Post Close

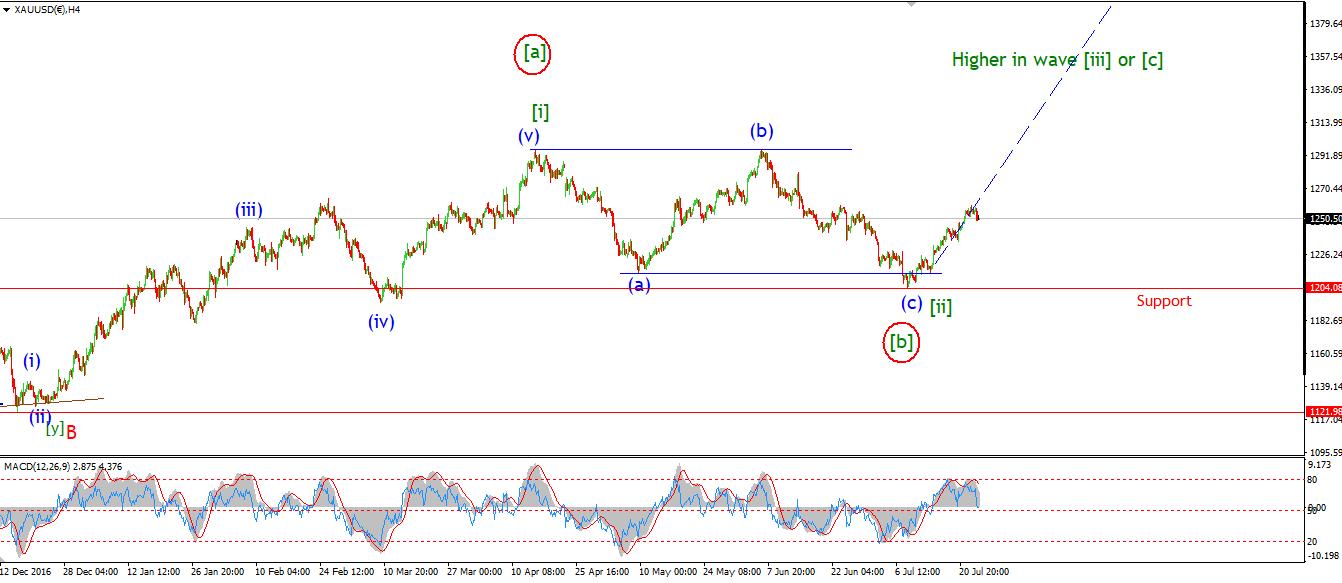

GOLD began its decline into a possible wave 'ii' brown today. The declines look corrective so far so the overall interpretation remains the same.

I have labelled the initial decline off the high as wave 'a' pink. Wave 'b' pink could be underway as I write, and wave 'c' should follow. The decline so far looks like it could be the start of a flat correction. This would trace out a 3,3,5 internal structure.

The previous fourth wave low of one lesser degree lies at 1234.97. 1231.96 is the 50% retracement level. This is a nice cluster of support and forms the likely target for wave 'ii' brown.

One measure of sentiment I follow Is the 'daily Sentiment index' This index is compiled by tradefutures.com. The index is now rising off an extreme low of 14% bulls among futures traders, which was registered last week. Another sure sign that the market is turning up now in a big way!

In fact, the more I look at the larger price structure, the more I think that 1550 is a minimum target, this rally may well take out the all time high if my hunch proves correct and the market begins a new impulse wave rather that a large degree correction.

For tomorrow; Watch for a continued decline in wave 'c' pink to complete a three wave correction. once wave 'ii' is complete, we will have another bullish Elliott wave signal in place.

30 min

4 Hours

Daily

My Bias: Long towards 1550 Wave Structure: ZigZag correction to the upside. Long term wave count: Topping in wave (B) at 1550 Important risk events: USD: New Home Sales, Crude Oil Inventories, FOMC Statement, Federal Funds Rate.

GOLD began its decline into a possible wave 'ii' brown today. The declines look corrective so far so the overall interpretation remains the same.

I have labelled the initial decline off the high as wave 'a' pink. Wave 'b' pink could be underway as I write, and wave 'c' should follow. The decline so far looks like it could be the start of a flat correction. This would trace out a 3,3,5 internal structure.

The previous fourth wave low of one lesser degree lies at 1234.97. 1231.96 is the 50% retracement level. This is a nice cluster of support and forms the likely target for wave 'ii' brown.

One measure of sentiment I follow Is the 'daily Sentiment index' This index is compiled by tradefutures.com. The index is now rising off an extreme low of 14% bulls among futures traders, which was registered last week. Another sure sign that the market is turning up now in a big way!

In fact, the more I look at the larger price structure, the more I think that 1550 is a minimum target, this rally may well take out the all time high if my hunch proves correct and the market begins a new impulse wave rather that a large degree correction.

For tomorrow; Watch for a continued decline in wave 'c' pink to complete a three wave correction. once wave 'ii' is complete, we will have another bullish Elliott wave signal in place.

USDJPY

30 min

4 Hours

Daily

My Bias: LONG Wave Structure: rally in wave [C] Long term wave count: wave [C] is underway, upside to above 136.00 Important risk events: JPY: n/a. USD: New Home Sales, Crude Oil Inventories, FOMC Statement, Federal Funds Rate.

The short term action in USDJPY was very encouraging today. The price continued to rise impulsively off the recent low, and broke back up through the 50% retracement level at 111.64, all positive signs so far.

The price structure is tracing out a possible wave '1' pink and it is beginning to look like a five wave form on the very short term charts. If the current rise breaks 112.42, That will help the bullish case immensely from here.

For tomorrow; As usual, We await a bullish Elliott wave signal off the recent low in the form of 5 waves in the direction of the trend, and 3 waves against.

DOW JONES INDUSTRIALS

30 min

4 Hours

Daily

My Bias: market topping process ongoing Wave Structure: Impulsive 5 wave structure, possibly topping in an all time high. Long term wave count: Topping in wave (5) Important risk events: USD: New Home Sales, Crude Oil Inventories, FOMC Statement, Federal Funds Rate.

The DOW rallied about 150 points today to a new all time high, And then came an immediate decline to begin a possible wave 'ii' pink.

I have shown a three wave structure underway in wave 'ii' pink off the recent high. The interim low was at 21574 today, So a three wave decline in wave 'ii' pink should finish at or just below that level tomorrow.

A further break above 21655 will likely signal wave 'iii' pink has begun. The 4hr RSI broke above the centreline again today in a final bullish signal for this rally.

On a side note:

I have noticed that President Trump has referenced the recurring stock market highs as a direct resultant of the new administrations policies. I would advise against taking credit for the bull market. Because you may well be held accountable for bear market to come!

If wave 'ii' completes tomorrow, then we can expect wave 'iii' to break out to new all time highs again before the week is out. The initial target for wave 'iii' pink lies in the region of 21877, This is a Fibonacci 161.8% projection of wave 'i' pink off the wave 'ii' low.

For tomorrow; Watch for wave 'ii' to complete in the region of 21550. And for wave 'iii' to begin from there.

Read more by Soren K.Group