Source: Clive Maund for Streetwise Reports 06/06/2018

Technical analyst Clive Maund examines the silver market and explains why he believes this is a good entry point "for all things silver."

The silver market has become so quiet that you can hear a pin drop, a most unusual situation in this normally rather volatile metal. What this means is that there is a big move brewing and probably sooner rather than later.

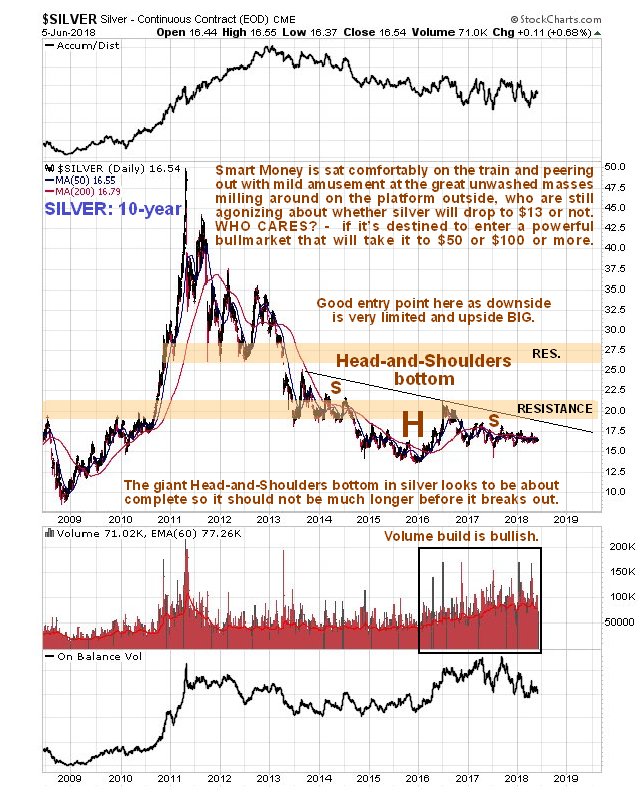

For five years now, since 2013, silver has been marking out a giant Head-and-Shoulders bottom, like gold, except that in silver's case it is downsloping because silver underperforms gold towards the end of precious metals sector bear markets, which is normal. This base pattern is mature, as we can see on silver's latest 10-year chart below, and with the Right Shoulder close to complete, the time for silver to advance out of this base pattern is at hand, and thus it is viewed as no coincidence that the dollar, which we look at in the parallel gold market update, is rolling over and looking set to drop.

As with gold, silver's base pattern can also be described as taking the form of a Bowl or Saucer, which we can see on the additional 10-year chart shown below, a second chart being used to avoid clutter. This is certainly worth knowing for as we can see, the price is making contact with the Saucer boundary right now, which means it ought to start higher again almost at once. An important point to observe is the volume buildup on the right side of the pattern, because for it to be a valid Saucer, volume should expand as the price starts to ascend as the Saucer boundary climbs beneath it. Volume has grown as the price has moved sideways for almost two years now, and should increase further as the price rises.

A 4-year chart enables us to spot something else of interest. First off we can see the Head and Right Shoulder of the Head-and-Shoulders bottom that we already viewed in its entirety on our first 10-year chart, and the giant Bowl or Saucer pattern is not shown due to practical difficulties and to avoid clutter, yet within this pattern we can also see an embedded Cup & Handle base that started to form with the drop in the summer of 2015. Like the larger pattern this Cup & Handle formation appears to be complete, with the price squeezing into the apex of the now triangular Handle of it. Thus a breakout and determined advance looks imminent, and we know to expect it because on the 10-year chart we have observed that the price is now making contact with the giant Saucer boundary.

Silver's 6-month chart shows us recent action in detail, but otherwise is of limited use technically. It reveals that the medium-term trend has been and is neutral, a situation that is not expected to continue for much longer, and it also emphasizes that it has been trading in an extraordinarily narrow range since early February above the support level shown, which it is now close to. Given what we have observed above we are clearly at a good entry point here for all things silver.

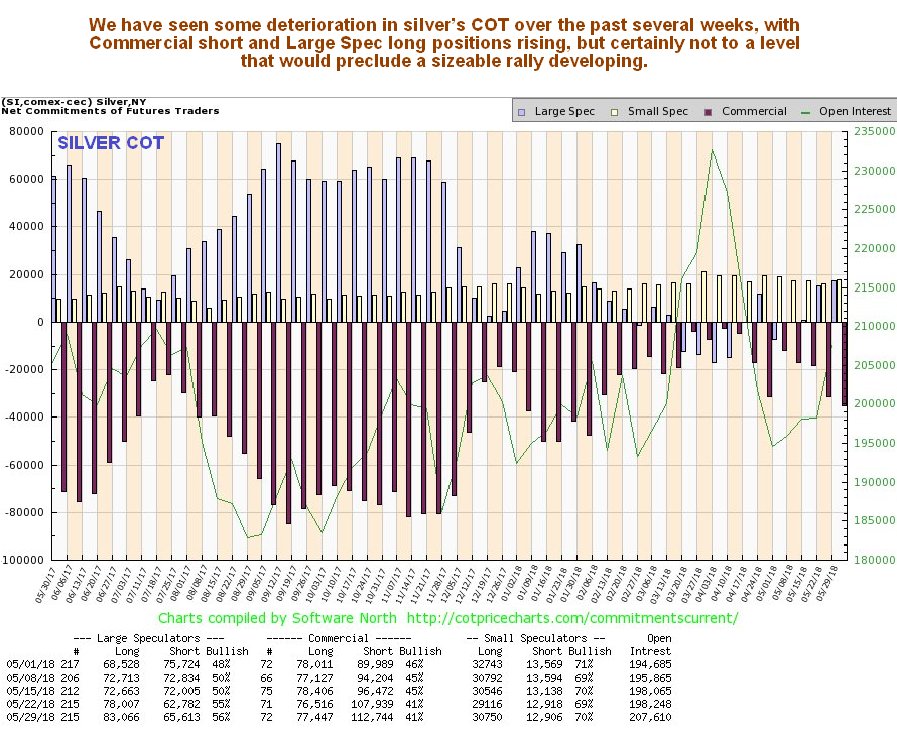

Silver's latest COT shows some deterioration in the COT structure over the past several weeks, with Commercial short and Large Spec long positions rising, but certainly not to levels that would preclude a significant rally developing.

Finally, we have the news from the bullion broker Sharps Pixley in London that as of this coming Friday, June 8, it will be drastically reducing its coverage of silver, because it is no longer commercially viable, as they say, "A combination of a diminishing pool of 'quality' silver stories, coupled with an inability to attract site sponsors from the silver sector to defray costs has meant that we have been working ever harder for no commercial gain." If this isn't a contrarian buy signal, then I don't know what is.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure: 1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. 2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

Charts provided by the author.

CliveMaund.com Disclosure: The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.

Read more by MarketSlant Editor