It’s Fed Decision day and that may help or hurt the strength in precious metals today, but the reason for the rally thus far this morning is not Fed based.

Fund Liquidators Meet Fresh Chinese Buying?

While we have lamented the end of year liquidations in precious metals these last weeks, the Chinese congress is now out and their investment cycle may be getting started with fresh allocations and actions that are a direct result of the political show being over.

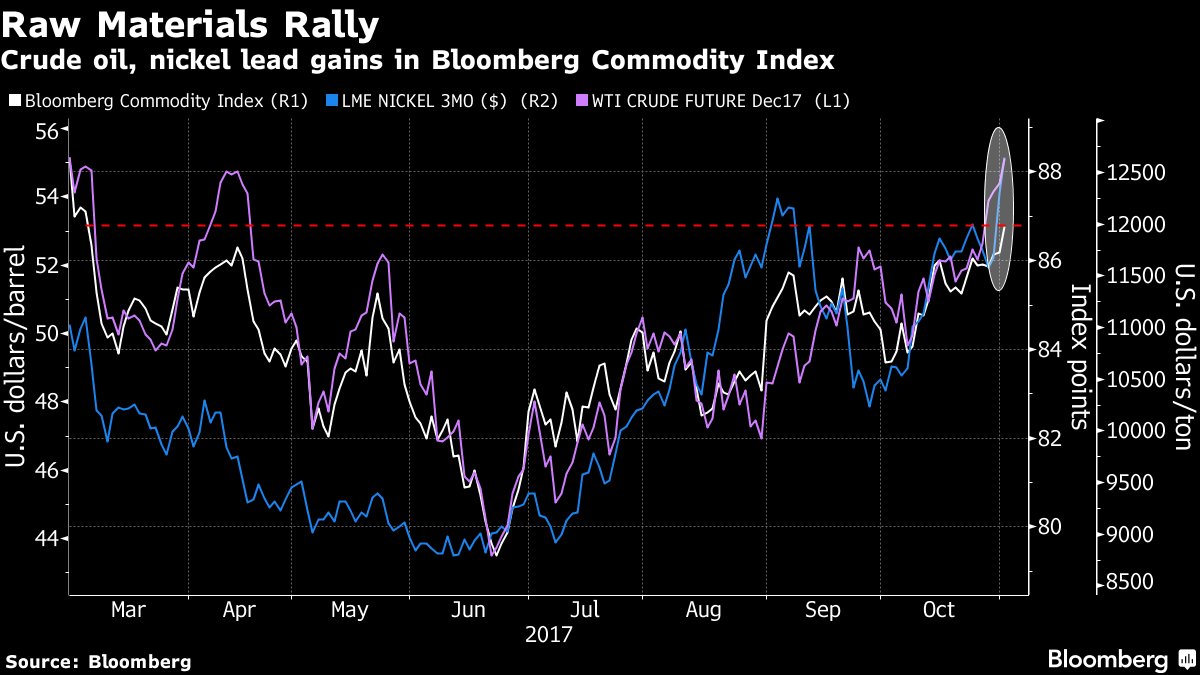

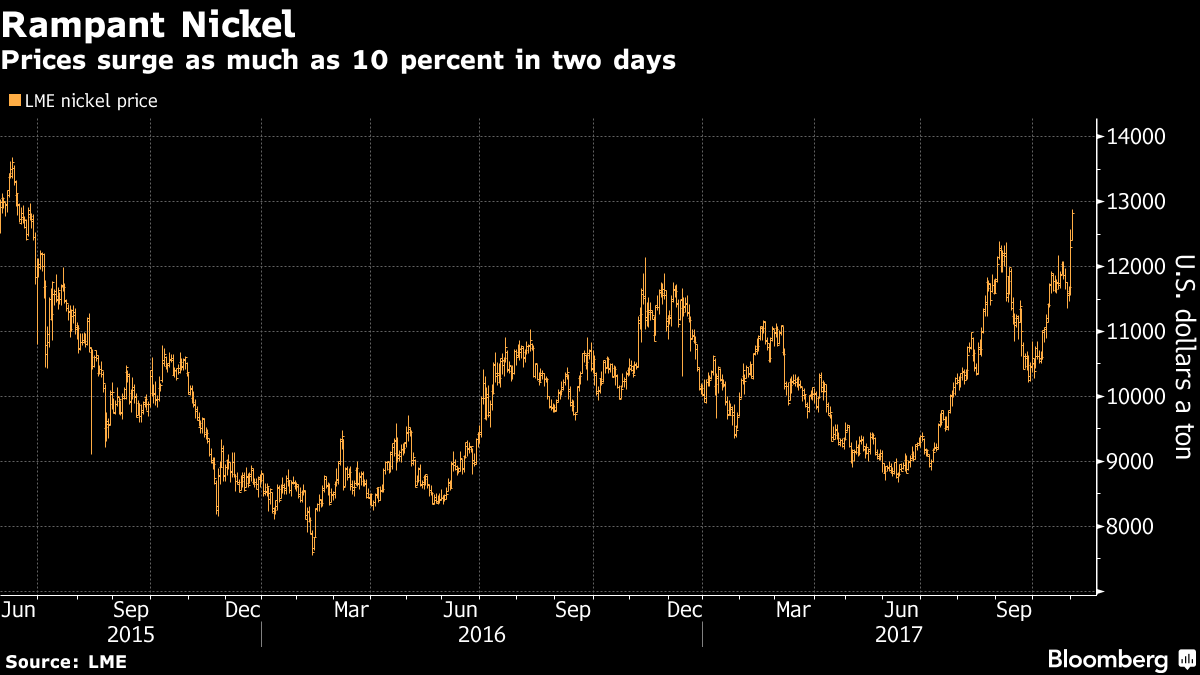

Nickel and Silver Lead

Base metals are on a tear again in China. The pack leader is Nickel which is catching a bid on perceived increases in industrial use due to Electric car production. And we agree with the rally, but do not trade it.

How to invest in Nickel is easy, how to trade it is impossible for our taste. If you want a risk free

(yes, no financial downside at all), long term way to invest in Nickel, contact Vince Lanci at Echobay.

The advice will be happily shared gratis, as his firm has been holding nickel investments for 6 years with no downside and a specific event driven horizon when it will be profitable.

According to Vince:

The vehicle for investment is easily accessible and has no fees attached to it. The only catch is how to get it efficiently. And it is scalable from as little as $100 to as much as $1mm with no price risk. You just have to be patient for the payoff.

T: 212-223-1000

Vince has assured us, his fellow contributors, that this is a good faith give back to the public that has read our content. Besides,

he says neither the investment vehicle nor the idea are proprietary. The story behind the idea is as old as money itself.

Commodity Firms Boost the Nickel Buying

The difference on Nickel is, this time firms like Trafigura and Glencore are bossing the market with recommendations.

From Bloomberg:

Nickel advanced as much as 4.8 percent to $12,880 a metric ton on the London Metal Exchange, the highest since June 2015. That added to Tuesday’s 5.3 percent gain -- the most in a year -- after Trafigura Group Pte joined Glencore Plc in unveiling bullish usage forecasts. The metal was up 4.3 percent in Shanghai.

Then there is Copper which is stronger, but less so in context.

Along Comes Silver:

Then there is Silver, up almost 2% this morning, which may be entering its industrial AND precious Goldilocks phase again like early in the year. Of late Silver was neither precious NOR industrial as far as investor (trader) sentiment . But long term we have and continue to say the floodgates for Silver use are just opening. Technology killed film and Silver use, and new technological applications will resurrect it. Bank on it. We are.

Silver is frequently a trade for us on our systems, but more importantly, it is an investment in the future. Bank on it.

Gold Follows

Finally there is Gold, which is catching a bid. The usual reasons will be trotted out: Weak dollar, Fed rate speculation etc. and all may be true to an extent. But it is eerily similar to the last couple times China went on a base metal buying spree. s we write this, gold is giving back gains as Fed nervousness likely is weighing on it. What we probably saw is short covering going into the decision, given urgency by base and silver rallies. Gold may be money again,

but that only makes it more scrutinized by the invisible hands that run our markets.

Gold 60 Minute:

Same as it ever was

If memory serves: The dollar got weaker, China loaded up on base metals, the market got frothy on base metals like iron. Then China weakened the Yuan, which.catalyzed a retail public chasing the rally, and implemented regulations to force smaller spec longs to stop piling in.

It's Fed decision day, terror attack in New York, and tax bill hit by delay.

Decision day

At 2 p.m. Eastern Time the Federal Reserve is expected to announce that its policy setting committee has decided to keep interest rates unchanged. With no updated economic projections or a press conference by Chair Janet Yellen due with today’s decision, investors will look to any change in the statement language for confirmation of the expected December rate hike. Of greater interest is President Donald Trump’s nominee for the head of the bank, a decision he’s expected to announce tomorrow.

New York attack

Eight people were killed and several more seriously wounded after a suspected terroristdrove a truck down a bicycle path near the World Trade Centre in Manhattan yesterday. The driver of the truck, 29-year-old Sayfullo Habibullaevic Saipov, an Uzbek man who had been in the United States since 2010 and was a registered Uber driver, was captured alive by police. Trump ordered the Department of Homeland Security to bolster the vetting of immigrants coming to the U.S. in the wake of the attack, without revealing specific details of what he wanted them to do.

Tax bill

House legislators’ ambitious plan to get tax legislation passed by Thanksgiving is already coming under pressure as the publication of their long-awaited bill has been pushed back. With the big reveal now due tomorrow, there will be just 10 legislative days available to succeed in the mammoth task of rewriting the U.S. tax code. The delay is being seen as a sign that negotiations among Republican lawmakers on the details of the plan may not be going as smoothly as possible.

Markets rise

Overnight, the MSCI Asia Pacific Index gained 1 percent, while Japan’s Topix index closed 1.2 percent higher as tech earnings and a weaker yen boosted investor confidence. In Europe, the Stoxx 600 Index was 0.6 percent higher at 5:50 a.m. with miners leading the gains as metals prices surged. S&P 500 futures were 0.3 percent higher, the 10-year Treasury yield was at 2.390 percent and gold was higher ahead of the Fed decision.

Commodities rally

A global metals rally saw nickel climb by the daily limit in Shanghai, adding to yesterday’s 5.3 percent rally. Copper also rose, with prices climbing 2 percent. Crude is having a good session, with a barrel of West Texas Intermediate for December delivery trading at $55.01 by 5:50 a.m. as oil added to its longest rally in three months. In non-commodity news, bitcoin continued its rally, trading over $6,550.

Read more by Soren K.Group