5 Minutes and 10% lower

Close up of 5 minute Futures chart with a low of $14.34

all charts via kitco except where noted

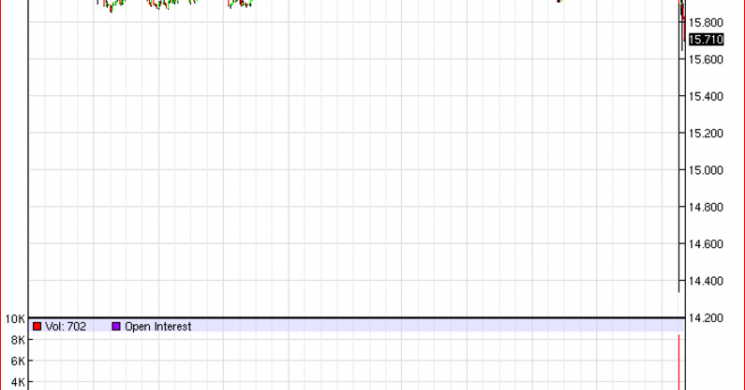

Silver Futures Chart after the deluge and recovery

Spot Silver dropped 6%before snapping back.

spot chart via Zerohedge

Updated Silver prices HERE

Best we can tell, after the CME reopen of futures someone or some THING sold approximately 8,200 contracts into the market in a 5 minute period.

The market immediately snapped back giving the impression this was possibly not an intended trade. But anyone who says they do know what happened at this point is just speculating.

Why it COULD happen. The timing is suspicious, but not proof itself of a spoof. So:

- SELL TO CLOSE - forced liquidation - someone had ot get out by end of day and blew it. So they were liquidated by their FCM

- SELL TO BREAK Spoof- thin market, a short can move it and test resolve with less volume than usual.

- SELL TO TRIGGER- Option expiry - an exotic or OTC option goes off and a player has to get out of a position or worse, the market is spoofed specifically to "knock out, in" or "pin" the option player with the smaller wallet.

- SELL TO BUY - tail wags dog - seller in thinly traded futures buys physical at a discounted price.

That's all we know or can guess but

IF YOU WANT TO KNOW WHAT HAPPENED YOU NEED TO KNOW WHICH MARKET TRADED MORE VOLUME, OTC SPOT, OR FUTURES

The most cynically reliable thing we do feel is this: Someone got stopped out. Possibly by spoof, possibly by liquidation. That is all we would be willing to bet on. Not much to run with admittedly.

As of this writing the market, after bouncing is beginning to trail off a bit. It is equally possible that we will not see that level again, or that we will test it soon. The only thing we are confident is in the fact that volatility will not disappear.

Note Gold is also now feeling pressure in sympathy touching $1218.50 before recovering.

Gold 5 minute chart

Finally Gold skew has been very low on the put side recently, which some interpret as bullish short term. The last time it was this low was election night. And the market spiked then swooned. So we feel that the skew without the ATM vol is hard to handicap. But unless it snaps much higher in the next trading day, we'd be inclined to say call buying, or lack of put buying on balance is predictable of nothing.

click Here for Gold

Read more by Soren K.Group