You Know What to Do

UPDATE July 5, 2017: the post is unchanged. The point is a validated sadly. This is not random. Remember when 'they' said to buy the VIX 2 months ago? We do. Need proof that 'their interests' are not aligned with your own except when convenient?

Given that they do not , how can research recommendations be perceived as anything but tools to sell their inventory? To trust them is risky. To trade against them is risky too.

In order of event: Gold was trading $1250-ish. We had a flash crash, a bounce,a recco buy from GS, a bounce, and now we are $30 lower from the recommendation. Voila!

Here is the post immediately preceeding this one for some context and the beginning of our worries.

We broke out the MS Paint for this chart! The yellow is right after the June 26th flash crash and subsequent buy rec by GS . The profits 5 days later are are NOT YOURS

Original post 6/28/17

So far the charts and wave count are all holding. We must admit that the double bottom at $1241 being broken gave us quite a scare. And we stick to the "triple bottoms are made to be broken" axiom. Bullish bias aside, if we dip below $1241 again, we think $1220 won't be a problem. Even then, as freaked out as it would seem, the market is still ok for its next run higher by many measures.

The Knot in Our Gut Just Got Bigger

One of our colleagues came out of hibernation recently and quite voluntarily voiced something we were afraid of in these recent swoops and flash crashes. Without giving away his system we will just say that with 30 years trading Gold and managing money for some of the biggest players in Metals during that time, when he makes a statement, we take note. Quite simply:

$1214 gets you $1200 and if we break that number a freefall should commence leading to $1150

So it is stuff like that that scares us. What's more his opinion is not based on Elliot Wave counts, but he reads them nonetheless. He just thinks that the wave count we are following is not going to hold.

Gartman And Goldman are Bullish Now

Do we have to say anymore? It has been our experience that when Goldman is bullish, the next $20 may be higher, but the next $50 is likely lower. As to Gartman, he has a bad rep in predicting Oil prices. Histrack record isnt so bad in metals. We happen to have a good idea why. Gartman is wired to a couple London Bullion dealers and when he gives info or insight, especially in explaining a move, he is very good.

So we are not as negative on Gartman as a "contrary indicator" as most in the trade are. That said, the power of a Goldman recco buy combined with a Gartman long idea is like crossing the streams in Ghostbusters ( the good one girls)

Finally, and this is purely observing the context of Gartman's statements: Talking about Gold and Bitcoin is like saying "I want some publicity so I'll act like I know my ass fro m my elbow in Crypto currencies."

Really, we know a shitload about these products and in some circles are considered experts in the macro concepts governing them.

The only thing we feel we are expert about in Bitcoin and its ilk is in learning everyday we don't know shit about them and got to keep learning. So who the F&*k is Gartman to even have an opinion on Bitcoin? He may as well be talking about Beanie Babies.

And that is the final straw or us.

Flat is Where It's At

Goldman and Gartman are bullish. Out gut says the downside is vulnerable, and a seasoned professional who rarely makes statements is now uber bearish. So what is our conclusion?

Project $1550 is still in play, but we would rather now buy strength than weakness. Flat is where it is at now with a buy stop entry above $1259 and a sell stop exit below $1240. The first upside target if the wave count holds is $1296. That's our call.

And if our bearish colleague is right, sell the crap out of it below $1241 on a settlement basis.

- The Gold Wave Count Still points upwards, but external signs make us nervous

- New info tells us the Flashcrash last week was most likely an options related price manipulation

- There is a new class action lawsuit worth watching as it crosses international borders.

The Bull Case Reiterated

By combining Elliot Wave and traditional Technical Analysis we have been fortunate to be on the right side of this move that started around $1214. But it is getting hairy now. Breaking $1247 took out a leg despite the fact we are back above it. Taking out $1241 was another area we liked. Being above it again is obviously good. but it would be much better if we saw some people "get short in the hole". Unfortunately we did not see shorts getting in net-net, but longs getting out. So on balance the analysis is still valid, but we are on alert that the next dip may not be bought at all. In Resistance/ Support Terms it reads like this

- 1550

- 1350

- 1296

- 1280

- 1257-1259

- 1247- 1248

- 1241-1238

- 1217-1214

- 1150

Numbers aggregated from these Posts

- MYSTERY SOLVED? GOLD OVER $1214 GIVES $1550 AS TARGET

- Project $1550 Gold: Buy Dips Above $1248

- Why Gold is Up and Why $1550 is Still The Target.

- Wave Count Hints at $1241 Bottom

- Above $1259 Settlement Gets you $1296

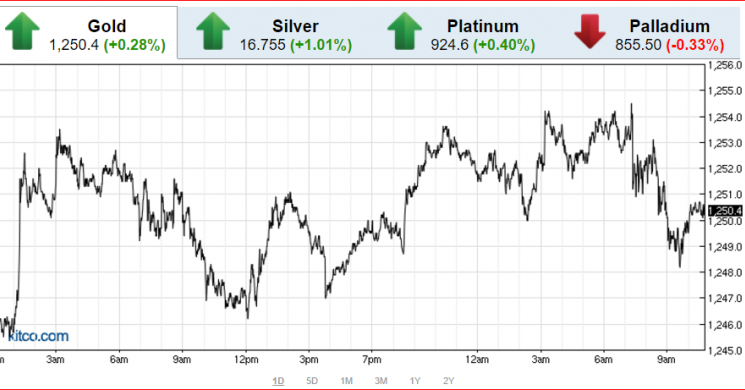

Gold Today is basically unchanged

About the Flash Crash - it was manipulated

We've been very vocal in stating that a fund puked to a commercial last week causing the $18 swoon. What was interesting was the strong bounce. While we still stick to our info that the most likely scenario was a fund puking to a commercial there was something that bothered us about the way it bounced. What kind of idiot would buy back in like that? And then it hit us. There was an option expiration we believe on the LBMA and it is quite possible a commercial wanted to "make his option position right". And that is what one London trader told us. We already knew that the COMEX expiration was coming due as well. Odds are overwhelmingthat COMEXoptiosn positions had offsetting LBMA expiring positions. That is just from our experience.

Our London Source:

Someone wanted to make themselves right at an expiration. The bounce came post expiry, after the risk went away. Possibly a cash settled LBMA look alike vs a Comex futures-settled hedge

Here is some analysis into how influential an option expiration can be. Even bigger than a daily Fix. It is during option expirys that the tail wags the dog.

Viking Analytics agrees and puts it rather eloquently:

The COMEX Gold Options Market is Enormous

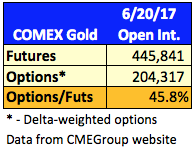

The flash crash of gold occurred one day before the COMEX gold market had a key expiration date. The COMEX gold options market is enormous, accounting for approximately 45% of the value of the COMEX gold futures market. While many market analysts pay attention to the gold futures market, it is rare to find an analyst that provides commentary on the options market. [Soren K- we agree and now number Vokingamong the few that "get it"]

The most recent Commitment of Traders ("COT") report can easily demonstrate the influence of the options market. The delta-weighted options on June 20th were approximately 46% of the futures open interest. The "delta-weighted options" essentially means the "equivalent futures contracts."

The main point that we are trying to make here is that the COMEX gold options market is enormous and influential, every bit as influential as the futures market itself.

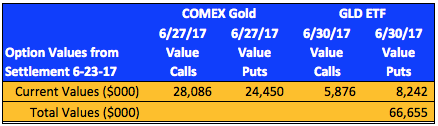

The Value of Options in the COMEX Gold Market and GLD

Not only is the COMEX options market significant, the options market in the SPDR Gold Trust (GLD) is significant as well.

At Viking Analytics, we have created a (beta version) program to calculate the value of every call and put option at the end of every COMEX trading day. We also calculate the value of certain relevant call and put options for GLD. At the end of the day on June 23rd, the value of all call and put options that expire in June was $66.7 million.

Moreover, the value of the options that expire Tuesday on the COMEX were $28 million and $24.5 million for the calls and puts, respectively as of June 23rd.

Moreover, the change in value of the aggregate calls and puts expiring June 27th might be as much as 50% of the value of the calls and puts themselves.

Therefore, there is a lot of money riding on the closing price Tuesday at COMEX [Soren K.- and look alike LBMA] options expiration.

This explains much more cleanly why a commercial sold volume and then the market bounced the next day. We have one source saying this was a factor now and have adjusted our opinions accordingly. We will not look for others because it doesn't really matter does it? it is a market reality that must be traded around. Gold is manipulated and the depth of that manipulation is so large that no court will be able to understand just how much money is stolen with: spoofs, fat fingers, pinned option expirations, fixes, slams, swoops, and the usual front running. And we have seen this first hand as victims in options in every commodity traded.

So whether a fund puked or an option expired, there was some manipulation going on. We already know the truth. The problem is in finding facts. By the time investigators see the fire investors have already choked on the smoke.

Some Flash Facts:

- The contracts traded the minute of 4:01am were MORE contracts traded than any other minute of the trading day Monday. The trading range in the 4:01am EST minute was about $18 per ounce.

- The second panel in Eric's chart above shows a dynamic bid-ask "stack" with the at-the-market bids in dark blue, and out-of-market bids in red. The main point here is that the flash sale of 2% of annual mining supply completely removed liquidity from the futures market. The order to sell 1.8 million ounces hit many of the bids that were offered at 4:01am. This is perfectly legal. However, it shows the power of some market participants (who have the capital to do so) to dramatically change market dynamics in a single (illiquid) minute.

The Game is rigged. And even with the new UK lawsuit gathering steam we do not believe the actual money stolen from investors numbers can ever be known. But we arepretty sure that whatever is offeredby these lying settlers, it is 10x that amount

Read more by Soren K.Group