Gold is weaker again. After dropping as much as $21 at yesterday's nadir, Gold is again under pressure. As of this writing Dec. is trading down $8.20 at $1327.50, while spot is in the $1323 area.

We suspect (hope?) that the market will now begin to trade sideways as downside volatility takes a breather post this morning's US open after dropping $21 from our first level of concern at $1348. Projections of a possible $15- $30 fall were made then and upon re-assessment that still holds. Some sideways movement may intervene before resumption of a descent.

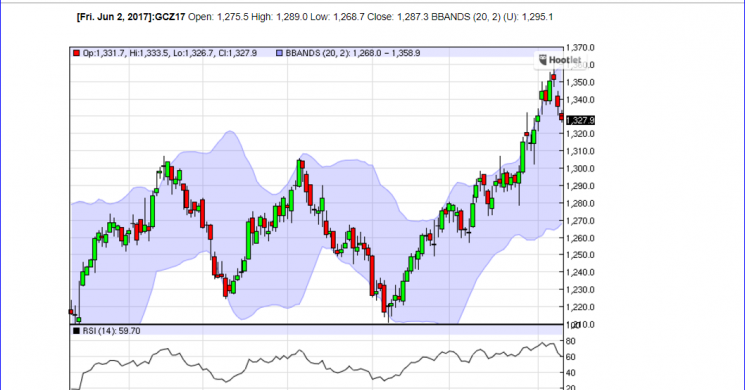

The problem now is that much of what used to be support and is now resistance was based on rising trend lines. Those lines come in higher now and imply a much stronger bounce will be needed than say.. $1331 to get a resumption of upside momentum. Here's a summary of our momentum indicators this morning

Hourly Spot shows some exhaustion of the swoon....

But, like the next hurricane, the 15 minute spot is saying a new cycle of momentum lower is beginning....

click HERE for live updates

Conclusion: If the 15 minute momentum indicator touches $1326 spot, then expect the hourly "pause" indicator on the hourly to take control. If not, then the disease will spread and another washout, perhaps to $1303 would occur.

Otherwise, the volatility tools we use have done their job, and it is now up to event driven rallies to rescue Gold or bear flags which will not doubt begin to form if we move sideways for a few days.

This is all because the market got ahead of itself and hot money pushed in, then out of the doors all at once. That triggered algos to sell, bullion dealers to sell and longs from lower to throw in the towel on their trades to book profits.

Good luck and congratulations hot money, you F**ked up an orderly rally again . Better trading for us and our methods for sure, but worse for Gold's case as a viable instrument of protection in the longer run. Go buy yourself an iphone X which will just enable the US government to more easily biometrically encode its populace.. but we digress.

Previous related posts in reverse chronological order:

$1340 Gold Hungover from Friday's Hot Money Pile on

Pre-Open: Yen Implies Lower Gold Tonight ($1343- $1348)

'Below $1348, Gold Could Fall Out of a Bunk Bed'

Pre-Asia: Gold Set its Sites on $1355

Pre-Open: Gold Catches a Bid at $1335

Re-Open: Debt Punt Leaves Gold Vulnerable

Gold Intraday: Look Out Above $1346

Asian Open: Gold, Yen Continue to Climb

On the Radar Today:

U.K. inflation accelerates, new sanctions on North Korea, and it's Apple's big day.

U.K. inflation, Brexit vote

Inflation accelerated to 2.9 percent in August, more than economists had expected, with clothing prices posting their biggest surge in almost three decades. Core inflation also rose, adding to the policy headache facing the Bank the England ahead of Thursday’s monetary policy meeting. The U.K. parliament voted 326 to 290 to let the prime minister’s Brexit law advance, meaning the government’s strategy for leaving the European Union remains on track.

Sanctions

The United Nations Security Council approved new sanctions on North Korea after the U.S. dropped demands to impose an oil embargo on the country in order to win support from China and Russia. The measures include reducing gasoline and diesel imports to the country by 56 percent and capping oil supply at current levels, while banning textile exports. The Pyongyang regime, which South Korea says remains ready to test anther nuclear device, has yet to respond to the measure.

Apple phones

Apple Inc. is holding a product event this evening at which it’s expected to launch three new iPhones, including the premium, $1,000-plus iPhone X. While the iconic product changed the phone market when it was first released some 10 years ago, it has lost its lead on technology to competitors.

Markets rally

Yesterday’s record-high close in U.S. stocks helped lift equities across the globe. Overnight, the MSCI Asia Pacific Index gained 0.3 percent, while Japan’s Topix index added 0.9 percent as the yen weakened further against the dollar. In Europe, the Stoxx 600 Index was 0.5 percent higher at 5:45 a.m Eastern Time, while S&P 500 futures climbed 0.1 percent. 10-year Treasury yields were at 2.151 percent and gold was lower.

Oil supply

OPEC’s estimate of its oil production is expected to show a decline in August from the previous month after Saudi Arabia pared output, according to a person familiar with the matter. West Texas Intermediate for October delivery was at $47.84 a barrel as of 5:45 a.m. as refiners in the U.S. continue to come back online after the damage suffered from Hurricane Harvey.

Read more by Soren K.Group