1. The first-ever hydrological survey of Antarctica found nearly ____________ streams, ponds, and waterfalls covering the continent.

Scroll down for the answer

2. Though the 10-ton sea cows of the Pleistocene survived long into the modern era, they were hunted to extinction within ____________ years of being discovered by humans.

Scroll down for the answer

3. Each year, the federal government contracts out about ____________ dollars of work to private firms.

Scroll down for the answer

The Many Ways 'Buy American' Can Harm the Economy

Barring the government from contracting with foreign firms will decrease competition and squander tax dollars. GDP will rise under Trump by overpaying for non-competitively priced items by the Government. This will be passed on to you as higher taxes and/or lower services. Buy American, yes. But price globally. Trust, but verify Donnie.. - Soren k.

Nicholas Clairmont and theatlantic.com

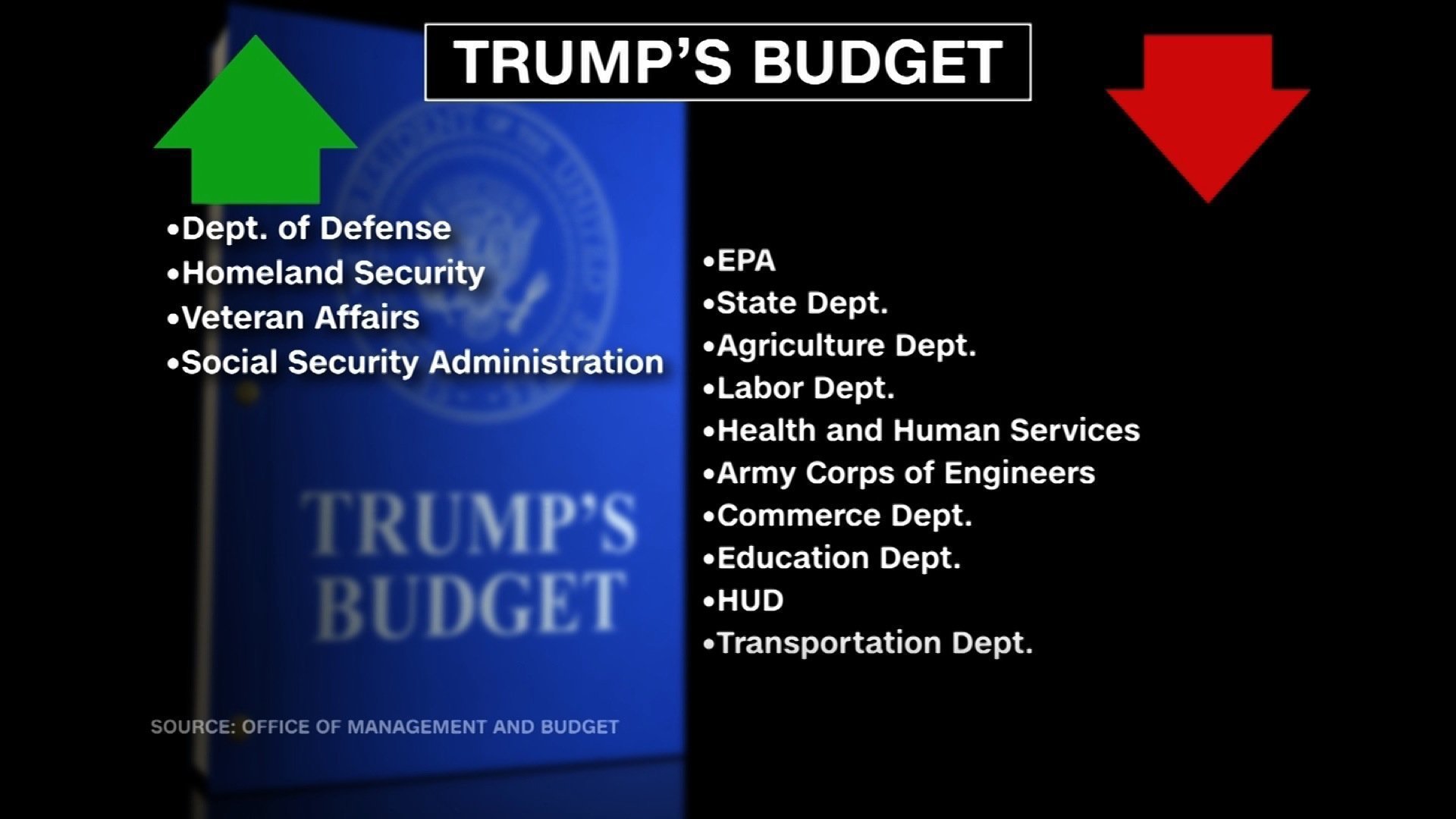

On Tuesday, at the Snap-on tool company in Kenosha, Wisconsin, President Trump stood before an American flag rendered in wrenches and signed a new executive order based on his campaign and inauguration-speech pledge to “buy American and hire American.” The signing ceremony followed a speech about the importance of American manufacturing in which Trump hit some familiar notes, rehashing his narrow election victory as well as promising to “get rid of NAFTA” and saying it’s “ridiculous” that doing so requires him to involve Congress.

But the emotional climax of the speech was his call to end what he dubbed the “theft of American prosperity” by outside forces. This is what the executive order was intended to thwart, by requiring that all of the federal government’s departments “buy American.” (The other half of the order’s mandate is “hire American,” which involves among other things restricting H-1B visas for skilled foreign workers.)

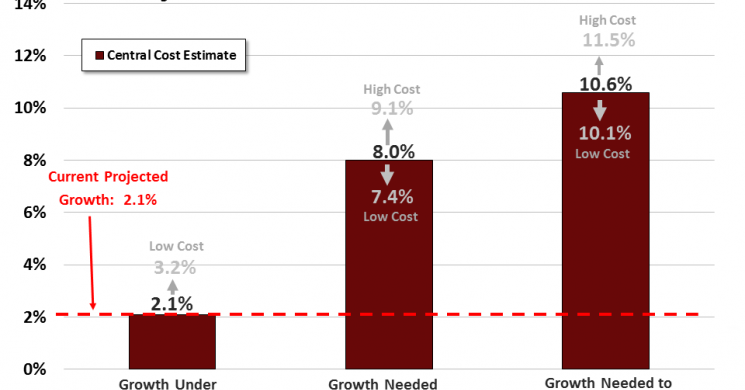

Here’s what “buy American” means in practice: The U.S. government contracts out nearly half a trillion dollars of work per year, putting out requests for firms to provide things like construction, IT support, and countless other services the government doesn’t do for itself. Except in certain cases like sensitive defense work, both American firms and foreign ones bid on these contracts, competing to name the lowest price and deliver the best results. As a result, the federal government gets to make use of private firms’ capacity and expertise at, theoretically, the most competitive market rate. But under the new executive order, foreign firms won’t be in contention. Only domestic firms will be eligible to win these contracts.

“We’re sending a powerful signal to the world. We’re going to protect our workers, defend our jobs, and finally put America first,” the president said. But will this protectionist policy accomplish those things? Two economists of different schools of thought whom I spoke with agreed that it will not.

“It's an assault on the taxpayer,” Steven Landsburg, a professor of economics at the University of Rochester and a self-described libertarian, told me. “It's a way of transferring income from the taxpayers in general to a special-interest group consisting of people in whatever industry it is you're buying from. Obviously if you've got two people offering to sell you something, and one is offering to sell it for $10 and the other is offering to sell it for $15, and you choose to pay $15 for it, I guess what I would say is that generally speaking that's something you're only going to do if you're spending other people's money. And that's of course exactly what's happening here.”

Laura Tyson, a professor at Berkeley’s Haas School of Business who chaired President Clinton’s Council of Economic Advisors, described much the same fundamental problem with the policy. “For every dollar spent, the amount you get for that dollar is going to depend on the price you have to pay,” she explained. “This kind of policy will reduce competition and raise the price of the product. So, instead of a global set of suppliers competing for U.S. government contracts, only U.S. suppliers will compete. And in some product areas, there won’t be a large number of U.S. suppliers, and [they] may not have the superior products or the superior technology. So, in those cases, both the quality and the price of the product that the government faces with a limited budget to spend on procurement will actually deteriorate.”

She also pointed out how it’s especially self-defeating for an administration like Trump’s. “I find that there's a glaring inconsistency in all this,” she told me. For an administration that wants to dramatically reduce federal spending and eliminate regulations, restricting bidders to American firms works directly against those goals.

So the view of these two economists is that the net effect of the executive order will be to make the services the U.S. government relies on more expensive by reducing competition. And it’s not just about prices; without needing to have an edge on foreign rivals, American companies don’t have as big an incentive to innovate. The products themselves will be worse, too. Plus, one of the biggest worries is that other countries could ramp up similarly protectionist policies in response, cutting American firms off from competing for vastly more business than the U.S. contracts; Most of the world is “foreign.”

But to the extent Trump has explained the reasoning behind his economic agenda, he hasn’t been trying to make the case that his policies would be the most efficient for the economy overall. Instead, he’s focused more on the unfairness of the international system to the U.S., and also on the suffering of the “forgotten people” who’ve seen their way of life destroyed by the cold logic of globalization.

On the international level, the system does seem unfair. The U.S. trades with countries that themselves have versions of the protectionist policies Trump proposes. And so, as Tyson told me, creating protections to retaliate in kind “may be politically popular, because what you're doing is basically saying, ‘We're going to do a tit-for-tat—we're going to do what other countries do to us.’" But this is a trap, she says: “They're not going to add, ‘and what that will probably do to you is raise the price of the things that you buy, or raise the price of the things that the government buys, or reduce the amount that the government has to spend on fixing roads.’"

It’s clear both economists think the policy is a bad thing overall, but when I asked Landsburg to at least name the likely positive results, however outweighed by negatives they may be, he said that the negatives actually go a step further. It’s not just that, from an economist’s point of view, the pros of increased demand for American production are outweighed by cons like higher costs. It’s that the pros don’t exist at all.

The argument goes like this: First, even as a way to transfer money from the thriving sectors of the American economy to, say, white working-class manual laborers in traditional industrial hubs, propping up manufacturers with government contracts is a bad strategy. As Landsburg explained to me:

If the U.S. government uses a dollar to buy a car made in Detroit, an American auto worker makes that car. If the U.S. government uses the same dollar to buy a car made in Mexico, a Mexican auto worker gets that dollar and uses it to buy an American product—let's say wheat—and an American farmer grows that wheat. Either way, you're employing Americans. So for American prosperity, the key question is not where the car is made—it's whether we overpay for the car.

The crux is the cost savings. If the American government buys a car for half as much, say $10,000 instead of $20,000, Americans are left with more money.

But what about that $10,000 that went to Mexico? Isn’t that at least worse for Americans than if the government had bought an American car at the same price? No, says Landsburg: “Initially, there is $X worth of stuff available for purchase in Mexico, and Mexicans want to buy $Y worth of stuff. If Y is less than X, the rest gets exported. If Y is bigger than X, the difference is imported.” If the government pays a Mexican citizen to make and export something, there is still the same amount of stuff in Mexico available for sale, but that person in Mexico is some amount richer. When he eventually goes to spend that extra money, it’ll have to be to import something extra, because, again, there’s still the same amount of stuff available in Mexico.

Landsburg sums it up like this: “We're buying from Americans either directly or indirectly either way. The only question is: Are we going to overpay or pay a fair price?”

So, Tyson and Landsburg agree, the White House’s policy doesn’t work out in theory. In practice, things are no better. If the government is restricted to “buying American,” it needs to define what American is. But doing so is fraught, Tyson explained to me. “Is the only thing that matters the nationality of the firm? I would think what should matter more is, if you're thinking about encouraging manufacturing in the United States, then you actually want to look at foreign suppliers and domestic suppliers in terms of how much they actually produce in the United States.” A firm’s location is not the same as the nationality of its ownership or headquarters, in other words.

Tyson gamed out what getting this wrong could look like, using an example that under Trump is not just notional: “A lot of the engines that the U.S. sells, they go to Mexico, they're assembled in a vehicle, and then the vehicle comes back to the U.S. Is that an American product? Would that product be allowed to compete for a government contract? It should. It absolutely should. Otherwise, you would basically have taken away a major part of the U.S. supply chain in automobiles.”

But the core issue remains: Making life too easy for U.S. firms will make life worse, not better, for anyone who participates in the U.S. economy. Many economists believe this, as do leaders in the business community. One example comes to mind: As the CEO of The Trump Organization and its many holdings, Trump doesn’t appear to have made any special attempt to use U.S. suppliers or to hire American workers. To the contrary, when a cheaper foreign option was available to make Trump ties or build Trump Tower, like a savvy businessman, Trump seized it. But as chief executive of the U.S. government, Trump’s ideas about how to pick suppliers are different. What’s changed is that now, he’s not looking to his own bottom line, but at his poll numbers.

Answers: 700, 27, half a trillion

Read more by Soren K.Group