Gold bugs are in a buying mood once again with the gold price knocking on the door of $1,300 an ounce. The yellow metal is up nearly 13% year to date on continuing global tensions – the terrorist attack in London being the latest example – along with a softening U.S. economy reflected recently in disappointing U.S. job numbers and a lower U.S. dollar.

Major gold companies have been cashing in on the rising gold price, with big players like Barrick (NYSE:ABX), Newmont (NYSE:NEM), AngloGold Ashanti (NYSE:AU) and Kinross (NYSE:KGC) all posting decent share price gains of late. The health of the sector overall can be seen in the Market Vectors Gold Miners ETF (NYSEARCA:GDX), which is up 13% in 2017.

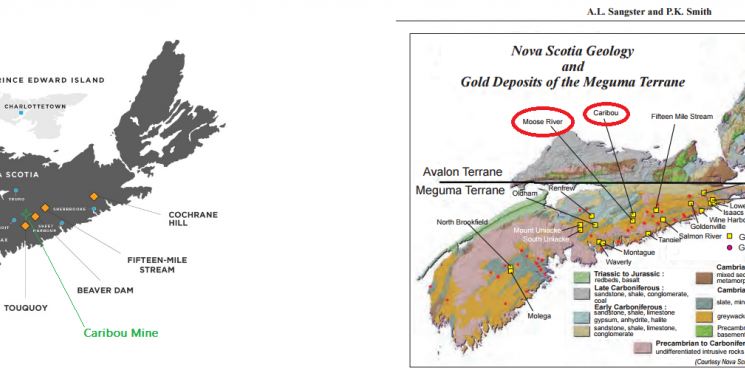

For exploration companies, it appears that gold fever is back and one of the most promising areas is in the safe Canadian jurisdiction of Nova Scotia. This is where Osprey Gold (TSXV:OS) is hoping to grow its resources in a past-producing gold mining area with an exciting drill program about to kick off this summer.

The story of Osprey, renamed from Gonzaga Resources in February, started with the acquisition of the Goldenville Gold Project – a 447,000-ounce monster of a deposit that is the largest historic gold mine in Nova Scotia's Meguma Gold Belt, producing 212,000 ounces between 1862 and 1942. Along with Goldenville, Osprey also acquired three other properties - Lower Seal Harbor, Gold Lake and Miller Lake - that were previous high-grade gold mines.

Those may eventually be developed by Osprey, but the focus for now is on Goldenville. A first-phase drilling program is planned within the next few weeks, with the goal being to expand the known gold resource at Goldenville, which is currently pegged at 447,000 inferred ounces at 4.96 grams per tonne.

Nova Scotia has a history of gold mining that goes back to the 1830s; since then, the Atlantic Canadian province has produced some 1.1 million ounces, mostly from high-grade pockets of mineralization concentrated in quartz veins underground. Gold production in the province largely ceased in 1942.

Visible gold in quartz

While not much gold mining has occurred since the 1940s, interest in the region has been re-ignited lately with the accomplishments of Atlantic Gold (TSXV: AGB) which is about to become Nova Scotia's latest gold producer, and the only permitted and fully financed open pit gold project currently in construction throughout the whole country. Its first gold pour from its Touquoy property – part of Atlantic's Moose River Consolidated project – is expected in the third quarter. Atlantic has seen a dramatic share price appreciation, going from 28 cents a share to $1.60 in just under a year and a half. That has Canada-focused gold investors wondering whether Osprey can do something similar.

According to renowned mining analyst Eric Coffin, who recently published a comprehensive report on Osprey in his HRA Advisories Hard Rock Analyst newsletter, the success of Osprey will depend on the composition of Goldenville's shales and “argillites” which host Nova Scotia's prolific vein structures. He notes that the region has seen historic gold grades above 10 grams per tonne, compared to other North American mines in production at just 1 g/t.

The fact that the veins lend themselves perfectly to underground mining in Nova Scotia has been well understood, but what is less grasped is the structures between the veins. As Coffin explains:

“Atlantic Gold began taking a closer look at the wall rock between the veins in 2015 and determined that they carried significant disseminated gold in amounts that, coupled with the high-grade units, could be amenable to open-pit mining. It was a bold idea to be sure… and some industry professionals wrote it off as hogwash at the time,” Coffin wrote.

“The idea of turning these vein-dominated deposits into bulk tonnage open-pit operations simply had never been explored to any significant degree. Yet fast-forward from 2015 to today and Atlantic Gold shareholders are now enjoying the proverbial last laugh as the company’s market cap has essentially gone straight up to $250 Million-plus. Atlantic’s Moose River Consolidated (MRC) project – which comprises the Beaver Dam and Touquoy properties with proven and probable reserves of 760,000 ounces of gold at 1.44 g/t gold – is now heralded as the only open-pit gold mine in Canada currently fully permitted, financed, and under construction.”

Asked about Goldenville's similarities to Atlantic Gold's MRC project, Osprey President and Director Cooper Quinn said with both projects being within the Meguma Terrain, the rock formations are broadly similar, although Osprey has yet to determine how much disseminated gold exists within the host argillite. “One of our tasks will be to see how much argillite we really have at Goldenville, and to what extent it's mineralized,” he told MINING.com in an interview.

Quinn said the company is taking a two-pronged approach: first, drilling to add ounces to its already impressive underground resource; and second, to investigate the potential for a bulk-tonnage deposit that is open-pittable, in a similar fashion that Atlantic took its project forward. The vision for the mine could include a combination underground-surface mine, depending on what the drills find.

“Our focus in the first couple of drill campaigns will be to expand resources more than upgrade resources immediately. We'd like to kind of determine what the full strength and depth potential of this thing is before we spend too much money building it.,” Quinn said. The structure is open along strike and at depth. He added:

“The colloquial phrase that I like is ‘the best place to find gold in the world is where there's gold’. We know there's gold in Nova Scotia, so instead of spending money looking around somewhere in the far north with soil samples searching for geochemical anomalies, let's look where there's a gold mine and see if we can pull up some additional resources.”

Core samples

Upcoming drill results are the most obvious catalyst that could move Osprey's stock price, which reached a 52-week high of 43 cents a share following the release of Coffin's newsletter on June 6. Another tantalizing news nugget is a batch of drill results taken from 2014 that have never been sampled. Drill core from 24 shallow holes – all about 30 metres deep – are currently being assayed. The results could buttress Osprey's theory that the deposit is possibly mineable at surface, Coffin noted.

Other factors in Osprey Gold's favour include developing a mine in an area that is generally open to exploration and presents low geo-political risk. According to the 2015 Fraser Institute Survey of mining jurisdictions, Nova Scotia ranked 17th out of 109 mining jurisdictions as far as policy perception. The property has power and gravel roads, and is located just five kilometres from the village of Sherbrooke.

Lastly, Osprey Gold has an experienced management team, led by CEO Jeffrey Wilson, Quinn and geologist Adrian Fleming, who is Osprey's chairman. Coffin notes that “ both Cooper Quinn and Adrian Fleming were instrumental in Underworld Resources’ White Gold Project discovery, which kicked off a major Yukon gold rush just a few short years ago. Underworld was taken out by Kinross – a $7B industry leader – in a $140 million transaction to the delight of early shareholders.”

While Quinn said he isn't ruling out any takeout offers, he emphasized the focus of Osprey right now is to explore the property. The company has raised an exploration budget of $1.8 million and Quinn said they're financed through to the end of the year to do just that.

“The team we have is exploration focused,” he said. “Myself, with an exploration background, and very experienced geologists with a few discoveries and exploration background as well. We have no immediate plans to push this through to development or anything like that. We'd like to first start building value by drilling off some hopefully significant resources.” On May 16th Perry MacKinnon joined the team as Vice President of Exploration. His 30 years in mining and extensive first hand geological knowledge of mineralized deposits in Atlantic Canada will be a valuable asset.

The drills will soon be turning at Goldenville, and investors should be watching to see what kind of market excitement Osprey will generate around a gold play that appears to have plenty of upside.

Gold nugget from Goldenville, Nova Scotia (December 1937)

About the author, Andrew Topf has a background in newspaper and trade magazine reporting, Andrew specializes in writing about mining and commodities. He has written for the Black Press newspaper chain in British Columbia, Business in Vancouver, MINING.com, and Baum Publications.

Read more by Streetcents