Gold Miners: Two Very Different Kinds Of Hype

By Gerardo Del Real Written Monday, October 23, 2017

Is Mawson Resources (TSX-V: MAW) the new Novo? At the risk of being bit anticlimactic, the answer is no.

But I do have to wonder (in this case out loud) what effect this morning's news from Mawson would have had on Novo’s share price had it been Novo announcing that it had discovered multiple new high-grade samples from outcrop up to 2,375 g/t gold.

A little background.

Novo Resources (TSXV: NVO) is exploring and developing gold projects in the Pilbara region of Western Australia. Novo has built up a significant land package covering approximately 10,000 km2.

This past summer, shares traded in the C$0.60 range. That was before the discovery of visible gold from a bulk sample. The 2x2x.5-meter pit for the bulk sample returned two ounces of gold per ton at surface.

The find has sparked a rush into Novo shares. A rush that has taken shares from the C$0.60 range to a recent high of C$8.83 for a market cap approaching C$2 billion with a B.

The speculation centers around Quinton Hennigh's theory. The theory is that the Pilbara region of Western Australia has mineralization potential similar to that of the famous Witwatersrand Basin in South Africa.

Since 1886, the “Wits” has produced over 1.5 billion ounces of gold, which represents about 50% of all the gold ever mined on Earth.

I wrote about it back on August 21, 2017. At the time, Novo’s market cap was near the $700 million mark. So what do I know, right?

Back to this morning’s news from Mawson.

The high-grade gold results from outcrop and mini-drill sampling at the company's new East Rompas discovery were nothing short of spectacular.

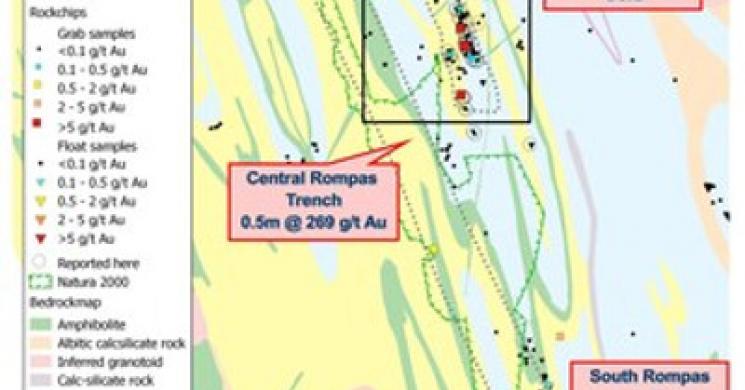

Results from outcrop and mini-drill sampling include 2,375 g/t gold, 1,284 g/t gold, 642 g/t gold, and 216 g/t gold. Many of those samples contain abundant coarse visible gold.

Spectacular visible gold within a brecciated calc-silicate vein in drill hole ROM0011 from 11.82-11.97m

The recently-discovered East Rompas prospect lies within Mawson's 100%-owned Rompas-Rajapalot project in Northern Finland, 500 meters east of the six-kilometer-long Rompas high-grade gold vein system.

The results are from a one-off. Past drill results include six meters of 617 g/t from 11 meters depth.

Mawson currently has a fully-diluted market cap of approximately C$50 million. Novo shares often add more than Mawson’s entire market cap in one trading day.

Mr. Michael Hudson, chairman & CEO, commented on the samples, saying:

"East Rompas is an exciting new discovery by the Mawson team, with the mineralized footprint now expanded to two semi-parallel zones over 750 metres of strike. Finding visible, high-grade gold at surface, in outcrop is rare, and the significance of discovering multiple outcrops with grades up to 2,375 g/t gold cannot be under-estimated. We are highly encouraged by the presence of gold in structural fabrics and the association with silicate and sulphidic alteration, that may indicate potential for disseminated gold mineralization. Geophysical crews are working at site and with the area fully permitted we plan to be drilling in early December.”

Mawson has a district-scale land package, is fully permitted, and begins drilling in December.

Behind the scenes there are several mid-tiers and majors that have looked at the project.

It would not surprise me to see a JV that allows the land package the aggressive drilling it deserves.

I continue to root for Novo but, in a space — the junior resource sector — where minimizing risk should be rule number one, it would be irresponsible of me to not bring attention to stories like the Mawson story

Read more by Soren K.Group