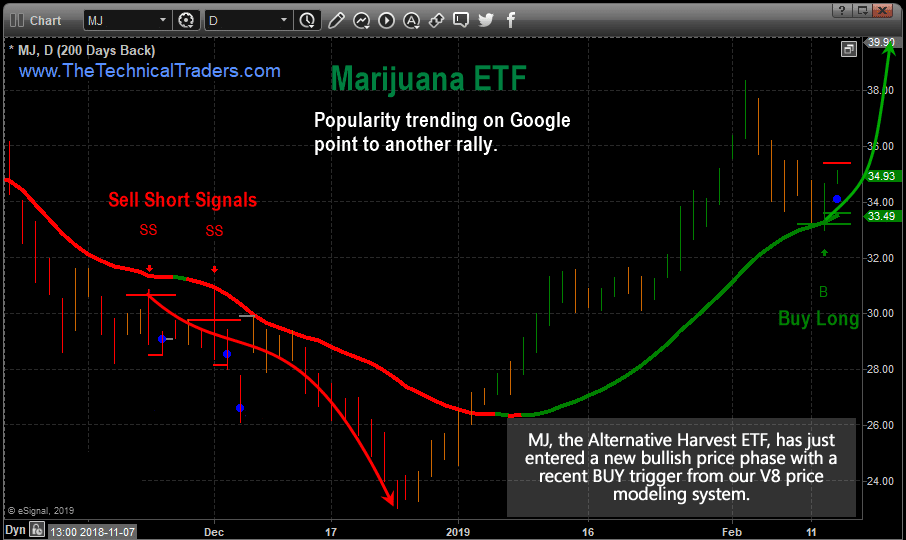

Our research team has been actively discussing the potential that the entire Marijuana stock sector could be setting up for another upside price rally. Since the bottom set up in the US stock market near December 24, 2018, many of the cannabis-related stocks and ETFs have seen incredible upside recoveries (of 25% or more). We believe the current setup in MJ, the Alternative Harvest ETF, is indicative of a new bullish momentum breakout.

The upside potential for this move is likely 12~25% or more over a short span of time. Watching MJ move from $34 to $39 over the next few weeks could result in a 14%+ move where a breakout of $39 to the upside could see MJ retesting recent highs near $45 (a +32% upside move).

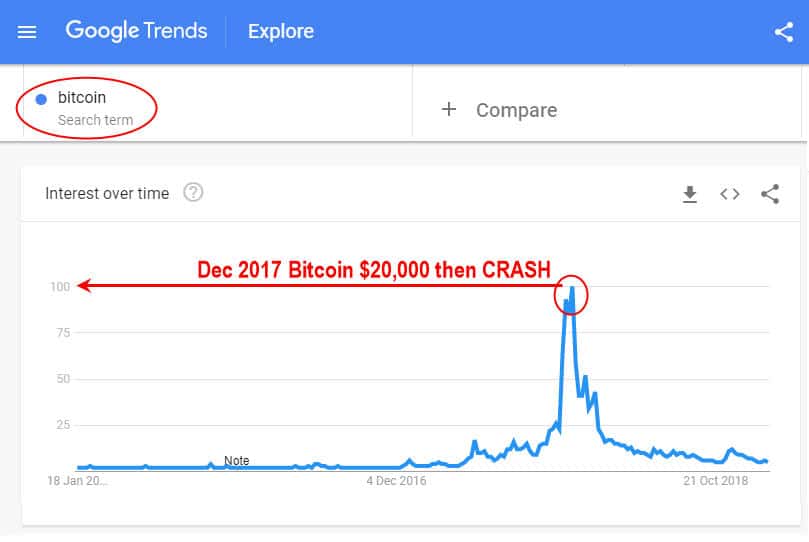

One aspect of this market sector to consider is the recent talk of nationalizing legal US cannabis in the US as well as the expected gains in state sales from legalizing the industry. We've all read about how some of the largest drink and tobacco producers in the world are investing heavily into this blossoming sector in preparation to secure market share when the dust settles. The entire Marijuana market sector could be a boom cycle, similar to Cryptos in 2016~2017, over the next 12~24+ months in the USA. Canada recently legalized its use which could help open the door for other territories to make it legal.

MJ has room to run to the upside and our initial projected targets for this upside move are just below $38. If our longer-term analysis is correct and the US major stock market indexes continue to rally, we believe MJ could attempt to retest recent highs near $45 over the next 30~60+ days.

These types of opportunities don't happen very often. Fledgling industries with strong interest drive investors to make speculative plays while driving prices higher and higher in most cases. Play this one smart and look to take profits above +8% on no less than half of your initial trade, then let the rest of your position ride out the run. If we are correct in our targets, $41~44 should be the next upside target before resistance is found.

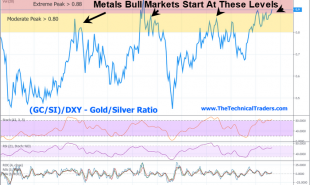

Another interesting way to look for interest in any sector is to look at the Google Trends for the search term popularity for a particular asset class or similar related phrases and Bitcoin is the perfect example.

Marijuana Stocks Searches

As you can see in the graph below Google trends is shows a steady increase of interest for “Marijuana Stocks” stocks.

We should warn you that this is also a capitulation and contrarian indicator once it breaks the 80-100 level. When search demand spikes and everyone is interested in these stocks that is when they top. So, we do expect a run-up in price, but after that price could go up in smoke as this is somewhat of a bong bubble in the asset class.

If you want to join a group of professional traders, researchers, and friends, then visit www.TheTechnicalTraders.com to learn how we can help you find and execute better trades. Some of our recent winners are GDXJ 10.5%, ROKU 8.1%, two other open positions with 15.4%, and 4% as we wait for new a couple high momentum trades to mature.

We believe 2019 and 2020 will be incredible years for skilled traders and we are executing at the highest level we can to assist our member’s profit from our trades with us. In fact, we are about to launch our newest trading solution for ourselves and members that is unparalleled anywhere else.

Chris Vermeulen Technical Traders Ltd.

Read more by TheTechTrader