Manipulation's Persistence and Comex' Demise

- Comex Demise is a welcome event

- How Market Structure Impedes True Metals Price Discovery

- DGCX/ SGE Rising: The GoldenYuan Replaces the Petrodollar

- Manipulation's Persistence

via Soren K Group and MarketSlant

Warning: Humor, sarcasm, and an ability to discern conjecture from fact are needed. While facts may be undiscoverable, truth is not. The end game is not path-dependent. The Comex is dead and metals will rise in part aided by manipulation.

Other Warning: We are on the road and apologize in advance if this post is a little more disjointed than usual. It is really 4 stories in one.

COMEX DEMISE / METALS MARKET STRUCTURE

The Long Good Bye

The Comex should be put out of its misery now. It's a toxic albatross around the CME neck. It has no reputable brand to market overseas. It is a walking liability. If you think the LBMA has lost its credibility due to the banks pulling their flow and the Fix becoming untethered to reality; then wait until the Comex contracts die a slow, painful, denial laden death. It will likely recede into the fade. Or worse, it will explode in the CME's face.

Out With a Bang?

It could end with a bang. Imagine if someone took delivery all at once. This would play on the Fractional Reserve Banking market structure in place for decades. The difference in size between actual metal and derivatives traded on Gold and Silver created the opportunity and framework for price manipulation for decades.

This is not to blame the derivatives market. It is simply to say, when the derivative market is larger than the real underlying, there is opportunity for "tail wagging dog" manipulation. When you combine this market structure with compensation incentives and "blind eye management you have the perfect mix for manipulation.

Simply put, deeper pockets have and continue to lever themselves to make themselves right. Now imagine if legacy positions had to be unwound. Four claims for every 1 ounce of metal. Think "It's a Wonderful Life" but Mr Potter winning.

Using silver as an example. Add up the total amount of paper silver traded on a single day from both US exchanges and you get about 950MM ounces of silver traded. Compare that with the approximate 900MM ounces a year that is mined. Get it?

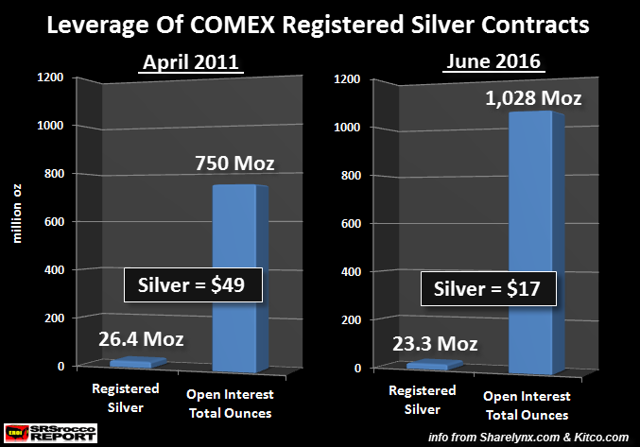

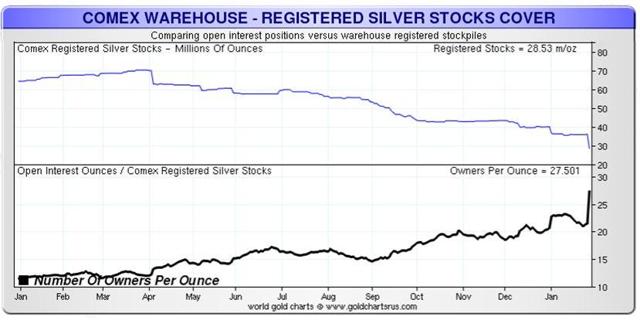

Now look at the Comex silver vault actual,versus potential claims against that silver.

This can openly end when someone stands for delivery. But do not hold your breath. Also keep in mind that much of the physical that has come out of the Comex vaults is now in Asia by way of London.

Corporate Lobbied Market Structure is the Enemy

The "Take delivery of ALL the Silver" situation will not happen. It won't happen until the ROR (and exit risk) for cash-and-carry play is better than the ROR on levered 'short cons'. Even then, the regulatory risk is too great.

Look at it this way. You have to borrow stock to short it. You need that stock up front to be able to short it. If it is not available, you cannot short the stock. Meanwhile, the long who makes his stock available for shorting gets paid interest on his "loan". Even more, the bank holding that stock will give leverage of 2x or more for the cash value of that share of stock.

Conversely,in precious metals, you can short Gold without borrowing it first. And the 'long' must declare intent to take delivery come first notice day. Only then does the "short' have to decide if he wants to make delivery or cover in the open market. And as to collateral value? Forget leverage. if you keep your metal in abank, you'd be lucky to get 50% of its value in collateral.

For example, Buffet in 1997 - Remember when the Government begged Warren Buffet to NOT take delivery from improperly hedged producers in 1997? - What a swell guy. He loaned it back to them at 40% interest. He NEVER intended to take delivery. He sold in the $8.00 area and was ironically front run by bullion banks on his exit.

Vaya con Dios Comex !

COMEX DEMISE / GOLDENYUAN RISE

Dubai's Gold Exchange (DGCX) is now listing the Shanghai Gold Futures contract.

So Comex will fade away. What is bearish for Comex, is however bullish for Gold and Silver. Here is the DGCX's Product Description:

China is known as the one of the biggest gold producing and consuming countries in the world. It is also one of the top two importers of gold globally. Traditionally, China has been deficient in gold investments at both the sovereign and investor level. Gold consumption in China has risen significantly with consistent purchases by the Government of China. The government has also encouraged the Chinese public to invest in gold and use it as an instrument for their savings.

Dubai has historically been a central hub for gold trading in the MENA region. The China Belt and Road initiative also passes through the region and holds strategic value for both China and the UAE. A large part of the trading community in the Americas, Europe and Asia are keen to participate in Chinese physical and derivative markets. At the same time the Chinese government wants to increase the acceptance of Chinese Yuan and the Chinese Gold price benchmark prices globally. The launch of the DGCX Shanghai Gold Futures Contract provides all stakeholders including the government in China, UAE and Dubai, market participants, SGE and DGCX a suitable opportunity to progress together on the chosen path with one singular goal.

- Tracks and prices the largest Gold market in the world by production and consumption

- Settlement based on the Chinese Gold benchmark Price as declared by the Shanghai Gold Exchange (SGE) - in Yuan Bitches = Comex Nail

- Traded and Cash settled in Chinese Yuan (CNH) - see above

- Zero Capital Gains Tax and Zero Corporate Tax - Tax Arb = Comex Nail

- Contract size of 1000 grams (1kg); Tick Value of CNH 10

- Efficient margining for optimal leverage - Bullion dealers and PBOC will use that for price control when they need to buy

- Trade your view on the Chinese Gold market - or alternately, your view on the US Comex

- Trade the spread between Shanghai Gold and correlated Gold products listed on DGCX = Comex Nail

- The margin offsets by DCCC for inter-commodity spreads offers greater capital efficiency - Arab oil profits buys chinese gold, bullion dealers arb it with cross margining. -= US Oil and Gold contract Death

Comex demise and DGCX success are Bullish for Gold and Silver. This is because the Asian players ARE taking delivery of Gold and Silver. This is in part because of the Petrodollar's coming demise. From Connect the Dots

Then : Gold > USD > PetroDollar

- Create Gold Demand: 1944 we steer world towards gold for good reason (we have it, and Germany's lack of Gold was the cause for WW2)

- Inflate Debt: 1971 we have to monetize debt to pay for wars in vietnam and korea > go off gold standard

- Create USD Demand: 1974 cut Arab deal USD for Oil > we sell them military arms, they buy UST

Now: PetroDollar > Gold / PetroYuan

- Arabs have their own strong army, US not buying as much oil, China wants more Oil

- China wants to replace USD as world reserve, Arabs want to sell more oil (without shale competition)

- Arabs cut deal to sell oil to china in Yuan. Arabs will buy gold with Yuan

- Arab world increasing trust in China, Russia a product of implicit backing of currencies with Gold

- Arab world increasing mistrust of US intentions- ambivalent to US policies

Endgame- Arabs get to sell oil locally to China and Russia. avoid shale oil competition in U.S. This is underpinned by Yuan and Rubble implicit backing by Gold, increasing mistrust of US, especially since Saudi's don't need our weapons any more.

So, the levered shorts are beginning to feel the pain now.

NYC Mines & Money Conference Live Stream

MANIPULATION'S PERSISTENCE / MARKET STRUCTURE

Manipulation Finds a Way

The question is, how do the shorts fight back? That answer is a version of what was done in the West. When everyone is finally done buying, the players lobby for leverage, higher margins, and institutionalize micro advantages to being short. This will happen. Perhaps in 100 years, after China has transitioned from USD peg to (implicit) Gold peg,.and then to its own PetroYuan. When it needs more leverage, it will undo its Gold peg and debase the Yuan. In the mean time, manipulation will increase in the Far East via spoofing lower, and price-gouging higher. Just like it happened here for 50 years.

Comex Fleecing Regulated Now? Move to Asia

Hopefully, the free markets will kill Comex for us. And those bullion banks, brokers, producers, players ( talking to you Buffet, Soros, et al) that have cooked prices for years, will start to cook them on other exchanges. Manipulation is not dead. It has just moved East.

LME's "liquidity provision" program is nothing more than a level 1 ECN for old LBMA dealers to "transparently" lean on their own order book.

If only those firms had no order flow, then we'd see what great traders they really are. We remember one time when a bullion bank trader was unhappy with his bonus. He foolishly approached the MD and complained in front of the group on their trading floor .The MD crushed the trader.

'Do you think you made the money for us?' he reportedly shouted. 'This chair you sit in made the money. I can put anyone I want in this char with basically the same results. The order flow we provide for you is why you are profitable. The chair is the money maker, not you!'

But we digress

Skin the Comex? Why Not!

Dear U.S. Bank with a lot of physical Metal: After relocating all your allocated silver to some vault in Asia, feel free to lift your Comex hedges, then get long, and then announce you are taking delivery on Comex. Then re-apply your hedges in Asia, sell the backwardation on Comex (like Buffet did) and walk away from the exchange.

We understand that you don't want to give up your US "rule of law" protections. We also know you'd rather not be subject to a DOJ investigation. So feel free to fire a couple traders and seed their new hedge funds. Then do all your deals with them via a closely held Singapore shell in which you control the voting shares. And it would help to have one of your own be on a US regulatory body. Even better, convince a Chinese national to do it as a client. Fees, storage, marketmaking profits, and no risk. the US cant extradite a Chinese national. Think of Buffet, but with balls.

And learn from DB's mistakes. They had to turn traitor to their co-conspirators in their own metals fraud because of more pressing (DOJ) issues. Why else would they sell their vault business to China 2 years after opening it?

So go for it! Kill the Comex. Don't worry about regulators. Remember, Government can be bought, or at least rented.

Government: Here to Help

Do you, the reader not think the banks and/or the government influence the timing of margin calls? Do you believe that an exchange will not do everything in its power to rescue the player with the largest marketshare at the expense of its own counterparty diversity? Worked for POTUS in 2009.

Barack Obama inverted contract law when he "rescued" GMAC and Chrysler bondholders.

From the Cato Institute

..... the Obama administration in 2009 bullied Chrysler’s secured creditors—who were entitled to “absolute priority”—into accepting 30 cents on the dollar, while junior creditors such as labor unions received much more. This subversion of creditor rights violates not just bankruptcy law, but also the Constitution’s Takings and Due Process Clauses.

Do you think a regulatory officer would be less risk to violate the law? We know from experience the answer to that is an emphatic NO. Ask any eczema- laden compliance officer you know. So, it's all good Bullion Banks. Just make sure you have a couple guys to throw under the bus.

In other EXCHANGE NEWS

ICE completed TMX Atrium all-cash acquisition. Financial impact will be immaterial to ICE. SGX offered to open its clearing infrastructure to APEX, a new Singapore commodity futures exchange backed by a Chinese hedge fund. Reported by the Financial Times. LSE purchased 67.0k shares at 3,366p per share, as part of its £200m repurchase program. Total purchases add 1.10m shares up to date. NZX revenues from continuing operations increased 3% y/y to NZ$18.6m. Calypso and R3 are testing their FX trade matching solution on Corda distributed ledger technology (DLT) platform. DGCX: the recently launched Shanghai Gold Futures contract helped DGCX see a boost in precious metals trading in April. Bloomberg is partnering with Twitter to launch a streaming television news service on the social networking platform, according to WSJ. The channel is expected to begin operations this fall. SEC: Senate will cast an initial vote today on Jay Clayton’s nomination as Chairman of the SEC.

Just Sayin'

Dear CME

Comex is a liability. The demand is now Eastern. The vaults are going east. The Banks are trading Far Eastern time. The price premium to spot is Asian. The money to be made is in the east. The retail are newly minted middle class Chinese, and Singapore citizens.

You know that exchanges ultimately succeed in regions of commodity demand. And you are expert in ring-fencing your liquidity pools. Time to be more aggressive in porting your franchise to Asian markets maybe.

So how are you going to do it? Acquisition? Partnership? Because next up is the Oil business. The global benchmark is already Brent and moving further east as we speak.

We know 70% of your revenue comes from interest rate products. We also feel strongly that CME is a buy as interest rate risk becomes a bigger factor. So you can afford to wait here as a company. But do you really want to? Effort at the margin is so little to preserve your commodity franchises. Maybe we are wrong.

Comex - The Hope Diamond of Exchanges

The Comex was cursed with ineptitude and corruption from the beginning. Did you know they had the S&P 500 index offered to them, but turned it down? But that's not all.

- Tax straddles - actually saw an ashtray that said "Tax Straddles Save Lives" - or something to that effect

- Hunt Brothers' Forced Out - Government usurping the free market ordering "liquidation only" to save the silver producers and bullion dealers - and all board members who were short.

- The "Red seat / Green Seat" fiasco(s)? - NMX and then CME were blackmailed by members to get paid as equity holders. - We recommended the "seat arb" to a client based on the exchange ineptitude and it paid off. Vincent Viola truly inherited a headache there.

Remember in 2011 when Shak and other spread traders were manipulated out of their jobs by cooked spreads?- That case isn't over yet. And it is likely the last decent con of Comex participants we will ever see, unless...

Read more by Soren K.Group