We are on the road today and are constrained to our phone skills.

For our part we can say to our credit that Silver did not break $18.54 where we noted the producer selling was. Gold as a result failed.

What we missed was the extreme sell off in silver due to its industrial qualities.

In short, what had narrowed the gold/silver ratio was silver's industrial demand.

This works both ways. So while we expected a $2.00 move in silver previously on these pages, we did not properly discount just how much the Chinese deleveraging events would undermine that demand.

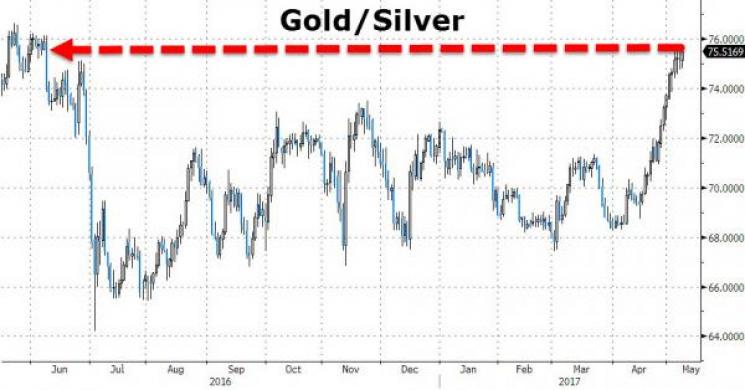

This is exhibited in the relentless climb in the ratio between the 2 metals.

Our friend Bubba Horwitz was right. We do stick to our guns that silver industrial demand will only grow in the years ahead .

But you cannot argue with results. And our own bias guided us to believing the silver gold ratio actually had a chance to come in further this time, even in a wash out. Hat tip to Bubba on that and many other calls.

-Vince Lanci

Via zerohedge

Amid heavy volume, gold futures have broken below their 100-day moving average this morning and are trading below the mini-flash-crash lows from Sunday night's relief at Macron's victory...

This has pushed gold to 2-month lows...

But the Gold-to-Silver ratio hovers above 75x at pre-Brexit highs...

H:T zerohedge

Silver Elevator Keeps Falling

full story https://monetary-metals.com/

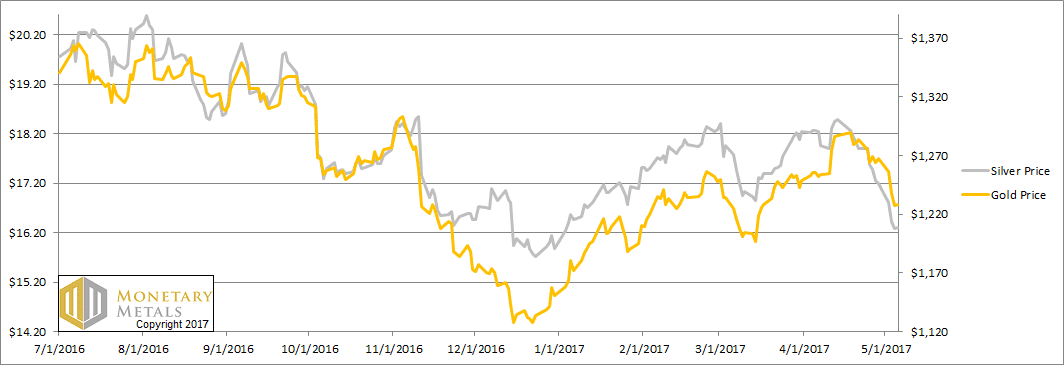

The dollar moved strongly, now over 25mg gold and 1.9g silver. This was a holiday-shortened week, due to the Early May bank holiday in the UK.

The big news as we write this, Macron beat Le Pen in the French election. We suppose this means markets can continue to do what they wanted to do before the threat of Frexit, shutting off trade between France and the rest of Europe, and who knows what else Le Pen was plotting to do to the French people.

This will be a short Report this week, as Keith has been working hard on a paper to address the question of which metal will have the higher interest rate. Look for that tomorrow.

Below as the only true look at the supply and demand fundamental of the metals, but first, the price and ratio charts.

The Prices of Gold and Silver

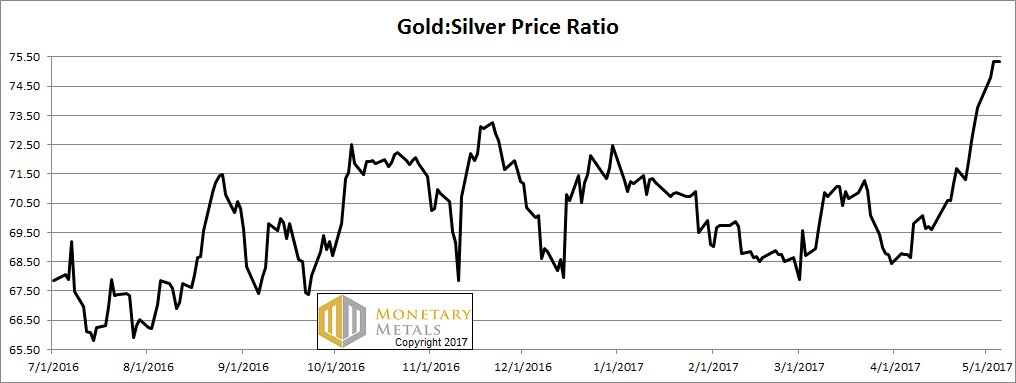

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It had another major move up this week, after a major move up last week and one the week before.

It now sits at the same level it was a year ago. If it breaks above 76, then the next resistance looks to be 80.

The Ratio of the Gold Price to the Silver Price

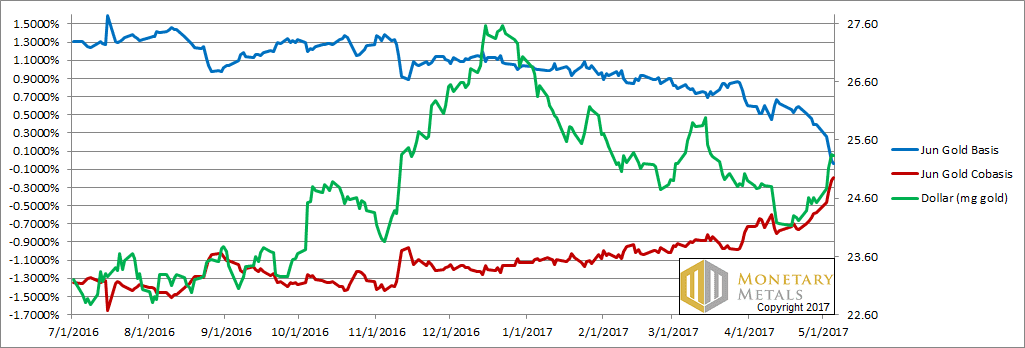

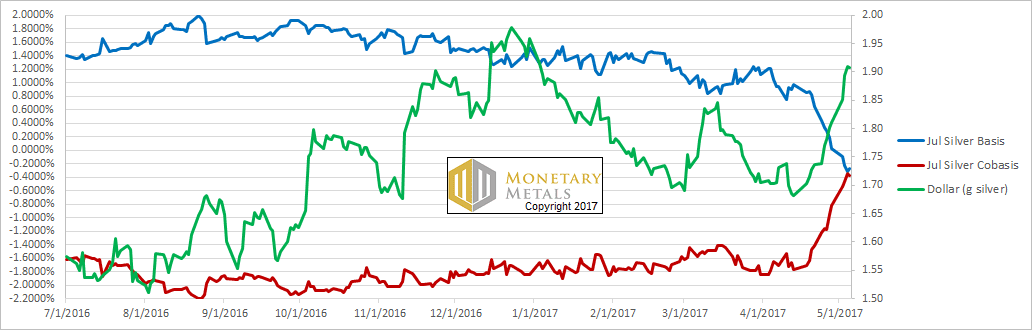

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

If we didn’t know better, we would say that as fast as the cobasis (i.e. scarcity, the red line) ran up, the price of the dollar (which is the inverse of the conventional view of the price of gold) ran up faster.

Actually, that is accurate. And consequently, our calculated fundamental price of gold fell over twenty bucks (though it’s still more than twenty bucks over the market price).

Now let’s look at silver.

The Silver Basis and Cobasis and the Dollar Price

In silver, the same phenomenon occurred though with exaggerated degree.

Last week and the week before, we asked:

Some speculators definitely got flushed. However, the question is how many and how much?

Then we said:

Clearly it happened to more of them this week. And, unless the fundamentals get stronger, it is likely to flush even more leveraged futures positions. Our calculated fundamental price fell three cents this week, now a buck thirty under the market.

It happened to more of them this week. That’s what a rising cobasis with falling price of silver means. A selloff of futures. A flush of the leveraged speculators.

Unfortunately for them, owners of metal were also selling. Our calculated fundamental price of silver fell almost penny for penny with the market price. It remains about a buck twenty under the market.

We saw a technical analysis trader write a note this weekend. He said he plans to short silver on Monday. When the technicals and then fundamentals align, that can make for an interesting week.

Read more by Soren K.Group