La Tempête Française

Summary

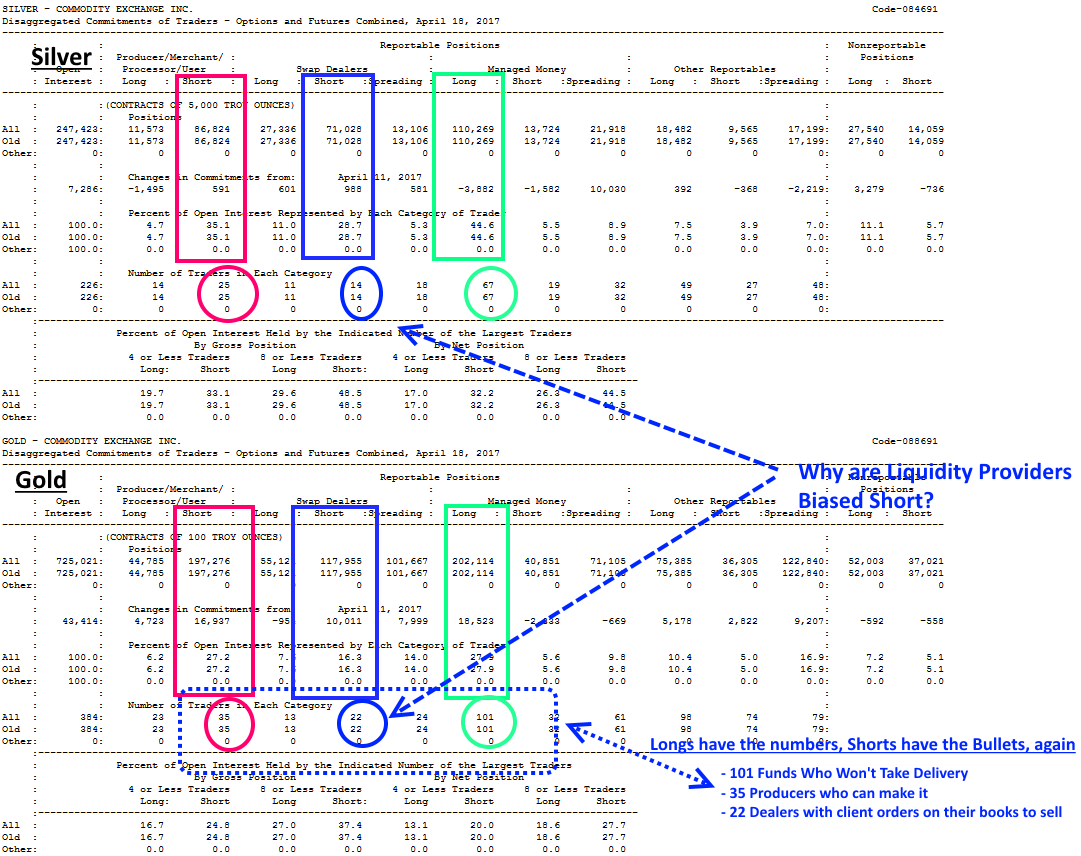

- Speculative gold traders pushed their net bullish position up for the fifth consecutive week. - in a flat market, how patient are the longs?

- Speculative silver traders finally cut back on net bullish positions, but silver remains at extremely bullish levels.- Producer selling remains unfilled

- Russia Added a large 800,000 ounces during March - Another nail in the USD coffin

COT Report This Week

Gold: Spec long positions for the fifth consecutive week. We think that they are still probably accurate post the COT close date

Silver: also increased on the week, but Silver declined post the COT close-date. Thus we expect the reality to be a bit lower.

Comex Sunset - It should be stated that the Comex is becoming les and less relevant as an indicator of sentiment. At the risk of sounding tin-foil hattish: the real deals are London / Hong Kong time now. Comex, like the London Fix, is going the way of the Do-Do bird. Data matters most in regions of commodity demand. Why else would the Bullion banks be buying Gold on US spot and selling it at a premium to spot in Asia? Think about it.

For our part, we are going to start listing the comparable data from the Eastern exchanges where price is increasingly determined. Moving on.

Election Effect Overview

With no candidate expected to take the necessary 50% of the vote to win the election, it is widely expected to come to a run-off between the top two candidates: Emmanuel Macron and far-Right leader Marine Le Pen. The big wildcard is if communist candidate Jean-Luc Mélenchon, who is surging in the polls, can pull into the top two spots with Le Pen. If that happens, then a run-off between two anti-Euro candidates would ensue causing a panic to "safety"

As we outlined candidate positions in our previous post today, and as the WSJ said:

"with the start of the French election just days away, investors are contemplating their nightmare scenario: a choice between far-left and far-right candidates. In recent days, a surge in opinion polls has placed Jean-Luc Mélenchon, a left-wing firebrand who promises higher wages and fewer working hours, as a potential candidate to move past this Sunday’s first round of voting. That could set up a second-round vote in May 7 with Marine Le Pen, an economic nationalist who wants to pull France out of the euro."

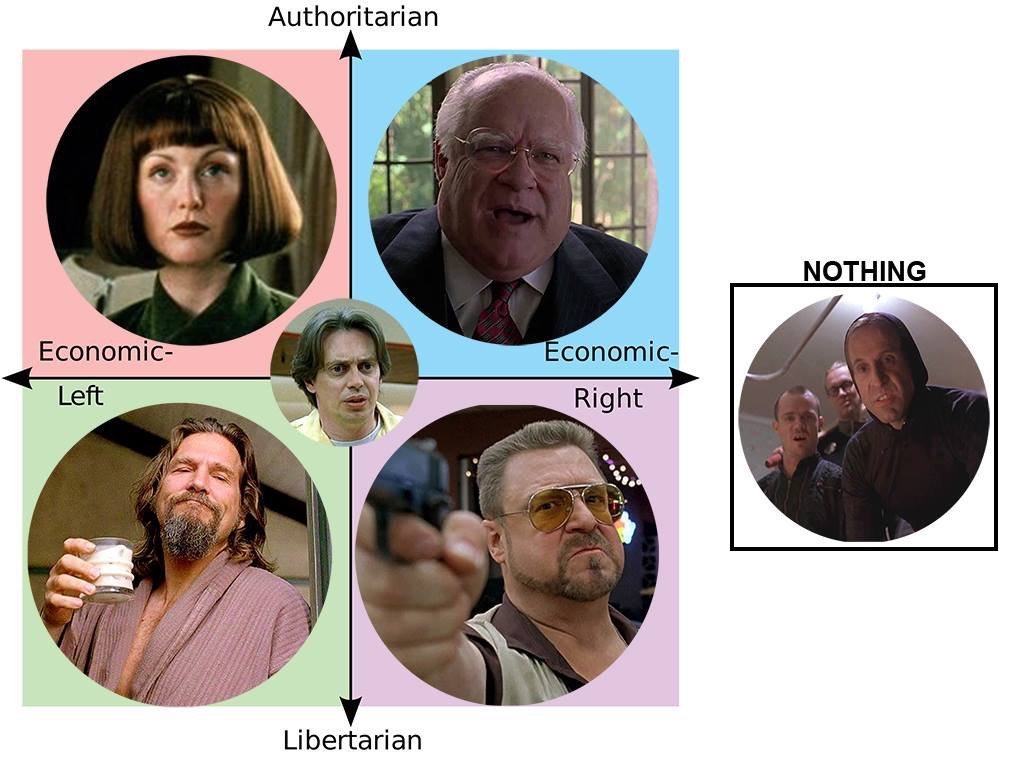

Ironically it is not the polar opposite-ness of the Le-Pen / Melenchon matchup that is the biggest worry. It is the 2 things they have in common - an authoritarian bent and fierce nationalistic pride, a They want out of the Euro and both favor an authoritarian approach to government. Really just an easier to see version of the U.S. election

Trump and Clinton may have been ever so slightly different in the 'how' they'd execute things, but there can be no mistake, both are authoritarian. Trump wants to spend now all at once. Clinton was content to kick cans down the road. The result would be the same. The timing would change, but secular trends are not stopped. They are managed. The end product of both sides' policies will be similar we feel.Economic Death by cancer or death by heart attack. But we digress.

Market Analysis

DeutscheBank

Melenchon’s rise in the polls has been one of the key market drivers since the end of March. Further decline in Hamon’s votes is unlikely to support Melenchon to the same extent as it did in the last three weeks. However, the more important point is that the risk around the first round persists as (a) the top 4 candidates are within the historical margin of error and (b) the high level of undecided voters increases the uncertainty of the outcome.

Pictet Asset Management

A runoff between Ms. Le Pen and Mr. Mélenchon “would be a disaster for France…[and] a disaster for Europe,” said Patrick Zweifel, chief economist at Pictet Asset Management. Under that scenario, investors would dump the debt of France and of weaker European economies and send the euro sharply lower, analysts say.

CITI:

- Since publication of our initial comprehensive piece on the French elections, the polls for the four major candidates have narrowed considerably and Mélenchon has replaced Hamon on the left wing. The narrowing of the polls and the historical error in actual voting relative to polls makes any of the six outcomes involving the four major candidates possible.

- In order of decreasing likelihood the potential outcomes are (1) Macron vs. Le Pen (2) Le Pen vs. Fillon (3) Macron vs. Mélenchon (4) Le Pen vs. Mélenchon (5) Macron vs. Fillon and (6) Mélenchon vs. Fillon.

- Based on current polls, in our baseline scenario of Macron vs. Le Pen in the second, Macron is expected to win comfortably. Le Pen would have to win the first round with a gap of 5pp or more and/or the participation rate in the second round to fall below 60% for her chances to improve significantly.

- We assess the expect market impact on bond markets based on expected yield and spread levels for a presidential win for the four candidates and indicative probabilities of a win for the candidates in the second round conditional on the outcome of the first round.

- Macron is favoured to win against all candidates if he makes it to the second round. Based on current polls market concerns about French elections should recede considerably in any outcome with Macron in the second round.

- OAT-Bund spreads have the greatest room to widen in case of a Mélenchon vs. Le Pen outcome, while it has the most room to tighten in case of a Macron vs. Fillon outcome. However, in the latter scenario the tightening in OAT-Bund spreads should be more than offset by the rise in Bund yields leaving OAT yields broadly unchanged.

DB Again

The first round: A close four way race

The first round polls have narrowed considerably The gap between the 4 major candidates has narrowed considerably over the past few weeks. Given the relatively narrow range between the various candidates and historical polling error, any of the six outcomes taking into consideration the four major candidates is possible.

Based on the final polls, Le Pen and Macron are still the favourites expected to make it past the first round and this remains the most likely outcome. As the current polls have Mélenchon and Fillon lagging, the scenarios which see them making it past the first round would probably be based on them doing better at the expense of the two front-runners.

- Mélenchon’s progress has been mainly at the expense of Hamon. To make it past the first round he would have to capture voters further away on the political spectrum. We would expect his gains to be marginally more at the expense of Le Pen rather than Macron This implies that in the second round Mélenchon vs. Macron is more likely than Mélenchon vs. Le Pen.

- In the case of Fillon, we would expect his gains to be more at the expense of Macron rather than Le Pen. Fillon’s experience and party structure could make centre-right voters tempted by a Macron vote switch back to Fillon at the last minute. This implies that in the second round Fillon vs. Le Pen is more likely than Fillon vs. Macron

- The probability of both Melenchon and Fillon making it past the first round remains low but cannot be ruled out entirely.

Prisoner's Dilemma : There are 6 potential outcomes

Here are the top 3 ranked weighed by combining poll probability and potential market related volatility

- Nationalist Left vs. Nationalist Right - Mélenchon vs. Le Pen: Conditional on Mélenchon making it to the second round vs. Le Pen, we would assign a higher probability (~60%) of Mélenchon rather than Le Pen winning the second round. According to polls and vote transfers between rounds, Mélenchon is more likely to appeal to the traditional centre-left and centre voters compared to Le Pen who would appeal mostly to the most conservative Republican party supporters. BASICALLY A TOSSUP WHO WINS FINAL ROUND. BOTH ARE ANTI EU = STOCKS DOWN, EU BOND MARKET BASIS WIDENS, GOLD UP

- Globalist Left vs Nationalist Right - Macron vs. Le Pen: Based on the current stated intentions and certainty to vote expressed in polls and barring a significant upside surprise for Le Pen, we would expect reasonably high chances (~80%) of Macron wining the elections. MACRON FAVORED TO WIN FINAL = BUY STOCKS, EU BOND SPREADS NARROW, SELL GOLD

- Centrist/ Gobalist Republican vs Nationalist Right - Fillon vs. Le Pen: Based on the current polls and historical polling errors, we would expect Fillon’s chances to win the second round to be around 70%. Le Pen’s chances to win are likely to increase if the participation rate in the second round is lower than 55%.

Gold Bull, Stock Bear Caveat:

The Banks are ready fro surprises this time. Brexit taught them a lesson. Which means there will be government dip buying in stocks and buyers of widening Euro Bond spreads. Gold, they will get to later, if they have to.

'F*ck French Elections, Hedge USD Risk'

Investors are nervous ahead of the French elections. However, long-term investors should not overstate the impact of that election on the gold market. As the chart below shows, the price of gold actually declined before the Dutch elections while the euro gained against the U.S. dollar:

It implies that macroeconomic factors and central banks' actions may be more important drivers for the currency exchange rates and the price of gold in the long term. Surely, the French election is much more important than the Dutch, given the size of the French economy and the key role of the country in the EU, but even the surprising and really disrupting Brexit vote caused only a short-term rally in gold prices. Hence, the EUR/USD exchange rate and the price of gold may be strongly affected by the prospects of the election in the short run, but their impact may not be long-lasting.

Put in simpler terms by Vince Lanci:

You should not care about the elections in France. France and Europe are screwed culturally and economically. You should care about your USD purchasing power as the tallest pygmy among paper money. You should be worrying about the USD's inevitable decent down the drain after every emerging market is long. Because the poor and uninformed will be even poorer. Emerging markets or emerging US citizens, same thing. Its all about inflation folks. F*ck the French elections, hedge your USD risk.

Non- Election Factors Driving Gold

Gold and Silver vs. Major World Currencies in the First Quarter of 2017.

- Gold vs. the USD – up 8.5% in the first quarter of 2017; Silver up 14.40% in the first quarter of 2017

- Gold vs. the Yuan – up 7.5% in the first quarter of 2017;Silver up 10.0% in the first quarter of 2017

- Gold vs. the Euro – up 6.2% in the first quarter of 2017;Silver up 8.60% in the first quarter of 2017;

- Gold vs. the Yen – up 2.9% in the first quarter of 2017; Silver up 5.2% in the first quarter of 2017

Russian Buying Chugs Along

On another note, Russia released its monthly gold reserves and it turns out the country added a chunky 800,000 ounces during the month of March. While this wasn't stunning, it does show the Russian government is still confident enough in gold (or a lack of confidence in the system) to continue to add significant amounts to reserves.

This is another nail in the USD coffin. Follow the bouncing ball here.

- Saudi Arabia is going to sell oil to China in Yuan

- Saudi Arabia is going to buy Gold from China

- Russia is now selling Gold to China

- Banks are now selling USD for Gold

Here is a historical parallel:

- Nixon took us off the Gold standard post Bretton Woods

- Saudi Arabia agreed to make all Oil sales in USD

- Central Banks dumped their Gold for USD.

About that $6 Billion Gold sale last week

Remember last week when, someone dumped 44,000 contracts on the market in 2 days? That was 1 or more large, smart funds exiting before an event. Think Soros, Druckenmiller types. That does not mean the market is doomed. Quite the contrary, it means that if Gold rallies, those funds won't be there to sell like they did election night.

From our post here after the first sale went down:

Large Player Coming Through?

Why were 22k contracts sold when Gold should have rallied? We think we know why. And it has to do with exiting a profitable position a market that too many hot -money types take liquidity for granted. We think and our network agrees that a large sell order was looming above the market for a day or 2 now and had been looking for a liquidity window to exit.

The USD weakness was that exit opportunity. We believe, but cannot confirm, the seller was a large fund, not unlike a Druckenmiller type who uses rallies and strength as selling opportunities to exit large positions. We do not think the seller was spoofing, manipulating or any other type of suspicious situation that we and others like us look for in moments like this.

The problem is who bought that Gold? We fear it was a transfer from deep pocketed players to hot-money types. And for that and all the other reasons it is smart to be flat going into this. This is not a black swan event by virtue of it being discussed. And Gold does not usually do well before events when people have already positioned themselves for the worst.

As a trade, we like gold when Silver is above $18.54 and have said as much before. The other factor is Gold option expiration on the 25th, which has large OI at the $1300 strike. This can be a pin, or a slingshot factor. Historically, it is almost always a pin in Gold.

French Fraud: The Illusion of Choice?

In the case of France and most EU nations, the secular trend is towards nationalism. And the two top candidates, while viewed as polar opposites on the liberal- conservative scale are authoritarians with a nationalist bent. It is what they have in common that should scare you. One of our favorite movies, The Big Lebowski illustrates the political spectrum in a way we can relate.

Jeffrey Lebowski is the big unethical capitalist on the economic right. His daughter, the artsy Maude, is on the economic left. Both are authoritarian. Both know what is best for you, and both are nationalist by convenience. it is the secular trend of nationalism that authoritarian types latch onto and portray themselves as deliverers of the 'goods' .

Remember HOPE and CHANGE? Yeah, Obama was an authoritarian figure like no other. A god-damn savior in his own mind. and Trump is the same person. Hope and Fear are opposite sides of the same coin. HRC couldn't sell Hope as well as Trump sold Fear. That's the difference.

France in in the same situation. A Communist and a Capitalist united by their desire for power and seizing on nationalist secular trends to get to power. That is why we believe the chances of polar opposite candidates making the final ballot are very high. Both are Nationalistic and anti-EURO.

Good Luck

About: The Soren K. Group of writers are currently 5 persons writing collectively. Backgrounds are professional, ranging from Finance to Banking to Real Estate. Topics include politics, markets, and Global Macro situations with a libertarian bent. Some posts are collaborative, some individually written.

Email: Sorenk@marketslant.com

Twitter: @Sorenthek

Read more by Soren K.Group