Originally on GoldinAmerica.com

Gold Comment by George Gero

Gold traders , investors,understood the INFLATION word and reacted yesterday triggering buy stops.

Comments:

- Recently gold ignored traditional headwinds of higher rates and strong stocks.

- All this means is we could see higher prices later on after option expiration and back to basics market forces.

Open Interest and Option Expiration

Open Interest reflects short covering :

- futures at 530412 not really gaining that much due to some short covering

- options however at 1,098081.

- Copper 258585, March-May spreading going on

- Silver 198081 followed gold yesterday up 2pct,

Ratios:

- gold-silver 80.40 better

- plat-palladium-1.00

- gold-plat 353.70 up 20 recently.

$1350 Gravity:

- next week Feb 22nd is option expiry

- $1350 can act as magnet as day approaches. But if repelled will be slingshot

- historically a “pin” is likely as expiry day approaches.

- if strike pins- what happens next days can be violent as ITM options must decide if they want to keep their futures positions.

Post Feb 22: Back to Basics

- high deficits, infrastructure and other rebuilding of FL,TX,PR,Ca,etc.

- Markets may be ahead of the FED for now, as higher prices, higher closes, higher open interest and higher commodity prices starting in the supermarkets.

Upcoming Economic Data

For more insights contact George Gero at

For more insights contact George Gero at

M.D. RBC Wealth Management george.gero@rbc.com

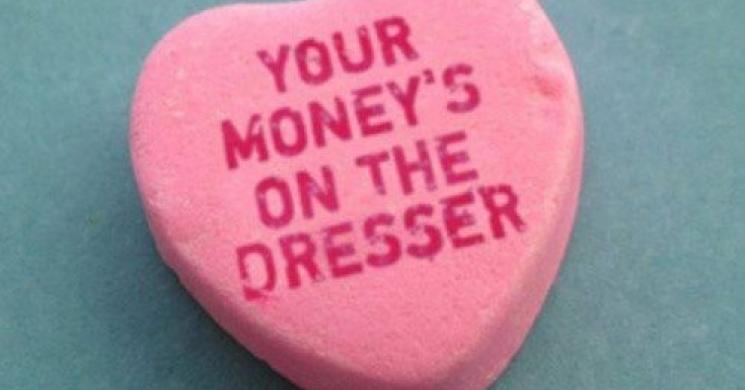

Cover photo: a thank you left behind by stopped out shorts perhaps?

Read more by Soren K.Group