Go East Young Man

- Editorial Intro by Vince Lanci for SKG

I feel compelled to comment here. SRSrocco writes from a cash-flow perspective often. He follows the money where he can, and uses empirical evidence to do so. In industry discussions, his work is a mix of fundamental analysis, industry knowledge, and more "follow the money" analysis. Many are avid readers of his stuff on precious metals. But marketslant readers should pay more attention to his Energy stuff here.

We whole heartedly recommend doing just that, if for no other reason, there is evidence of an increasing inverse relationship between the 2 markets. Soren K. has over 20 years experience trading energy quite successfully. And despite his own ability to see macro trends affecting price (fracking in 2007, Shale in 2010) he admits a black hole in leveraging that knowledge on the equity side. But SRSrocco does apply his knowledge on the equity/ industry side.. More on that in SRSrocco's energy post in a bit.

In the meantime, read this. It confirms our own bias that Gold, its pricing mechanisms, and its flows are moving east. SRSrocco's examination describes the what and some reasons. We are more interested in predictive drivers in our own work. But it is nice to see the data playing out as we predicted. - -Soren K. Group]

Metals Today:

Gold is down around $20 trading $1221 last spot. Silver is trading $16.11 down 50 cents . For updated prices click HERE

U.S. Gold Exports Surge As Its Gold Trade Deficit Continues

via SRSrocco Report.

It’s no secret that the East (Asians and Indians) continue to acquire a lot of gold as Western demand has weakened this year. According to the most recent data released by the USGS – United States Geological Survey, U.S. gold exports surged during the first four months of the 2017 versus the same period last year.

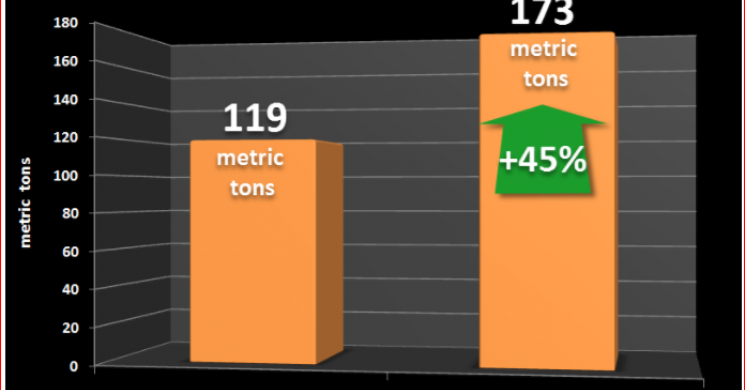

How much? A great deal. In the first four months of 2017, the U.S. exported a stunning 173 metric tons of gold (5.5 million oz) compared to 119 metric tons (3.8 million oz) during the same period last year. Thus, U.S. gold exports Jan-Apr 2017 surged 45% versus last year:

This is quite a large increase. I would imagine part of the increase is due to the fact that U.S. precious metals retail demand is off considerably ever since Trump was elected President. U.S. Gold Eagle sales are down a whopping 62% 1H 2017 versus the same period last year.

For example, the U.S. Mint sold 501,000 oz of Gold Eagles during the first half of 2016, versus 192,000 oz for the first half of 2017. This is a drop of 309,000 oz.

That being said, the drop off in physical gold investment demand in the U.S. has been offset by elevated demand in the East. As I mentioned in a previous article, the U.S. exported 31.4 metric tons to Hong Kong alone in January. Thus, Hong Kong received more than half (57%) of all U.S. gold exports during January this year. [EDIT: He is right, and the drivers are market structure, a cultural difference in what Gold is, and a burgeoning middle class there while the West's is dying both literally ad\nd figuratively- SKG]

So, what were the top five countries that received the majority of the 173 metric tons of U.S. gold exports?

Top 5 U.S. Gold Exports JAN-APR 2017 (mt =metric tons)

- Hong Kong = 66.7 mt (38%)

- Switzerland = 48.3 mt (28%)

- U.K. = 25.5 mt (15%)

- India = 22.9 mt (13%)

- U.A.E = 6.1 mt (4%)

Of the 173 mt of U.S. gold exports, these five countries received 169.5 mt, or 98% of the total. Hong Kong and India received 51%, while Switzerland and the U.K received 43% of the total. However, much of the gold that is exported to Switzerland and the U.K. make its way to China, India or other Asian countries. So, it is safe to assume that the majority of U.S. gold exports are eventually making their way to the East.

What is also quite interesting is that the U.S. continues to export more gold than it produces and imports. During Jan-Apr 2017, the U.S. produced 77 mt of gold, while it imported 88 mt, for a total of 165 mt. However, total U.S. gold exports for the first four months of the year equaled 173 mt, or 8 mt more than it produced and imported.

Thus, the U.S. continues to run a GOLD TRADE DEFICIT.

While precious metals investors in the West are frustrated by the low gold price (and the failure to break above $1,300), the East doesn’t seem to mind a bit. The Eastern philosophy for owning gold is to acquire it on price dips for the longer term, while the West tends to become frustrated over the shorter term.

So, I don’t look at the 62% decline in U.S. Gold Eagle sales Jan-Apr versus last year, as a bad thing. Rather, I just brush it off as the West ‘s FICKLE investment nature.

Lastly, I had the pleasure of chatting with Chris Martenson of PeakProsperity.com this week. It was way overdue because Chris is one of the few analysts whose work is quite similar to what we do here at the SRSrocco Report. I will be releasing our interview when it is posted on their site.

Check back for new articles and updates at the SRSrocco Report.

EDIT: Soren K. We feel SRSrocco's work complements our own. We do not mean to attach our name to his star. It is comforting to see someone do the flow work that sometimes confirms our opinions, and sometimes contradicts. In any event an analyst who is well versed in fundamental measures like cash flow and EBITD, and more subjective analysis like conditional probabilities is someone we want around to "check" our own work. From one of our own predictive posts on the topic:

The Key to the Gold Market's Eastern Success Lies in Market Structure

Essentially, the contracted specialist has a free "put" to not do what he is morally obligated to do. This is not a new model. But it is now full circle where banks as liquidity providers ( the guys who rigged and or passively played a role in rigging the Gold and Silver Fix) are now at the hub of the Gold flow. Yet in much bigger markets like FX, the banks wont participate in this way. This is because the FX market is still largely OTC and a good profit center franchise still. That is not to say the Specialist/ DMM type market-structure cannot work. It is necessary in many cases where the marketmaker is the gold dust that gets the virtuously reinforced cycle of liquidty going. That is a paraphrase from the Goldman sponsored book "B2B exchanges"

More: It also wants to shoulder aside U.S. exchanges CME Group and ICE which launched London gold contracts last month, although they have yet to attract any business.The LME's partners from the banking sector are Goldman Sachs, ICBC Standard Bank, Morgan Stanley, Natixis and Societe Generale. They have founded a company called EOS Precious Metals along with commodity trader OSTC and The World Gold Council, an industry market development body.

And demand is moving East. Incumbent exchanges in precious metals should consider getting the gang back together to augment their currently homogeneous and hedged (conflicted?) liquidity pool and make a stronger play in China. Traders who invest their competitive ego and heart as well as financially vested interest into making London contracts work are out there.

Even More:

"If the LME can provide liquidity, then that's where people will go and so will we," said a source at one gold producer.The LME plans to offer a much wider range of contracts than its competitors do at the moment in London.The CME is offering gold and silver contracts to connect London with its established New York market. ICE runs the London gold auction, which sets a global benchmark price for bullion, and has a daily gold contract that will enable participants, which include most of London's largest bullion banks, to clear their trades.Neither set of contracts has traded since launching in January. The CME said it was working with major banks to synchronize their systems to start trading.

While the regulators are patting themselves on the back for catching the Gold and Silver scandals after 20 years, the players have moved on to greener pastures.

Read more by Soren K.Group