- Gold Demand slumped to a 10-year Low Year over year in Q1

- Demand is Set to Rise as Inflation Picks Up

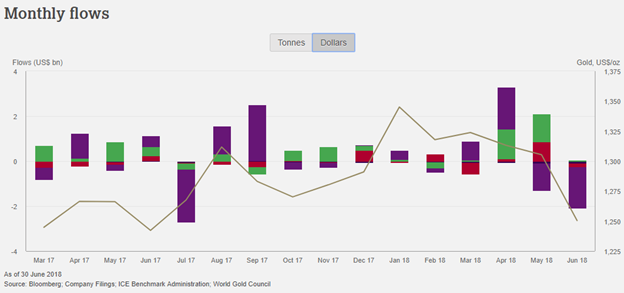

- Gold ETF Flows Hit a Seasonal Low in June

The first quarter of 2018 saw gold demand dip to the lowest Q1 levels since 2008, during the height of the financial crisis. According to the World Gold Council, the drop-in demand was a function of the lack of investment into gold bars and coins, as well as, a decline in the demand for gold ETF due to the range-bound nature of the precious metals market. It appears that investors are looking for a trend to follow and are less interested in purchasing gold for the long haul. Fortunately, the range bound nature of precious metals markets is likely to end relatively soon as global inflation takes hold, which should pave the way for higher gold prices.

First Quarter Gold Demand

First quarter gold demand slipped to the lowest levels since the financial crisis dropping to 973.5 tons which was the lowest first quarter in the past decade. Jewelry demand stabilized around the globe which slightly offset investment related product demand. Growth in China and the United States help buoyed demand near 488 tons. Central banks further boosted demand increasing their stockpiles to 117 tons which was a 42% increase year over year. Demand for gold as a byproduct in the technology space increase 4% year over year to 82 tons.

Supply Increased More than Expected

Gold supply increased more than expected, but most of the increase came from producer hedging as opposed to an increase in mining supply. Gold producers hedge their exposure to the gold market by selling gold futures as well as over the counter gold swaps. In some cases, gold producers will hedge their risk using options. The total supply of gold increased 3% to 1,064 tons, as producers hedged longer dated futures which will hedge production in future years. The actual mine production during the Q1 was 770 tons.

Inflows into Gold ETFs Should Rebound in Q3

The beginning of second quarter saw a robust increase in ETF flows into gold related products. According to ETF.com nearly 3.8 billion were invested in gold ETFs so far in 2018. That's more than 2.5 times the new net inflows that gold ETFs amassed over the whole of 2017. Some of the increase in gold ETF demand has come from a rise in inflation expectations, along with geopolitical unrest.

Since April, flows into gold ETFs have declined and are now poised to hit a seasonal low in July. The increase in April flows into gold ETFs followed the March Consumer Price Index which showed a 2.4% year over year increase which scared investors. Inflation expectations are on the rise again following a stronger than expected Producer Price Index. According to the Department of Labor statistics, U.S. Producer prices rose in June, leading to the biggest annual increase in 6.5 years. The year over year figure rose to a whopping 3.5%. The combination of range-bound markets and stable inflation reduced flows into gold ETFs. Over the past 18-months, the lowest flow increases into gold ETFs came in July 2017. This was followed by a robust rebounded in August and September.

Third Quarter Demand Should Rise

With inflation on the move, gold demand should pick up lead by a rebound in ETF investments. Stable central bank purchases and solid demand for jewelry, should allow prices to test the upper end of the current range. Continued stronger than expected inflation figures should also boost demand which in turn would lead to an increase in prices.

If you are looking to take advantage of a time to add precious metals to your portfolio, click on this link to get access to your Investment Kit or better yet, give us a call today at 800–982–6105.

Good Investing,

Treasure Coast Bullion Group

Read more by Treasure Coast Bullion Group, Inc - Staff Writer