Nowhere Safe Left to Hide ?

- The Fed Threatens to Raise Rates but Gold Does not comply

- Debt ceiling debate is turning into a crisis, and is hurting the USD

- French Election is far from over as Le Pen courts the moderate vote

- Gold rallies $12.00 off the lows in the face of Fed talk

via Vince Lanci

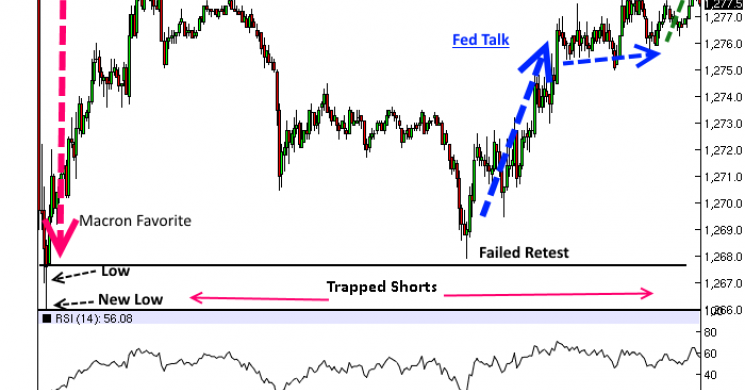

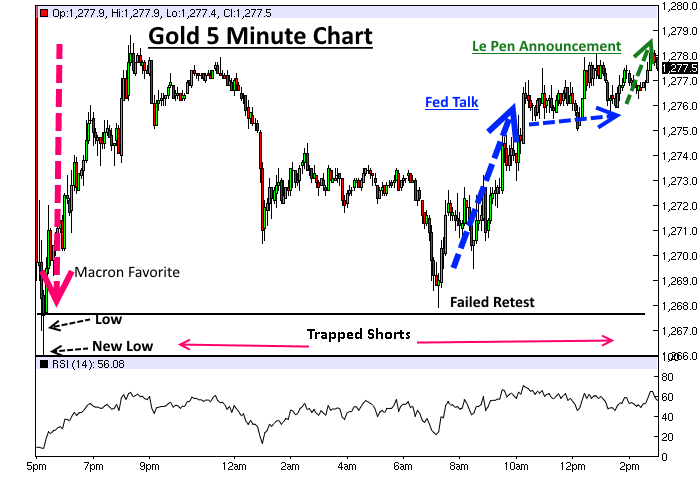

Gold had plenty of reasons to sit down and stay down today. Chief among them was the French election, which got the ball rolling at 5 p.m. last night. Futures touched a low of $1266.00 between 6 and 7pm EDT. They then retested those lows but came up short around the morning fix, getting down to $1267.90. Then the Fed came out talking rate hike. This should have killed Gold but it did not. Why? We think we have an idea, but first let's look at the Fed situation.

The US domestic situation had been pricing in that we were closer to the end of a hike cycle. Factors contributing to this were soft inflation, disappointing earnings and poor macro data. For the Fed to even be talking hike was inconsistent with previous softer rhetoric. Could it be that the Fed was reacting to the likelihood of a centrist candidate favored to win the French elections as its reason to hike? Color us shocked! But far be it for us to question the wizards at the Fed. As a result June rate hike odds spiked to 69%. That is a large jump. One would think that this is classic Dollar up Gold down behavior. But that did not happen. Gold rallied. And it did it all by itself, it did!

So what happened? First lets look at the markets that should have reacted most tot he Fed tough talk; the USD, and the Bond market. The USD should have bounced on the rate hike odds increase. But it did not.

And gold should have backed off we would think. But it rallied

So what gives? It seems there is a new focus in the markets. Another potential crisis from which people are fleeing to safety. But the USD is not what they are buying. Why not? Because the potential crisis on deck is the US Debt ceiling. So Gold rallied on the back of the Debt ceiling issue facing us now. And we think near day end, it got a push from Le Pen's attempt to court the Leftist voters that are hostile to the EURO.

For now we should focus on the Debt ceiling. One way fear manifests itself in events like this is in the yield curve of our bonds. Bond yields will invert during times of possible default as a knee jerk reaction to that worry. Going back to March 8th Treasury Secretary Mnuchin wrote a letter to congress voicing concern on the debt ceiling. The key paragraph stated

“Treasury anticipates it will need to start taking certain extraordinary measures in order to temporarily prevent the United States from defaulting on its obligations”

The letter also stated: It will suspend the sale of State and Local Government Series (SLGS) securities, which count against the debt limit, as of March 15 and “until the debt limit is either raised or suspended” As it’s done in the past, Treasury will use additional extraordinary measures. Mnuchin says that “honoring the full faith and credit” of U.S. outstanding debt is a critical commitment.

And on that note, yields inverted on the bond curve. They bottomed at around -1.25 on March 15th. Flash forward to this week and the same thing happened. only this time, the low of March 15th was taken out solidly.

The same spread has taken out the lows by 100% from -1.25 to -2.50. That is the canary in the mine. That is why Gold held, and that is why the USD did not rally. That is why The Fed is playing chicken with Trump now with a weakening economy and a debt ceiling fight looming.

The next crisis on deck is domestic. The USD will not help. So you can put your money in the EURO, the Yen, or Gold now.

If the Debt ceiling issue is not resolved by August, here is how it could play out. Failing to raise the debt ceiling after those measures mentioned by Mnuchin on March 8th run out would risk the United States defaulting on its debt. Via the Hill

“By CBO’s estimate, the Treasury would most likely be able to continue borrowing and have sufficient cash to make its usual payments until sometime in the fall of this year without an increase in the debt limit, though an earlier or later date is possible,” the CBO said in the report.

Treasury Secretary Steven Mnuchin said during his confirmation hearing that he supports increasing the debt limit, and Office of Management and Budget Director Mick Mulvaney said last month that the administration plans to use extraordinary measures as long as possible.

Based on past behavior, Trump will play brinksmanship until the last minute. Using his Mexican wall as a stick (carrot?) to somehow get the Congress to listen to him is just the beginning we think. other measures will add to the drama as the deadlines approach. This should underpin Gold.

From Zerohedge:

Trump also has expressed a willingness, in the past, to let the U.S. effectively default on its debt: We suspect that attitude may change.Perhaps the stock market will start to pay attention soon too.

And then there is the Le Pen factor. As we stated in a prior post today:

Marine Le Pen injected more uncertainty i n the race for French President by dropping her Party Leader status in order to garner more centrist votes. And the race has likely tightened by 10-20 points as a result of it.

Bookmaker odds currently are laying 1 for every 1.15 bet on Macron, and Paying 8 for every 1 bet for Le Pen. This handicaps Macron as 87% odds favorite of winning and LePen as 13% chance. Those odds may change shortly now that LePen has opened up far left Melenchon backers to vote for LePen based on the candidates' common ground of being anti-Euro

The reality is Le Pen is a long shot. but if she can get even a passive endorsement from Melenchon, her polar opposite in every way but one, their shared hostility towards the Euro, she can make this a race. If she successfully sheds the Nationalist Party racist tags, then the more moderate (less racist) French can focus on 1 issue, FREXIT.

And if the election on May 7th is a 1 issue decision and Le Pen wins? Brexit > Trump > Le Pen > Frexit .. and no more Euro.

Finally, there is an option expiration tomorrow, with significant open interest at the $1300 strike. We feel that a new high in the $1294 area, as unlikely as that may seem tomorrow, will get you a $1300 print. Gravity will take hold, and there will be a drive towards it.

Got Deutschemarks? Where will Gold be then?

Vince Lanci has 27 years’ experience trading Commodity Derivatives. Retired from active trading in 2008, Vince now manages personal investments through his Echobay entity. He advises natural resource firms on market risk. Over the years, his expertise and testimony have been requested in energy, precious metals, and derivative fraud cases. Lanci is known for his passion in identifying unfairness in market structure and uneven playing fields. He is a frequent contributor to Zerohedge and Marketslant on such topics. Vince contributes to Bloomberg and Reuters finance articles as well. He continues to lead the Soren K. Group of writers on Marketslant.

Twitter: VlanciPictures

Website: Echobay.com

Email: vlanci@echobay.com

Read more by Soren K.Group