It would seem that North Korea's ability to launch has less staying effect than Yellen's ability to talk. The photo of Calvin and Hobbes is dedicated to this realization we must be the ignorant ones.

We want to believe Yellen is Calvin and we are Hobbes. Yet the data clearly points to us and the rest of our concerned citizens that we are Calvin; unable to comprehend and unwilling to learn why or how the repeal of logic and math has been replaced by iPhones and complacency. Go figure.

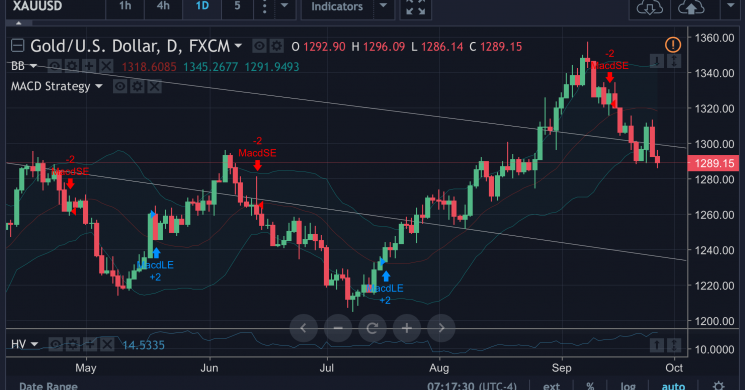

Spot gold is trading down approximately $4.00 as we write this at $1289.70 right above the new low it put in last night at $1285.75

Click chart for live interactive prices and charts (aka click pop)

Gold

At roughly 4:30 am the selling resumed putting a new low in place for these last few days. We again see little resistance to an event driven spike higher, but now see fovernemenrlmetart talk is winning the war against CEO-political uncertainty as Yellen's words propped the Usd again.

Yellen lifts the dollar, Trump to announce tax cut plan, and May's Bombardier headache.

December hike

Market-implied odds of a U.S. rate rise before the end of the year have climbed above 60 percent after Federal Reserve Chair Janet Yellen said yesterday that the bank should be “wary of moving too gradually.” The Bloomberg dollar index headed for a five-week high and the yield on the 10-year Treasury was at 2.29 percent by 5:50 a.m. Eastern Time. Yellen said that it would be imprudent to wait for inflation to hit the 2 percent target before tightening further, as she heads into what could be her last few months as Fed chair, with Republican Senator Richard Shelby on Tuesday saying he didn’t thinkPresident Donald Trump would reappoint her.

Tax plan

The White House and GOP officials will launch a tax reform plan later today. It’s likely to include a corporation tax cut from 35 percent to 20 percent and a reduction in the top individual rate to 35 percent, while Congress will be allowed to decide whether to impose a higher rate on top earners, according to people familiar with the plan. Following the latest failure to repeal Obamacare, both the president and the Republican Party are seeking a legislative win on this key campaign issue. Washington insiders expect a battle in Congress as lawmakers disagree on key elements of the fiscal plan.

May Bomb[ardier]shell

Despite efforts from British Prime Minister Theresa May to the contrary, the U.S. Commerce Department slapped import duties of 220 percent on Bombardier Inc.’s new jetliner. This matters for May as it’s one of the largest employers in Northern Ireland, the home turf of the Democratic Unionist Party upon whom she relies for support in parliament. She said the decision was “bitterly disappointing.” It was also a blow for debt investors; the aircraft maker’s euro-denominated bonds tumbled by the most in two years after the announcement.

Markets rise

The S&P 500 Index posted a 0.01 percent gain Tuesday, narrowly avoiding a fourth day of losses. Overnight, the MSCI Asia Pacific ex-Japan Index was little changed, while Japanese stocks fell as more than 1,000 companies traded ex-dividend, pushing the Topix index 0.5 percent lower. In Europe, the Stoxx 600 Index was 0.3 percent higher at 5:50 a.m., with S&P 500 futures gaining 0.1 percent.

Fed-speak week continues

The embarrassment of riches in monetary pronouncements continues today with Minneapolis Federal Reserve President Neel Kashkari speaking at 9:15 a.m., St. Louis Fed President James Bullard at 1:30 p.m., Governor Lael Brainard at 2:00 p.m., and Boston Fed President Eric Rosengren taking the evening slot at 7:00 p.m. In economic data, U.S. August durable goods orders figures are due at 8:30 a.m., and pending home sales at 10:00 a.m. The oil market will be watching the EIA inventory report at 10:30 a.m.

Read more by Soren K.Group