- Precious Metals Show a Strong Seasonal Performance During the Summer

- Both Gold and Silver Outperform Oil during July and August

- With Oil Prices Likely to Trend Higher, Gold and Silver are Likely to Outperform

The summer is generally a good time to purchase precious metals. Gold and silver historically have outperformed when the weather is warm. They have also outperformed other commodities specifically oil. If you are looking to add precious metals to your portfolio, look for dips in the price during the summer months, as they are likely to be short lived given the historical performance of precious metals during July and August.

Determining Historical Performance During the Summer

One of the best ways to determine how well precious metals perform during the summer months is to perform a seasonality study. This type of analysis looks at the historical performance per month of an asset. You can determine not only how often gold or silver increase or decline, but also the average performance during a specific period.

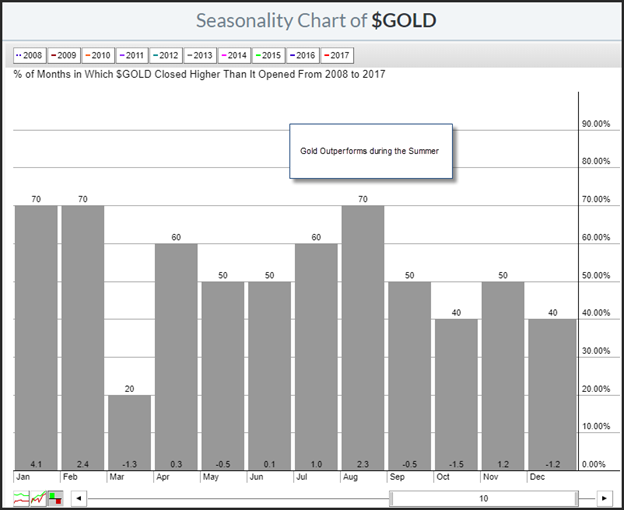

A seasonality study of gold prices show that it historically rises in both July and August. Historically gold prices have increased 60% of the time in July, with an average gain of 1%. Gold performs even better during August rising 70% of the time with an average gain in August over the past 10-years of 2.3%.

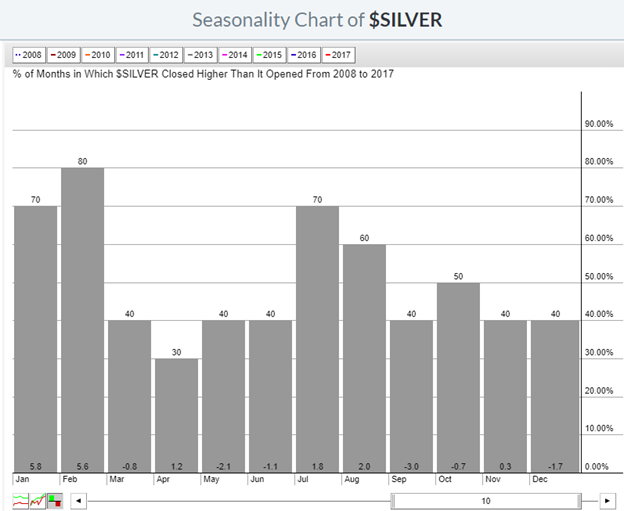

Silver performs better than gold during July but usually underperforms the yellow metal in August. Historically, over the past 10-years, silver prices have increased 70% of the time in July, rising an average of 1.8%. During August, prices generally climb 60% of the time notching up an average gain of 2%.

While gold and silver have eased during the late spring and early summer, oil prices have experienced a wild ride, first rising and then falling. Most analyst believe the upside in oil prices has yet to be reached. In November, sanction on Iran will take hold, and prices will likely begin to rise. The oil market is very tight with lower than normal inventories which are likely to remain in place during the balance of 2018.

Historically both gold and silver prices have increased relative to crude oil especially during the summer months. With oil likely to rise, its prudent to believe that gold and silver will outperform and rise during the balance of the summer.

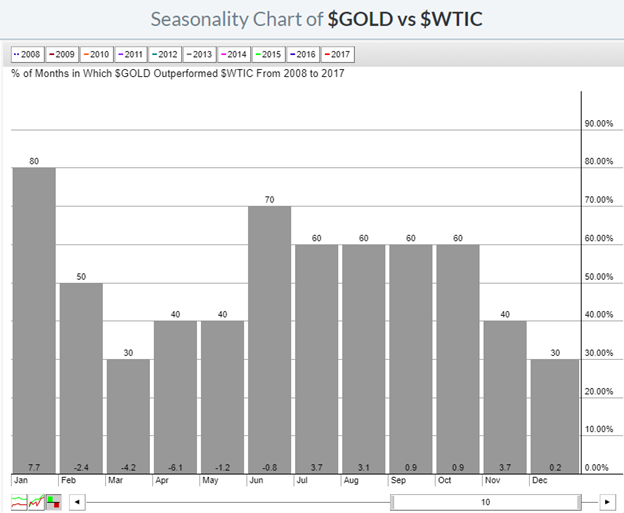

A seasonality study of gold prices versus crude oil prices shows that gold outperforms oil during July rising 60% of the time with an average outperformance of 3.7%. In August gold generally outperforms oil rising 60% of the time for an average gain of 0.9%.

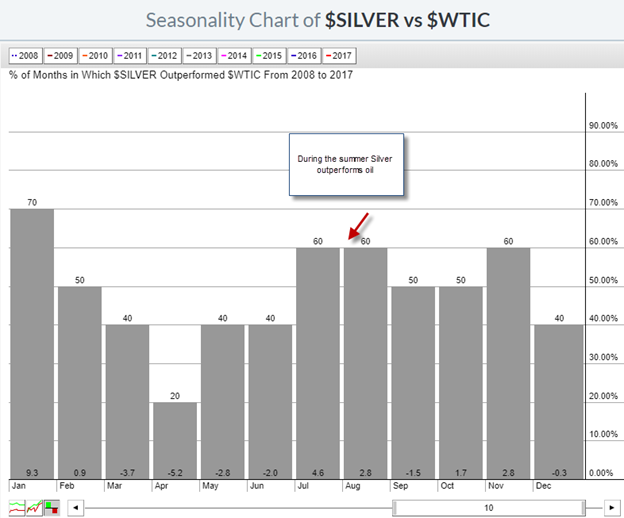

Silver is generally a big winner versus oil prices during July. Historically it has outperformed oil rising 60% of the time with an average outperformance of 4.6%. While not as strong in August, silver outperforms gold by an average of 2.8%.

Summary

In analyzing the seasonality of precious metals, you can see that historically gold and silver have experience a strong performance during the summer months. Additionally, precious metals have historically outperformed oil prices which are likely to rise given geopolitical risks and declining inventories. Both gold and silver generally outperform oil during July and August, providing the backdrop of a robust environment to buy precious metals.

If you are interested in taking advantage of a robust environment to purchase gold and silver, to your portfolio, click on this link to get access to your Investment Kit or better yet, give us a call today at 800–982–6105.

Good Investing,

Treasure Coast Bullion Group

Read more by Treasure Coast Bullion Group, Inc - Staff Writer