Someone Dumps 22,000 contracts into Market. Gold says MINE!

Someone decided this morning was an opportune time to dump over 22,000 gold futures contracts (almost $3 billion notional) sparking a quick plunge in the precious metal...

h/t zerohedge

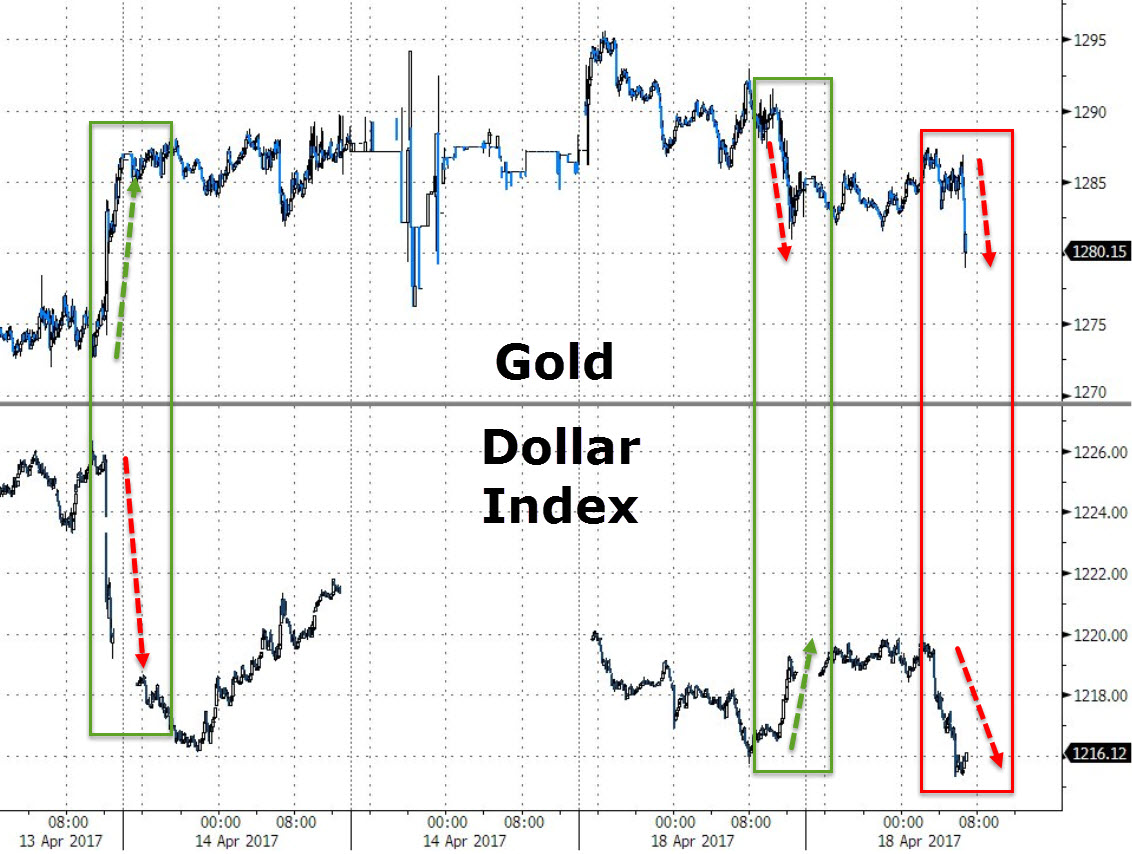

This morning the USD swooned giving Gold a perfect excuse to spike. But it did not. Instead, it feebly firmed from $1286 to $1288 and proceeded to wash out down to $1280, even while the USD was still well under its jumping off point. Why?

Large Player Coming Through

Why were 22k contracts sold when Gold should have rallied? We think we know why. And it has to do with exiting a profitable position a market that too many hot -money types take liquidity for granted. We think and our network agrees that a large sell order was looming above the market for a day or 2 now and had been looking for a liquidity window to exit.

The USD weakness was that exit opportunity. We believe, but cannot confirm, the seller was a large fund, not unlike a Druckenmiller type who uses rallies and strength as selling opportunities to exit large positions. We do not think the seller was spoofing, manipulating or any other type of suspicious situation that we and others like us look for in moments like this.

This was not hot-money exiting. it was most likely a big player taking profits when he could, and not waiting until he had to.

Gold Get's Revenge

interactive chart HERE

On the flip-side, Gold took it like a champ. then it proceeded to rally and overperform on the next USD sell-off erasing all the losses , and is actually up on the day as of this writing. Could it be that There are bigger forces underpinning this market than just hot-money now? We hope so. But still think a pull back is likely even if today's bounce off the lows was eye opening. In fact, we prefer a pull back now to shake out the piggybackers.

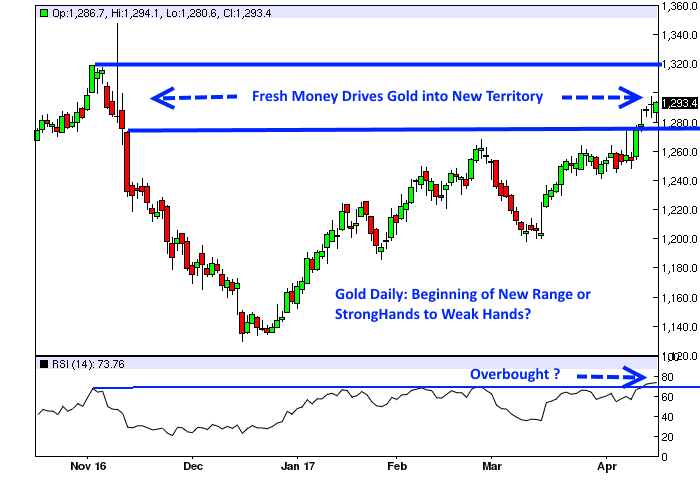

If a large fund sold into strength today it did so taking profits at a much lower level. Traders should be very careful because chances are that order was hanging over the market and being sold in small chunks for the last 3 days.And if that gold has been bought by less capitalized players, then consider those new longs as weaker hands. This is very common near market tops. Strong deep-pocketed unlevered players sell out to momentum chasers. Some bearish news comes out, and those new longs just do not have the staying power their predecessor did.

Trump's election night was an example of this at lightning speed. Most big players that are savvy on their exits, look for windows to get out. They do not wait for bad news. The other caveat is this: If it was a player like Druckenmiller, then expect other large funds to be exiting soon too. Funds like Soros, Odey, and others who play the 6 month type trades.

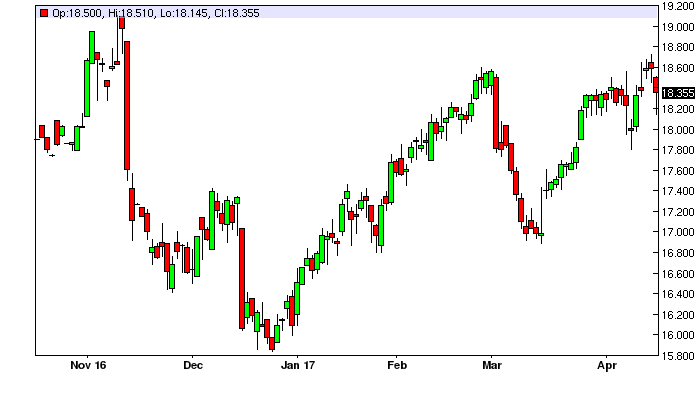

Silver Bugs

And not to beat a dead horse, we are not comfortable being long Gold when Silver cannot get above it's producer selling levels.Had we been long from $1230 area, we'd be getting out here, and looking for a new dip to buy, or perhaps a pop to $1310 to short.

interactive chart HERE

Gold to $1320

To be clear, we called for Gold to rally 2 weeks ago when it pierced $1255. We were right.

We also warned that Gold could wash out if nothing happened over the Easter weekend. Nothing happened and still Gold held. So we were wrong there.

And that offered an opportunity to reassess. Our new conclusion is this: Failed missile or not, the Trump Administration is hell-bent on starting a fight with North Korea. Gold is discounting that. So, while temporary "peace" could break out at any time and make Gold take a nosedive to $1255 it's a dip to buy.

It would just seem that Neo-Trump is war bound with someone, having beaten the press, and Syria, and Russia... he is just going to keep going until he messes up. Just like in his business ventures. The man snatches defeat from victory constantly. Failing upward and leaving destroyed lives in his wake, you gotta be long Gold.

To wrap all this in a bow:

Large Funds are likely exiting here if today's tape reading was accurate. So the next $10 may be up, but that foretells of the next $50 being down if history is any sign. The other caveat is our concern that Silver is a drag on Gold here. While that does not mean Gold cannot rally and leave Silver behind, it does smell like Silver is at least a weight keeping gold from even higher highs. We'd really like to see Silver punch through $18.54. Again, Gold is relatively stronger for a good reason here. That being the geo-political tensions. it is just our experience that those never ending problems seem to get mitigated as OI is on the highs and everyone is long. Finally, When strong hands are gettingout andweak hands are getting in, that shows up in intraday volatility spikes. The battle for the top of the hill may be starting.

The Bull Trade

The $1310-$1320 target for Gold is still viable. Technical pullbacks that hold above $1255 and last for no more than 5 days will likely become bullflags and the market should resume rallies towards the target. Buy everything is Silver breaks and holds above $18.55. Mortgage the kids and take profits at $20.50 in Silver.

The Bear Trade

So if much of the caveat is Silver based, then why not short silver? Short Silver here with an $18.55 print stop loss makes sense right? We just are not wired that way. That is the smart trade now odds wise. We just want to have money in our pockets to buy and get long above $18.54 since we think there is little between there and $21 to stop it. The proper bear trade is this. If gold does not make new highs in the next 3 trading days, then a bull flag is unlikely. Sell it. Same for Silver.

But Remember, Nothing Has Changed BTD!!

Nothing is solved. Nothing will be solved. Trump has discovered that the only thing he can get done on his time frame is: bomb stuff, antagonize opponents, and spend money on the only projects that are always "shovel ready".. the military. There is inflation. it will be chased. Real rates will remain negative as interest rates rise (if they even raise then now), the recovery is teetering and the Fed is hard pressed to raise rates into weakness.

Just buy the dips now in Gold and have a 6 month trading time frame. As the market gets more interest, the time frame will shorten. For now, still think like an investor. Unless you happen to be Druckenmiller.

Vince Lanci

About the Author:

Vince Lanci has 27 years’ experience trading Commodity Derivatives. Retired from active trading in 2008, Vince now manages personal investments through his Echobay entity. He advises natural resource firms on market risk. Over the years, his expertise and testimony have been requested in energy, precious metals, and derivative fraud cases. Lanci is known for his passion in identifying unfairness in market structure and uneven playing fields. He is a frequent contributor to Zerohedge and Marketslant on such topics. Vince contributes to Bloomberg and Reuters finance articles as well. He continues to lead the Soren K. Group of writers on Marketslant.

Twitter: VlanciPictures

Website: Echobay.com

Email: vlanci@echobay.com

Read more by Soren K.Group