The Fed is the Market, Until Someone Bigger Comes Along..

intro from the road by Vince Lanci

“Free markets for free men”- patch worn on the Nymex floor during Iraqi war.

The reality: We were cheerleaders for Halliburton and naively thought we were on the same team. Money that can’t cross borders freely for its citizenry is not a free market. There was a time before each government sought to secure its tax base through FIAT that money was universal.

That time, when gold was money, is back. But gold isn’t currency. BTC is currency. And their combination, whether in a single product, or on 2 different fronts, will take the fight for economic freedom to the Fed doorstep.

Economic freedom is a right corporations enjoy but most citizens do not. And those that do, must pay a tax and withstand a full body cavity search to play. Meanwhile, the west’s corporate controlled government enables its own demise via these uneven playing fields. No matter, the last US middle class people will pay a 300% income tax to cover government spending we bet.

The Fed Has Forgotten The Market’s Basic Rules

The axiom “no one is bigger than the market” has held true forever. When the 2009 stock market reinflation began to be understood by professional traders as the Fed becoming the ultimate backstop to the market, that axiom was discarded by many. And that was wrong.

You see, the largest marketmaker, backstop, supporter, is always eventually supplanted by a successor. The king will die. Long live the next king.

The thing that will eventually dethrone the US govt as market backstop may not come as many see it coming including myself : via a fundamental reckoning or a credit downgrade. No, those things may be resultant of an outside disruptive force on the very nature of centralized power.

It may come like it does in most markets; when the big fish has a position that leaves it too little room to maneuver ( debt service etc) and then a bigger fish comes along that can take advantage of the next thing. That fish could be Russia, China, or a state controlled capitalist set up that can mandate controls more easily to what it wants. Meanwhile the west’s pesky democracy, or what’s left of it will need to be eradicated. Then they can put down any egalitarian economic forces.

So in the west, with corporate controlled governments, the king will be dethroned only by true economic grass roots revolution. And that will only happen if they do not put us down before hand.

Decentralization Kills Power Abuse

Either way the killer concept that will be used is the same thing that has disrupted how we communicate, fight wars, and handle work. That is decentralization as the ultimate disruptor ofcoalesced incumbent power. The playing field will be leveled.

That is what BTC and it’s ilk are. They represent the re- democratization of money. This will openup the markets to a bigger, dare we say it, more fair and definitely more like the real invisible hand that free economic markets aspire to.

The question is how will the incumbent central bankers handle it. It certainly won’t be to our benefit. I write as if the success of a truly free economic society are a given. But they are not.

Control of money is being threatened by a grass roots movement. State Run capitalism will just ban or claim the new tool as its own. China and Russia are already doing oil for gold deals via Blockchain. And why not? They own their banks. The western governments will try to co-opt, restrict, demonize, and finally replace the money of choice with a castrated version that offers convenience at the price of losing that rediscovered financial freedom.

Those on power have no incentive to say “we are wrong, we accede to the public’s desire for an evolutionary government.” Lol.

This will end badly when the Fed gets its shit together.

When that happens, expect a multi-year smack down attempt as they’ve seek to tame crypto currencies they can’t own. And when you think it is over, that is when it is just beginning. The tech ain’t going away.

But if there is one thing that will make enemy governments unite in defense, it will be the true democratic society that can happen. It won’t be martians that bring governments together. It will be it’s own citizens chafing at modern feudalism.

Sincerely:

Vincent

About the Author: Vince Lanci has 27 years’ experience trading Commodity Derivatives. Retired from active trading in 2008, Vince now manages personal investments through his Echobay entity. He advises natural resource firms on market risk. He pioneered and executed the Nat Gas EOO arbitrage trade of 2006 to 2008, netting over $90MM for a NYC hedge fund before retiring. Over the years, his expertise and testimony have been requested in energy, precious metals, and derivative fraud cases. Lanci is known for his passion in identifying unfairness in market structure and uneven playing fields. He is a frequent contributor to Zerohedge and Marketslant on such topics. Vince contributes to Bloomberg and Reuters finance articles as well. He continues to lead the Soren K. Group of writers on Marketslant.

As Bitcoin Nears $10,000 "Central Banks Kept Up At Night"

Via zerohedge

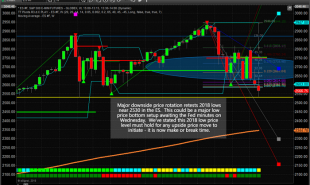

The price of the largest cryptocurrency soared 16% over the weekend, bursting through $8,000 and $9,000 at a record pace and nearing the Maginot Line so many predicted at $10,000.

image courtesy of CoinTelegraph

$0000 - $1000: 1789 days $1000- $2000: 1271 days $2000- $3000: 23 days $3000- $4000: 62 days $4000- $5000: 61 days $5000- $6000: 8 days $6000- $7000: 13 days $7000- $8000: 14 days $8000- $9000: 9 days

Bitcoin highs over the weekend at $9,721...

The 16% surge is, however, only the 4th biggest jump this year as Bitcoin is up 950% year-to-date.

As the price has soared, more and more mainstream interest has grown with one major exchange - Coinbase - now having more client accounts that Charles Schwab

“The Coinbase data is evidence that adoption is not slowing down,” Alistair Milne, the Monaco-based manager of the Altana Digital Currency Fund, told Reuters.

Furthermore, "promises of bitcoin futures opening the door to institutional money are supercharging the price," said Charles Hayter, founder of cryptocurrency data analysis website Cryptocompare.

Notably, as Bitcoin tops $160 billion, the market cap of all cryptocurrencies topped $300 billion for the first time - making their estimated market value greater than that of Wal-Mart.

However, as Reuters reports, the staggering price increases seen in the crypto-market have led to multiple warnings from central bankers, investment bankers and other investors that it has reached bubble territory.

Some say that this could prompt regulators in the West to crack down on the market in a similar fashion to China, where bitcoin exchanges were shut down earlier this year.

“Regulators know the rewards of cryptocurrency and blockchain could be huge but (they) have more than one eye on the catastrophic ramifications if good governance, stability and control are not preserved,” said David Futter, a fintech partner at law firm Ashurst, in London.

“If the carrot of self-regulation proves insufficient, the regulators will not hesitate to use their stick.”

Most critically though it is the central bankers that matter and they appear confused by crytpocurrencies' surge - some unable to sleep due to the disruptive change looming and others dismissive of the 'bubble'. As Reuters reports, it keeps them awake at night because these private currencies threaten their control of the banking system and money supply, which could undermine the monetary policies they use to manage inflation.

“The problem with bitcoin is that it could easily blow up and central banks could then be accused of not doing anything,” European Central Bank policymaker Ewald Nowotny told Reuters.

“So we’re trying to understand whether bank activity in relation to cryptocurrency trading needs to be better regulated.”

“Bitcoin is a sort of tulip,” ECB Vice President Vitor Constancio said in September, comparing it to the Dutch 17th century trading bubble.

“It’s an instrument of speculation.”

China and South Korea, where cryptocurrency speculation is popular, banned fundraising through token launches, whereby a newly cryptocurrency is sold to finance a product development.

Russia’s central bank said it would block websites selling bitcoin and its rivals while the ECB told European Union lawmakers last year:

“they should not seek... to promote the use of virtual currencies” because these could “in principle affect the central banks’ control over the supply of money” and inflation.

But St. Louis Fed President James Bullardadmitted to Reuters in a recent interview what the real concern was:

“(We could) wake up one day and most of the big banks have been eviscerated and most of that activity has moved elsewhere."

Yet Japan in April recognized bitcoin as legal tender and approved several companies as operators of cryptocurrency exchanges but required them register with the government.

Finally, in an effort to counter the private decentralized cryptocurrencies, some central banks such as Sweden’s Riksbank and the Bank of England are also looking at the merits of introducing their own digital currency.

But not everyone is concerned...

While US exchanges anxiously await the $10,000 as some sell-the-news event, Korean exchanges are already trading above $10,000 and holding it...

Read more by Soren K.Group