- Consumer Inflation is at a 6-year High

- Inflation Expectations are Subdued

- Precious Metals Prices Generally foreshadow Changes to Inflation

In May of 2018, U.S. consumer inflation hit a 6-year high, but the rise in prices has yet to spill over into precious metals prices. Historically, gold and silver prices were tied to increases in inflation as investors feared the erosion in value of their wealth. The recent rise in consumer inflation has been offset by a climb in the U.S. dollar which appears to have offset any gains the market would normally experience in precious metals prices. Future inflation expectations remain elevated but will need to break out to drive precious metal prices upward.

Consumer Inflation Rises

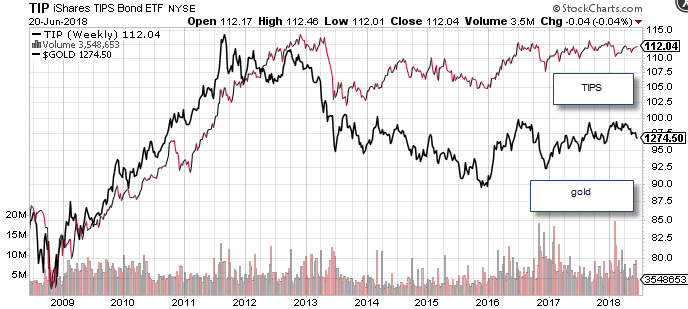

Consumer inflation has been on the rise, but its not clear that investors believe that run away inflation is in the cards. This might be one of the reasons that precious metals prices have not accelerated. One of the key market gauges of inflation is the TIPS (Treasury inflation-protected securities), which provides investors with a bond that is protects against inflation. The returns are principally protected, which means that the price of the bond subtracts future inflation and provides a return to investors excluding inflation. When future inflation expectations are low, the TIPS will decline and when future inflation expectations are rising the TIPS will climb. The TIPS bonds, as well as precious metals prices, reflect the markets expectation of future inflation as opposed to the Consumer Price Inflation index (CPI) which reflects current levels of inflation.

As you can see from the chart of the TIPS bond ETF, the markets future gauge of inflation has increased by has been unable to pierce through the peak levels see in 2013. In fact, it appears that gold as a gauge of inflation peaked just ahead of the TIPS bond. While gold prices are down nearly 33% since their highs in mid-2011, the TIPS is nearly unchanged. This means that there is a divergence in the way precious metals traders view inflation relative to TIPS traders.

U.S. CPI Hits 6-Year High

In its latest reading the U.S. CPI rose 0.2% in May, hitting a fresh 6-year high, as the core rate which excludes food and energy climb 0.2%. There were no revisions to April where consumer prices were up 0.2% overall, and 0.1% excluding food and energy. The annual pace accelerated to 2.8% year over year for the headline from 2.5% year over year, and 2.2% year over year for the core versus 2.1% year over year. Energy prices were 0.9% higher following the 1.4% April bounce, and are up 11.7% year over year. While the core rate of CPI is above the Fed’s 2% target rate, it does not appear that the central bank is concerned about inflation. In fact, in its latest announcement the Fed stated that it believes the inflation will ease from current levels, in 2019.

One caveat that should cause concern for investors it the rise in wealth in the U.S. As household become wealthier, they need to protect their investments if prices begin to rise. The ratio of U.S. household net worth to nominal GDP has soared to new all-time highs each year since 2014, as we surpassed prior peaks in 2006 and 1999, mainly due to the Fed's policy of zero interest rates and quantitative easing. As the Fed pulls back, and the markets become more volatile, one could make the argument that money needs to flow into inflation protected assets. This wealth effect could buoy inflation and should help put a floor under both gold and silver prices.

If you are looking to take advantage of a time to add precious metals to your portfolio, click on this link to get access to your Investment Kit or better yet, give us a call today at 800–982–6105.

Good Investing,

Treasure Coast Bullion Group

Read more by Treasure Coast Bullion Group, Inc - Staff Writer