The Path Forward for Blockchain

BlockChain is Fracking, Lateral Drilling, and Globex All Over Again

Before reading please note, these are general musings based on observation and experience. No trade recommendations are offered. You should consider this as an intro into one group's view of the future.

Via Soren K. Group and Marketslant.com

Based on our collective observations and experience at Soren K. Group we feel as qualified as anyone to opine on the path ahead for Blockchain adaptation and success determiners. One of us has already been publicly dubbed as "expert" in the field of pygmies. We would simply say that our knowledge is based on applying existing models to the field.

What we do understand intimately, especially Soren K, "Bon Scott", and "Fay Dress", are that market structure is key to understanding the path of any disruptive industry development. That helps us handicap the path forward for this new game-changing industry. We know how it ends. The trick is understanding the likely path to that end.

We love assessing new developments in old industries like lateral drilling in oil, fracking in Nat Gas, Retail (Amazon made Scaling less important than Networking) and now in Banking.

We see Blockchain as totally changing Banking's ( and a ton of other industries) face in the next 10 years. The "How" is dependent on the people at the helms of the industries affected by the C2C model blockchain enables. Secure individual ledger accounting kills disintermediators just like globex obviated many brokers and then how algos unemployed traders.

For now lets briefly focus on the immediate developments in Blockchain and what they broadly imply the potential paths are ahead for the groundbreakers (Bitcoin, Ethereum) and the lurking Tech Behemoths (Google, Amazon). It is during these times of disruption that not only do industries reprice themselves but traditional measurement tools like EBITDA etc. are worth less. These fundamental tools themselves are changing as new realities change industry PE baselines

It is during these times that conditional analysis and path dependency assessments are king in understanding change. When an industry is growing and its existing markets are is up for grabs is when knowing market structure and business models helps a lot in protecting yourself.

To do this one must see the relevant models for the industry and their limitations. They are the models governing Network and Scale.

Network Effect and Scalability Models

Network Effect

The business model of cryptocurrencies is based on the Network Effect model. A business that relies on networking is focused on adding users. It doesn't need to add infrastructure at first and increases in value simply by adding users. Essentially, as a network adds users it grows in value.

The Telephone was a good example. Once the wires were hung, the way to increase a phone company's stock is to add users. A successfully "networked" business makes its service indispsensible to people. Imagine being the last person in commerce to not have a phone. That businessman would pay a lot for the privilege or risk being excluded from his own business network.

A more recent example is electronic trading. Imagine being the last floor-trader trying to exit a position in an empty "pit" where everyone was executing on their E-trade screens. That is pure Network effect. The Network effect is the demand side of the "scalability" model.

Scalability

A business "scaling" successfully means it can add supply at lower marginal cost (operating leverage). A great example is mining. Once the drilling is done, an increase in supply is basically just adding more variable costs like labor and turning up the speed of extraction. The hole is already dug! But Scalability and Networking both have limitations andeventually need each other.

Risks to Both Models

One of the risks to the network model is the ability to grow to accomodate new "traffic". That means at some point it must add infrastructure. This is fairly easily done in Tech (though risky) compared to other industries. Scaling a network based Tech business is essentially opening up the architecture to other users with computing power. The first problem, like in trading exchanges before them is the incumbency created in successful people. And in Bitcoin we will see soon that the people in question are the voting members who control the mining servers and therefore their "fiefdoms". Going public may alleviate that risk, but not remove it as discussed further down.

Scalability also runs into its own problems when it has a ton of potential supply it can bring to the market at a low marginal cost but no one wants it. At this point they must acknowledge a need for a greater network to sell to. That sometime means adding salesmen or marketing or partneringwith a selling NETWORK to raise awareness. Not easily done for any business whose people are "wired" for scale models. Again, the problem is management. Google has none of the issues that Bitcoin and the other crytos have going forward. Google and Amazon are not perfect, but they are perfectly positioned.

For here, let's look at Bitcoin's potential path by using Trading Exchange's Application of the Networking Business Model. Our analysis shows the businesses are very similar. For now we will cut to the chase.

GLOBEX 2: Enter the Google, Exit the BitCoin

Right now the BitCoin group is running into what we call "floor trader fear". The voting members are chafing at the idea of scaling their supply by adding servers and/ or server power. This would disrupt their own little empires, not unlike the trading floor fearing Globex back in the day. And so many exchanges held out and protected the floor. And in the end they died. PHLX, AMEX, COMEX, PCOAST, CSCE, all gone or absorbed because they were late to adapt new technology and protect their liquidity pools. If Bitcoin removes power from its voting members control by demutualizing and uses those proceeds to increase server power they will likely excel. But Google and Amazon are now playing and they are all about unlimited server power. Plus they have the eyeballs already. This is no unlike having the "marketmakers" already trading on a screen at Globex. The "liquidity pool" ofbuyers and sellers are already on Amazon and Google. Bitcoin does not have that past "early adaptors". Remember Palm?

When, not if, those behemoths are up and running they will immediately have an embedded network of both customers AND service providers at their disposal in the form of search eyeballs (google) and buyers (Amazon). They will be set up to crush the opposition if they choose to create their own currency. Imagine Amazon offering amazon money for amazon purchases. Now imagine them offering 20% discounts if you use their money. The choices at this point boggle the mind. Tactical choices thought no longer used will come into play again. Some examples: Freemium, Coupons, Customer Loyalty, Vertical Client Integration (P.O.S.), Travelers checks and more.

To be fair, Google has invested in Bitcoin as well. What smart trader would not hedge himself. But just like Netflix is Amazon's biggest cloud customer, but will eventually put Netflix out of business (after NetFlix kills Hollywood's distribution network); So will Google/ Amazon/ Apple attempt to obviate the need for any currency but their own.

Blockchain is the railroad. Amazon and Google have the oil. Like Rockefeller before, The railroad will be made "exclusive" to their products.

Google and Amazon are Already in the Game

Attached is the Daily Blockchain News recap with an example of Google's foray into Blockchain. The goal here is to introduce their own currency or be brokers of deals using their "search engine" coupons. The coupons are the gateway to their new currency. Exactly how this goes down we do nto know. This post is one example of how it could go down. The bottom line for the big tech companies is how they can lever their networks more efficently and add scale without increasing fixed cost. That comes in the form of levering existing networks with new products geared to cement loyalty. What better way to do this than to have your own money ? What will Home Depot do? WE HONOR AMAZON CASH? meanwhile the plumber, pipes, and sump pump you buy next month will all be through Amazon. And you'll get a discount by using Amazon cash on your amazon credit card.

Amazon and Google are just a big cash register with all their products at point of sale. Gum, Mints, and People magazine will become Disinfectant, Steam Cleaners, Rugs, and a Local Handy Man. And instread of asking for your loyalty card they will actually take blockchain driven Amazon currency. Remember ATMs? After everyone was on them, they stopped being free.

We feel that BitCoin is going to have problems going forward. They are also best positioned to overcome those problems. But if they do not increase computing power their client base will eventually be relegated to people trying to export their wealth from oppressive regimes. Meanwhile you and I will be buying Nike sneakers on amazon for 20% off because we are now using Amazon cash on our Amazon Credit cards. And Google will also offer similar concepts if you click on one of their paid advertiser links.

Amazon Suggests : Do you want a fidget spinner with your ADD Meds?

How to play it:

This is not short term stuff. When we made retail recommendations on how to play Amazon we could not personally pull the trigger on our own ideas as we were aware of short squeezes and things outside our commodity knowledge. But the question we asked ourselves was simple: Would you rather buy Amazon at ATHs or Sears at ATLs? The answer 3 months ago was Amazon. Which means we should have shorted every retail firm that was not positioning itself to survive. That meant shorting Target. The client did. We did not.

In that vein we are watching closely to see how Banks handle things as well as the usual players. For now; Bitcoin (NYSE) may do very well for years. Second tier players (like AMEX) in crypto will almost certainly go belly up. Amazon and Google (Globex) will destroy certain industries already under pressure when they adopt blockchain. Even energy will be affected. This ties in with the blockchain trades china is doing with Russia for oil deals already going down.

Imagine if Google enters the commodity trading field replacing ISDA and clearinghouses?! Why not? They took themselves public. if one continues monitoring the economic, technological, and Regulatory drivers behind the current market structure, a person can tweak this simple analysis to make their own decisions.

Short Term Trade Ideas For Giggles

Right now we are looking for new trade ideas in retail to sell short (downstream and upstream) with a 6 month time horizon and looking into shale oil's increasing balance sheet cannibalism to stay operational (The marketmaker who eventually puts himself out of business).. and as always we are married to Silver and it will be the death of us!!

There is 1 paired trade we like. Short apple, Buy amazon. Apple's walled garden model has had a good run, but we do not see it holding up against Google's open architecture style. And Amazon benefits. Now Amazon has its own shiny new thing to touch and feel called ECHO. Like an electrician who already services thewires in your walls, soon you will be buying stuff from Amazon through those walls.

Apple we bet is going to be the new "slide show projector" your grandparents drag out at parties and the kids roll their eyes. That's not to say it wont take a longtime for that to happen. Incumbency is hard to break for sure. But growth? We do not see it at the pace that amazon will grow and Google can grow. Apple is a big middle-aged rolodex to be pilfered by Amazon.The hedge for Apple just might be (Funeral) Service Corp Int'l.

Another Satisfied Apple Client goes down with his ship? (Actual web page of SCI)

- Soren K. Group

Current Crypto Prices

via Florin Oprea and Blockchain-asia

Deals, Investments & M&As

Blockchain Raises $40m From Lakestar And Google's Venture Arm

Oscar Williams-Grut - Business Insider

Bitcoin Startup Blockchain Taps $40 Million in New Funding

Nate Lanxon - Bloomberg

Blockchain, the London-based bitcoin currency service provider, has raised $40 million of fresh funding, representing one of the largest investment rounds in the financial technology sector since Britain’s vote to leave the European Union.

PHILIPP SANDNER, Frankfurt School Blockchain Center:

Big IT companies such as Google have been rather quiet concerning blockchain technology so far. Therefore, this investment is a bold statement.

Top 5 Cryptocurrency ICOs For June And July 2017

The Merkle

FAO: And here’s the list: PRIMALBASE, TEZOS, EVEREX, DENT, CIVIC.

Cryptocurrencies

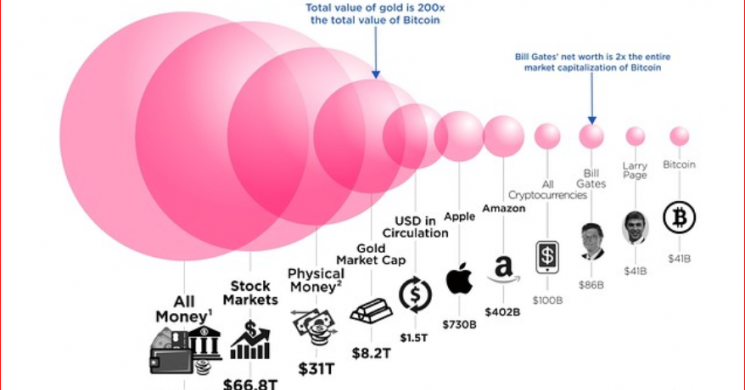

How Big Is Bitcoin, Really? This Chart Puts It All In Perspective

Sue Chang - MarketWatch

Bill Gates’s net worth still beats bitcoin’s entire market cap.

FAO: Yeah but he is the richest person in the world….

On Bitcoin, India's Government And Tech Companies Find Common Ground

Sindhuja Balaji - Forbes

The Bitcoin craze is catching on in India. While tech geeks and young investors eye the digital cryptocurrency as its value soars, the government, too, is contemplating a course of action surrounding its regulation.

Exchanges & Trading Venues

New Ethereum-Based Decentralized Cryptocurrency Exchange Aims to Improve Security and Transparency

Diana Ngo - Coinjournal

Hong Kong’s Open ANX Foundation has unveiled openANX, a project aimed at building a new decentralized cryptocurrency exchange and trading platform built on the Ethereum blockchain.

Coinbase Appeals Decision in Cryptsy Collapse Lawsuit

Stan Higgins - CoinDesk

Coinbase is appealing a court decision from earlier this month in a lawsuit filed on behalf of customers of the now-defunct cryptocurrency exchange Cryptsy.

FAO: Although we are in soft launch, we cover topics globally - we covered this also - here.

BitPeople

Cryptocurrency Liquidity Solutions For FX brokers: Conversation With B2Broker CEO Arthur Azizov

Leap Rate

Latest Developments & Agreements

EY Launches Blockchain Financial Services Center In New York

ETH News

The Financial Services Innovation Center is a part of the firm's global innovation network wavespace, but the key focus is in helping financial services organizations achieve breakthroughs.

Regulation

The EU And Blockchain: Taking The Lead?

Finextra

Long time the European Union has taken a positive, but wait-and-see attitude towards blockchain and distributed ledger technology. Both related to use cases and regulatory intervention. But that is changing rapidly.

FAO: As I already commented in our sister publication, FinTech Daily News, it’s better late than never for Europe to move this way.

Startups, Accelerators & Hubs

Startups See Service Outages Amid Ethereum Blockchain Backlog

Stan Higgins - CoinDesk

The ethereum blockchain is beginning to show signs it's being impacted by a new influx of users.

Amid a surge in mainstream media interest, not to mention projects raising funds via ICOs, transaction backlogs were visible on the network. Data from Etherscan shows that more than 300,000 transactions were broadcast on 20th June, the highest amount ever observed on the two-year-old blockchain.

FAO: As I said yesterday, these are just growing pains.

Analysis

Arjun Kharpal - CNBC

Bitcoin And Ethereum Crash... For A Few Minutes

Seeking Alpha

This event doesn't change the fundamental bullish case for investing in Ethereum. Although, it highlights the risks.

FAO: Risks are part of our daily life. Humanity cannot evolve without people taking some risks...

Aberdeen Says Cryptocurrency Bubble Will Burst Even If Coins Change Finance

Camila Russo - Bloomberg

Peter Denious, head of global venture capital at Aberdeen Asset Management Plc, said we’re in the midst of a virtual currency bubble, and like all bubbles, it will eventually burst.

FAO: The stock market changed the economy at the beginning of the last century, and the global stock market crashed in the 1929...you can’t make an omelette without breaking eggs...

Read more by Soren K.Group