Asian Open:

Gold Opens sideways, Traders digest Xi's speech, New Zealand gets a government, and China's Q3 GDP headlines a huge day of data. Here are some of the things people in markets are talking about.

Gold Price Updates HERE

Xi Speaks, Markets Listen

Market-watchers ‘round the world devoted time to digesting and interpreting Chinese President Xi Jinping's marathon speech to kick off the week-long Communist Party congress. In the end, it's what he didn't say that may have mattered the most: there was no mention of a specific growth target. References to the environment in his remarks exceeded those on the economy. As a result, investors judged it doubtful that any major reforms were in the offing. China's yield curve inverted during Xi's address; the rally in large-cap domestic equities near the end of the session fueled suspicion of government intervention. The congress continues Thursday with an open discussion held by a financial sector delegation slated for 10:00 a.m. Tokyo time.

Kingmaker

Winston Peters is ready to fulfill his role as kingmaker. The New Zealand First party leader said he'll make an announcement on Thursday afternoon that will decide who governs New Zealand. No party won a majority of seats in New Zealand's September election. The incumbent National Party, led by Prime Minister Bill English, won a plurality of seats; the opposition Labour Party was awarded the second-most, and leader Jacinda Ardern refused to concede defeat. Peters has held meetings with the two major parties to see what concessions they'd be willing to give in exchange for his support. The kiwi came under selling pressure against most of its G-10 peers on Wednesday ahead of the decision.

China GDP

Economists expect China's steady expansion to continue with third-quarter growth projected to dip a tick to 6.8 percent year-on-year. People's Bank of China Governor Zhou Xiaochuan, however, claimed that second-half growth could accelerate to 7 percent, a call that stands in stark contrast to the consensus view for a slight second-half cooling. Chinese credit growth has remained robust, facilitating the nation’s strong expansion, even as policy makers aim to reduce risks to financial stability and cut down on industries with high overcapacity. And that's not all from the world's second-largest economy. Industrial production is forecast to rise 6.7 percent through September relative to the same period last year, with fixed asset investment moderating to growth of 7.7 percent. And retail sales are expected to keep expanding at a double-digit annual clip. Recent optimism about the Chinese economy has provided support for industrial metals like copper.

Coming Up...

The Bank of Korea is slated to deliver its interest rate decision, at which economists unanimously expect the seven-day repurchase rate to be held at 1.25 percent. Investors will be zoning in on any hawkish overtones and the potential for a dissenting vote from a policymaker who favors higher rates now. It's also jobs day in Australia, where analysts are looking for employment growth of 15,000 in September on the heels of 54,200 the prior month, with the unemployment rate holding at 5.6 percent. Meanwhile, Japan's trade surplus is forecast to swell to 556.8 billion yen in September. The nation's all industry activity index is expected to bounce back with a gain of 0.2 percent month-on-month in August.

All Time Highs

Solid earnings propelled major U.S. equity benchmarks to fresh record highs on Wednesday. And if the good times for American equities do end, it’ll be Congress’ fault – according to the White House. Ten-year Treasury yields climbed. Ahead of the open, Nikkei 225 futures are trading markedly higher while S&P/ASX 200 futures are virtually unchanged.

It's China GDP day. Time to dust off the old chart. Below you have the Bloomberg China Li Keqiang Index alongside the official growth measure. The former was inspired by remarks of the Chinese Premier years back that GDP data was "man made." Bloomberg's constructed one that tracks three indicators of underlying activity: growth in credit, power output, and freight volume. So before you get all judgmental, that's why the two are NOT meant to be exactly the same but equally, you'd at least expect they should generally track each other. As you can see, one's all over the place while the other is "stable." The number you're looking for today is somewhere between 6.6 to 6.9 percent.

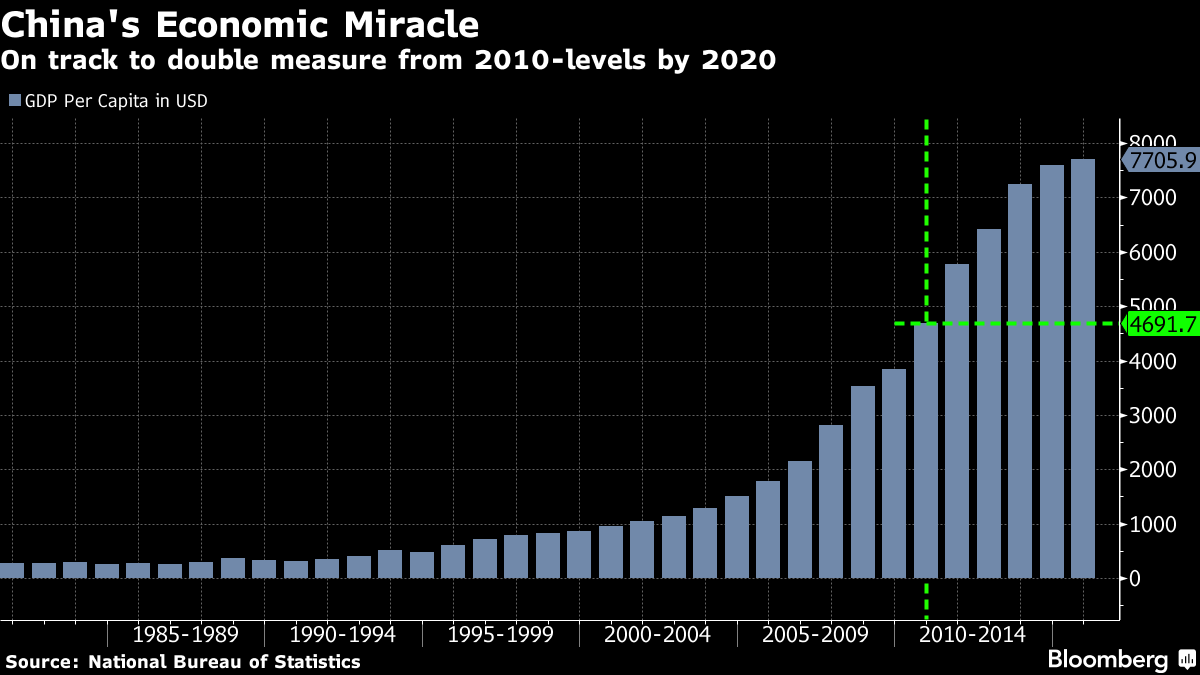

Now today's release is more special. It coincides with the ongoing party conclave where the powers that be are overseeing an economy that's different in size, texture and complexity than in previous gatherings. In 2012, growth was at 7.5 percent. In 2007, it was at 14.3 percent. In 2002, it was at 9.6 percent. And China is well on track to meet the 2015 growth pronouncement of doubling GDP per capita from 2010-levels by 2020.

But growth has come at the expense of most things money can't buy – the environment, and in some cases, property. For Xi to turn China into THE global superpower by 2050, both China bulls and bears agree he'll need to look beyond just numbers – man made or not. The next 30 years cannot be like the last 30.

You can follow Bloomberg TV anchor David Ingles on Twitter at @DavidInglesTV.

Read more by Soren K.Group