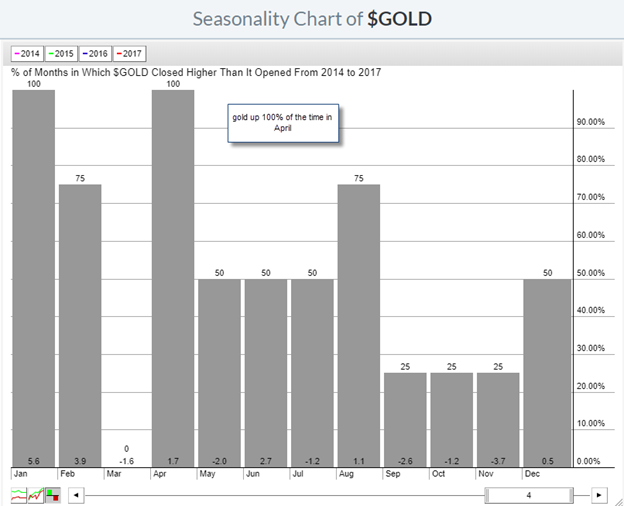

- Gold Should Rise in April

- The Seasonals are Favorable for Riskier Assets

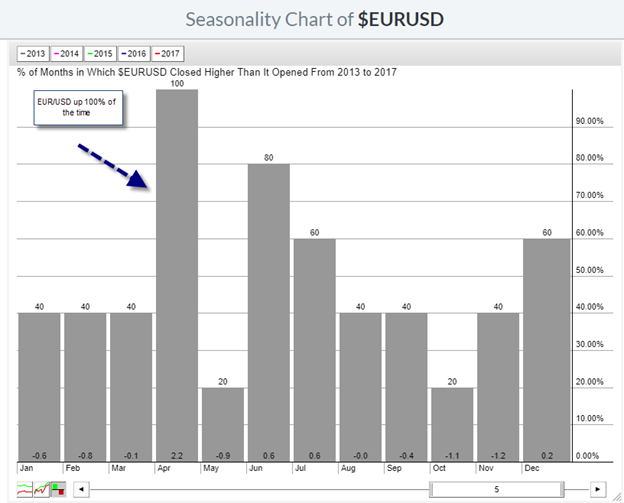

- The Dollar Should Face Downward Pressure in April

Many times, as investors we focus on today. Instead of looking at the forest, we zero in on the trees. When you are making a long-term investing decision where you are focused on catching a trend, you can use a seasonality study to help you gauge historical market performance. A seasonal study of April shows that riskier assets perform at their best in this month, while the dollar struggles. Gold prices ride the coattails of a weaker dollar and have reflected strong performance in the first full month of spring. Silver prices have slightly underperformed in April and appear to be more at ease in July.

The current market environment reflects positive sentiment toward stocks, and potentially a falling dollar. February economic data has eased back slightly which should allow yields to slip, which could weigh on the dollar and allow gold to take flight.

Seasonality

By performing a seasonality study, you can evaluate the performance any asset during a month or quarter. By evaluate the percent of positive returns in conjunction with the average increase, you can get a gauge for the overall market environment during a specific period. One issue with the average return during a month is that it can be skewed by a couple of months.

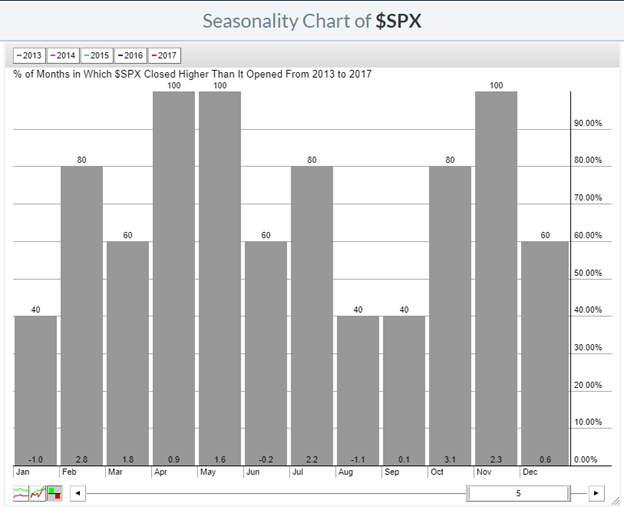

Riskier Assets Outperform in April

April has been very kind to equities. The benchmark S&P 500 index has increased in value in April 100% of the time during the past 5-years. The average gain is approximately 1%, which is not large, but it is consistent. The S&P 500 index has been up 90% of the time in April over the past 10-years and 75% of the time in April over the past 20-years. Over the past 20-years, the average gain is 2.2% which shows that recent gains on average have been subdued.

As sentiment rises and riskier assets gain traction, yields have moved lower, which has weighed on the US dollar. To measure the change the dollar during April you can perform a seasonality test. Over the past 5-year the EUR/USD has increased in value 100% of the time in April. Surprisingly, the exchange rate has increased a robust 2.2% during this month which is relatively large for a currency pair. Treasury yields have been lower 60% of the time in April over the last 5-years which have helped cap dollar advances. The seasonality of the EUR/USD appears to be a short-term phenomenon. If you look at the last 10-years, the EUR/USD is up 60% of the time, which means that most of the years during years 1-5, showed dollar gains.

This brings us to the most recent seasonality of gold. Gold prices over the past 4-years have been higher 100% of the time, for an average gain of 1.7%. In evaluating the historical performance, you can see that recent years have outperformed the 20-year seasonal trend in gold in April shows a rise 70% of the time for an average gain of 0.7%. What is also notable is that the performance of gold in March is generally lower, declining 100% of the time for an average loss of 1.6%. Gold bullion prices closed near $1,318 in February, and you might expect prices to dip near those levels providing a great opportunity to buy gold ahead of April.

If you are looking to take advantage of a time to add precious metals to your portfolio, click on this link to get access to your Investment Kit or better yet, give us a call today at 800–982–6105.

Want to read more articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles visit our Treasure Coast Market News page.

Good Investing,

Treasure Coast Bullion Group

Read more by Treasure Coast Bullion Group, Inc - Staff Writer