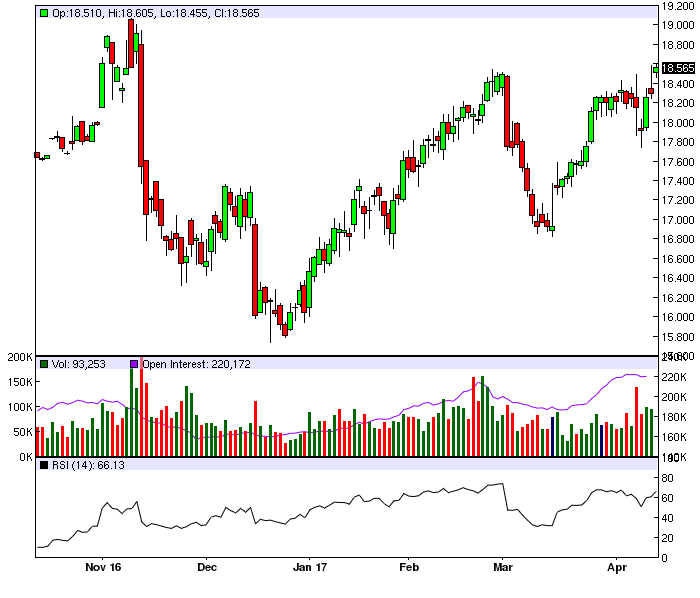

Notable Futures & Options Prelim OI

- Gold: Aggregate OI up another 10.8K bringing two-day total to +33.5K with market up 1.93%

- Silver: Aggregate OI up 4.4K to a record large 224,587.

- Pay close attention to mid-morning final for adjustments as SIK7 is in the middle of the index roll.

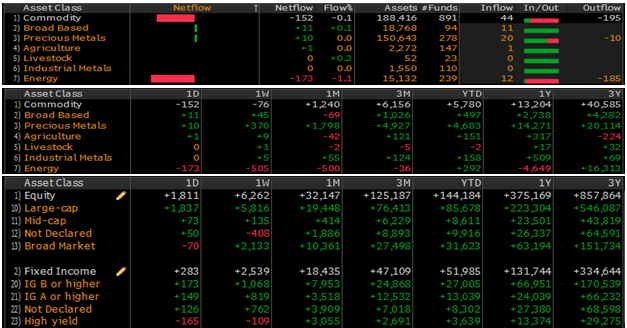

- Calls being Sold and puts being bought in Gold and Silver. This is not bearish. It is a sign of commitment to futures longs via buying hedges.

Silver Now

interactive chart HERE

Tape Watching

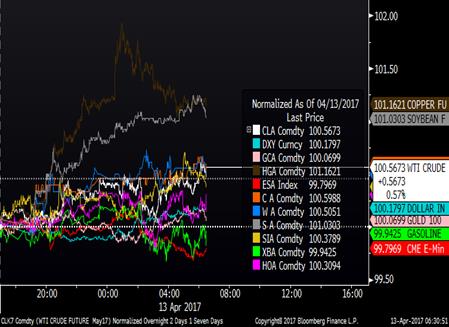

- Gold rally we have experienced due to pullback in stocks, good technical, and benign rates,and weaker dollar has hit 1290 area.

- President Trump mentioned dollar strength could hurt US economy

- Despite Chair Yellen’s policies as to FED rate raising bias.

- So far nothing definite about Yellen staying on, as this also is a factor

- US.Open interest climbing still as funds re-enter second quarter allocations

- gold 466916,up again, copper 291102 more hedgers,silver up also 224587 and options also up at 1,055141,

- Lots of calls sold, puts bought for protective positions.

- Pullback profit taking likely short term, but higher moving averages,higher close,higher open interest still bullish.

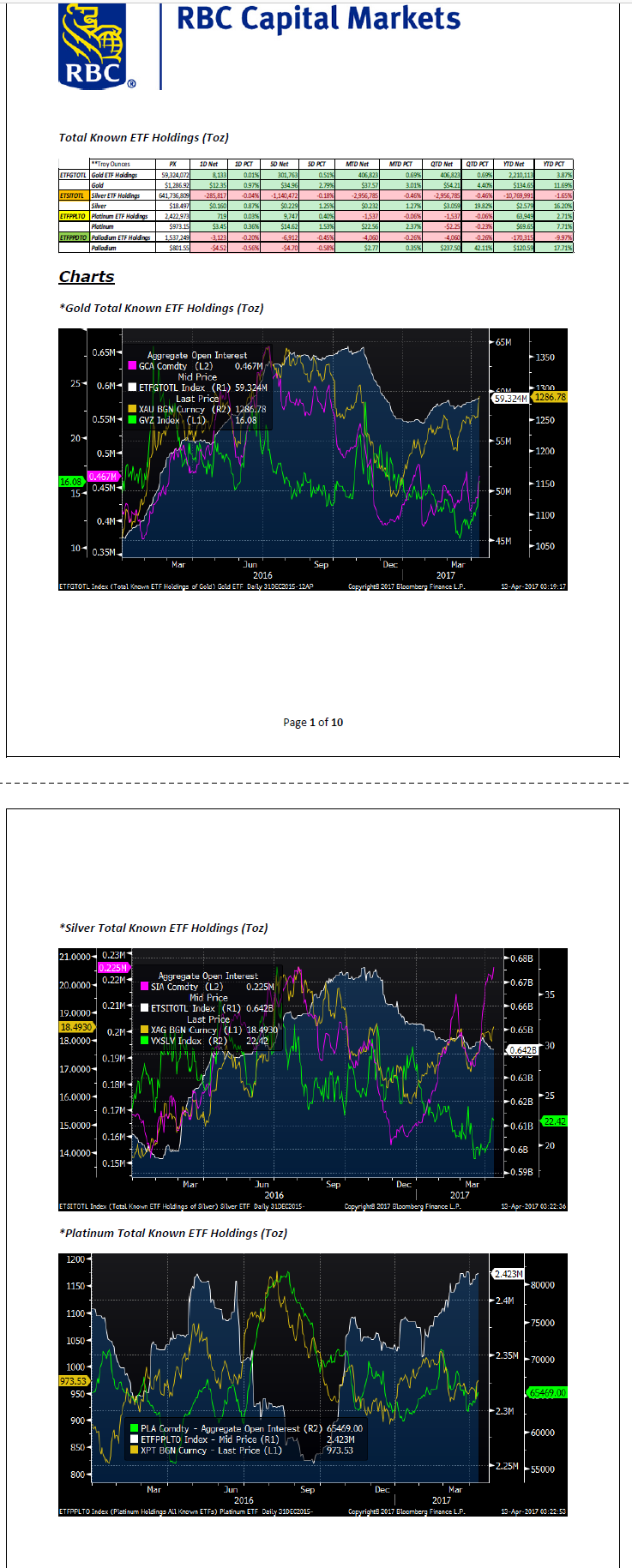

ETF Snapshot

Courtesy:

- A.George Gero

- Managing Director –senior consulting group- Financial Advisor

- george.gero@rbc.com

Overnight Activity

ETF Report

About: The Soren K. Group of writers are currently 5 persons writing collectively. Backgrounds are professional, ranging from Finance to Banking to Real Estate. Topics include politics, markets, and Global Macro situations with a libertarian bent. Some posts are collaborative, some individually written.

Email: Sorenk@marketslant.com

Twitter: @Sorenthek

Read more by Soren K.Group