UPDATE:

Lest you think we are picking on BMO. read this

Here is another example from the Archives

dated 7/27/16

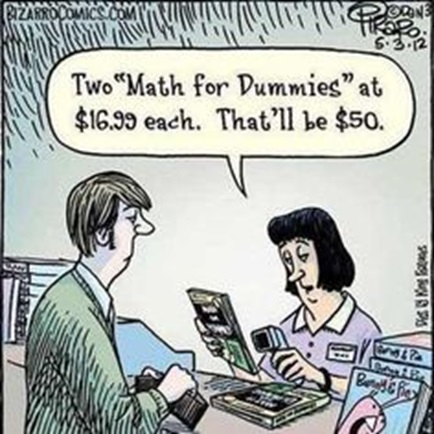

I read an article yesterday that was posted from a commentary by BNP Paribas, one of France’s largest banks. Their senior economist has raised his gold average price for 2016 to $1,245.Sounds possible. But as you read the article, it becomes clear that this wizard called for an average price in 2016, late last year of $960 for 2016. Now, gold at that time was $1,070, so for his average to be realistic, he had to be expecting gold to drop below $900, for a least a period of time. Duh, now, with gold over $1,300 he figures the average may come in at $1,245 and he remains very bearish.How does this guy, cash his paycheck, without falling down from laughter.

This is a senior economist at one of the largest French banks. What a farce.

Dear BMO,

We could use a little help here if it's not too much trouble

Can you be more specific on your "we would be buyers of dips" statement? For a firm that uses state of the art risk management tools, can assess volatility and acceptable STD and VAR as well as sharpe and sortino ratios, you seem to be awfully vague when it comes to your dip buying. Here is your statement to Kitco news

BMO: ‘We Would Still Be Buyers’ On A Dip In Silver PricesBy Allen Sykora of Kitco News; asykora@kitco.com

Tuesday August 23, 2016 08:35

Analysts at BMO Capital Markets say they would favor buying silver on price dips. Their base-case outlook is for silver prices to remain range-bound, although with a greater downside risk than upside risk in the near term. Analysts say they are not revising their price forecasts for now, noting that silver and gold are not far from BMO’s second-half forecasts of $19.75 and $1,360 an ounce, respectively. For the metals to rise further, they would need a new structural catalyst, BMO says. Meanwhile, analysts continue, there is a downside risk from a potential Federal Reserve rate hike. “At this point, we would still be buyers on the dip given our global outlook,” BMO says. Still-high net-long positioning by speculators in the futures market means any sudden shift in market sentiment could cause a large number of positions to be unwound. However, “if our current view on weak global growth is maintained, we expect the ongoing uncertainty to remain supportive for precious metals and would buy on the dip.”

Given your target of 19.75 in Silver and your statement that you "Would favor buying dips"

- At what price(s) would you buy the dip?

- How would you buy the dip: Dollar cost averaging, barbell averaging, pyramid, inverted pyramid, something else?

- At what price and or global indicator or circumstance would you say your purchases were incorrect and then sell? Is this criteria based on VaR of trade, Var of Bank, global GDP, electronics demand, customer pain tolerance or something else

- Are you actually trading the silver market or are you recommending it to your clients as a broker/ agent? Or are you flow/ prop trading? "We would be buying" is no different than "We are not buying"

- Given your own history of expanding then contracting proprietary trading e.g.- Natural Gas options debacle of 2007, are you even supposed to be trading commodities at all for your shareholders? Unless it is buy, mark up and then immediately sell to your own clients?

- How about real estate? are you long any Vancouver mortgages or did you sell them off because you are risk averse and see an inflated market?

Apologies to Allen Sykora, who we are avid readers of. We are just tired of being Gartman-ed by firms giving vague infomercials to keep their name in the public eye. They are also known to hedge every statement with a contrapositive or simple sliding certainty. For once we'd like to see the following:

- We are bullish and will remain so unless something specific or combination of several event types happens.

- If it does, we will reassess our thesis and decide if it is still valid.

- And from a capital point of view, we view a price change without news of X% would also give us pause.

- We will not slowly move our price targets when we are wrong in the hopes that we can maintain credibility while slowly changing our opinion.

- We will not say on Oct 31things like : Gold will average 1320 this year when it has already averaged $1240 and would have to go to $1400 for the remainder of the year to make us right.

- We will not do the above in the hopes of not getting called on our math fantasies

In the issue of transparency, our group of writers are also dip buyers. But that is because we have a short position. And our criteria are plainly stated for all to see. HERE UPDATED: Silver Sell Signal target $1784. We are selling our intellectual capital. What is BMO selling if it has no skin in the game to begin with? And if you do have skin in the game, why advertise your intentions if not to misinform and create your own exit strategy? Our little position here is of no consequence. But yours may be large. Why state an opinion at all then if not to further your cause or worse, to create your exit as so many banks with broker dealer status do.

UPDATE: 1:43 EDT- The short Silver trade should be closed out if we close above 18.86 based on the system. That does not mean the market will not wash. It does mean that the reason we got short is no longer valid. Soren K.

3:10 pm Silver Short covered. Autopsy here

Read more by Soren K.Group