Top Day

- GBP Flash Crashes 800 bips in 2 minutes on a likely human spoof fed upon by HFTs

- Stocks lower globally, as markets are losing confidence in anything human hands touch

- Gold Catches a break and may have a nice trade in it now

- Payrolls and FEd members to speak in what is the most important day this week

GBP Flash Crashes

At 7:07 Pm Et, the GBP sold off in a thin market only to recover most losses. As of this writing, the GBP is now down "only" 1.5%. HFTs, Algos, Barrier Options may all seem to play a roll in the event. But the instigator seems to be good old fashioned spoofing. Someone wanted it lower, and got more than they may have bargained for.

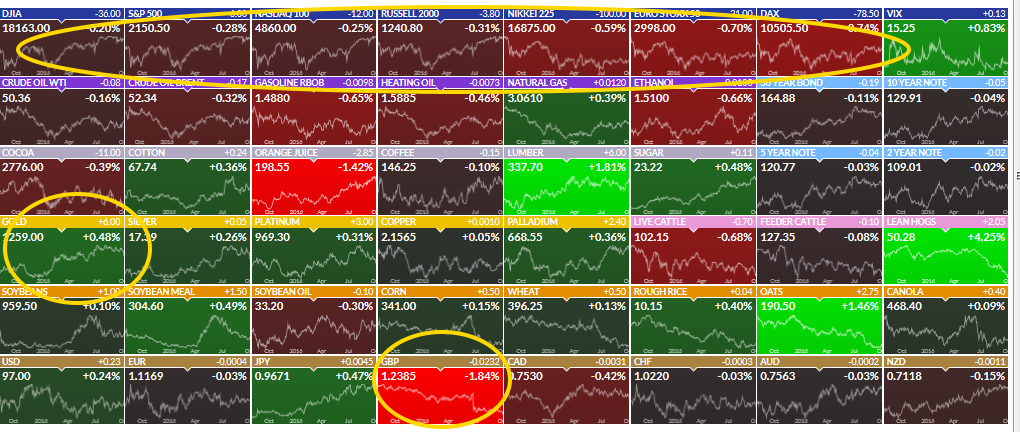

Global Stocks and US Futures are Lower. Gold Is Stable, up 0.50% as of this writing

- GBP down 1.8% at 1.23

- GCZ up 0.5% at $1259

- S&P 500 futures down 0.3% to 2151

- Stoxx 600 down 0.4% to 342

- MSCI Asia Pacific down 0.3% to 140

- US 10-yr yield up 2bps to 1.75%

- Dollar Index up 0.28% to 97.04

Payrolls are Due Today

- Fischer, Mester, George and Brainard are due to speak today

- Payrolls are due with expectations of a little under 200k increase

Consensus is that The Fed will hike and that hike is most likely to be in December (61% chance), post election

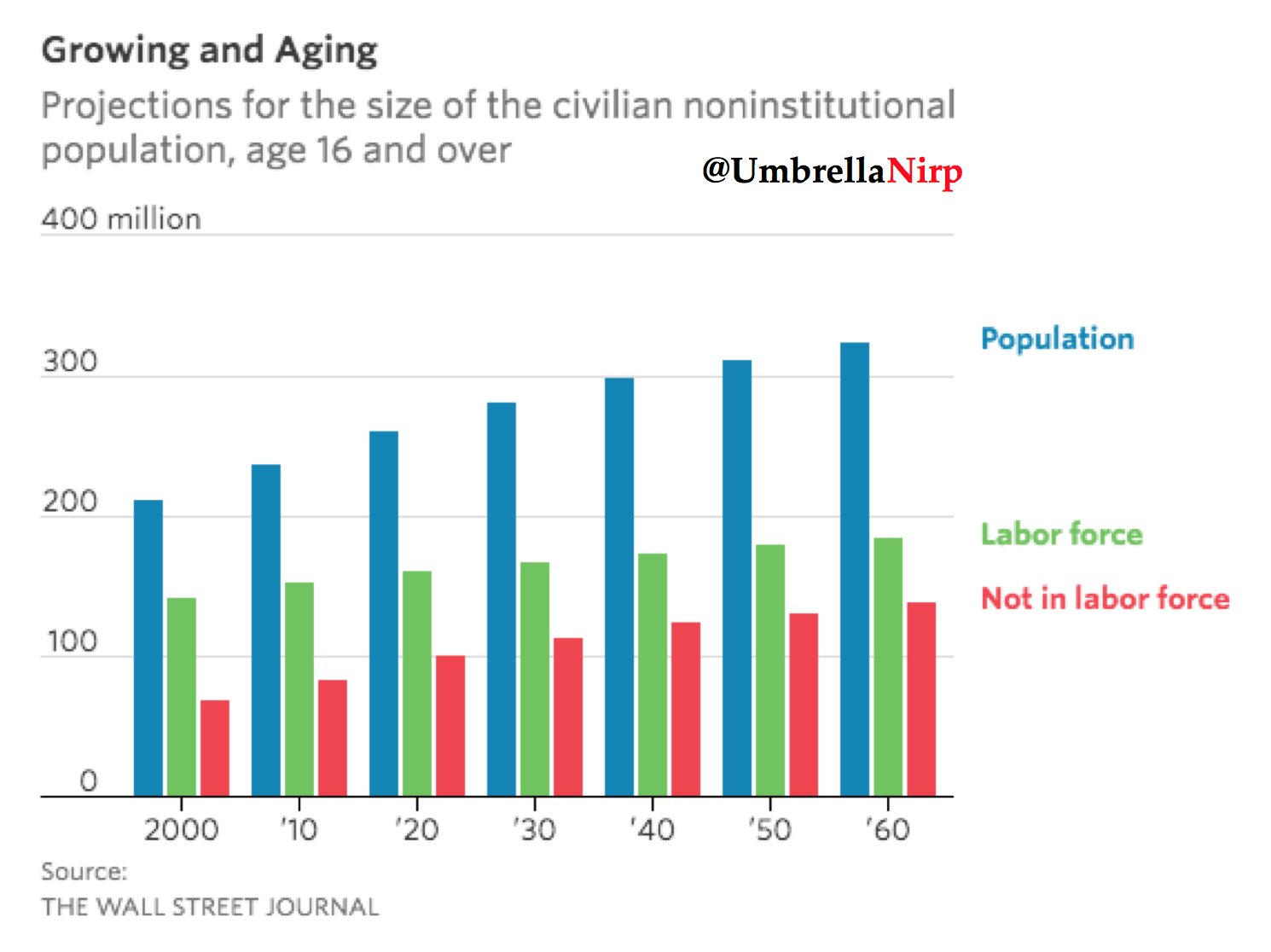

Meanwhile in Millenial Land: Where the Kool-aid flows, but the jobs don't

Gold May Have a $50 Move Coming: Trade Idea

- $1250 is not a comfort zone- a trade is presenting itself

- Remember the GDX analysis, "First way wrong way"

- From an oversold position, if $1250 holds, a rally to $1300 before selling back off is not unreasonable

- If $1250 does not hold on a weekly basis, any spec longs should consider $1242 as their level to get out

- Investors should chill. Gold isn't the only asset that will be slammed in the coming months

- Its buying power will remain constant on average as it always has been for the last 1000 years.

Read more by Soren K.Group