Overview:

initial jobless claims came in at 261k on expectations of 265k. This had no meaningful effect on the Precious Metals Complex for now. We think the trend will continue lower headed into Yellen's opening statement at Jackson hole. After that, all bets are off. Technical analysis is still relevant during events, the levels just get hit faster andthe inside noise matters less. We will be out of our own position at target, stoploss, or by 9AM Friday.- Soren K.

Yellen Preview

From usa today. Yellen’s speech at 10 a.m. ET Friday in Jackson Hole, Wyoming, is the big event Wall Street has been waiting for. Yellen is expected to outline what “tools the Fed has to fight the next battle, the next crisis,” as it comes to grips with the new world of slow growth and low rates, says Gene Tannuzzo, senior fixed income portfolio manager at Columbia Threadneedle Investments.But market pros will likely focus on comments from Yellen that shed light on the Fed’s near-term plan for interest rates. The Fed has left rates steady all year after boosting rates off zero back in December for the first time in nearly a decade.

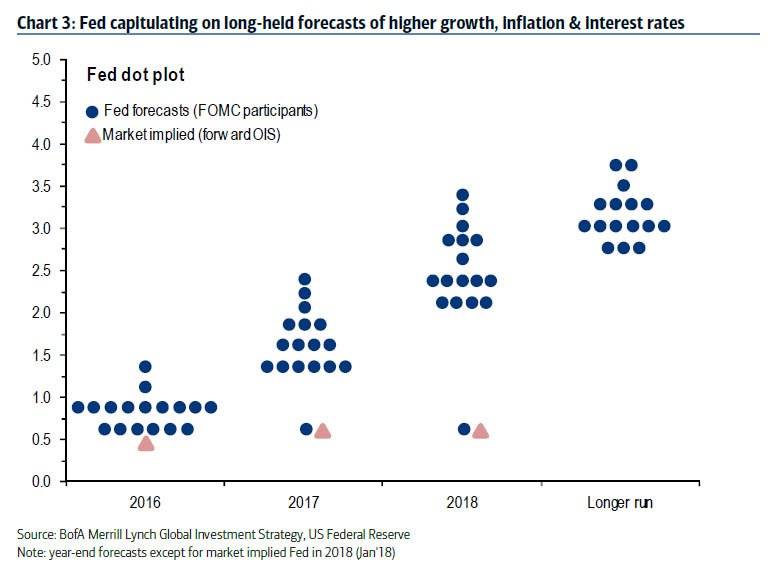

For our part we don't think any actual announcement of a rate hike will come tomorrow. But we are admittedly cynical given: the election (Clinton must win), the lack of real economic growth, and some tells that another round of QE is loaded and ready. Including our speculation that PIMCO is frontrunning the next QE event. Maybe rates are raised, but that may cause them to be lowered soon thereafter as the rest of the world is getting ready to permanently monetize its debt in Helicopter drops or otherwise.

To Our point

Yesterday Summary

Originally post: Gold Update: VBS trade entered, Silver loathes us

UPDATE: 2:46 Aug 24th: VBS Trade Entry

- Short Gold at $1328.20 near/on close Wednesday

- Overnight and tomorrow intraday stop loss is $1335.50

- Target is 2x the amount risked = $14.60= $1313.60

- If market comes in lower, option to lower stop loss to $1328.20

- Take half profits at target, lower stop for remaining position to Thursday's high of day. ( or take it all off, we get a little piggish depending on the time of day)

- Take whole thing off Pre Yellen either way. ( if ITM we might leave a tail of 1/3 position with no downside target and stop loss in place.) otherwise it's a discretionary exit

- A reversal during Yellen speech would likely be wicked e.g. "We are going to raise rates, we swear, just not this year"= lift off**

- Is Gartman Bullish? Go back to #1 above

** Deep pockets buy from panic sellers. If Gold drops $20 more do you think the Chinese will puke their position? Shake all the hot money out and let the longs be strong unleveraged hands.This is a swing trade for 2 days. We can easily see how a Fed induced swoon lower is a great opportunity for investors. Who has faith that these people can stop inflation when it starts while they still haven't put a stake in deflation after 8 years?

Today's Activity

-Not much to add to the above. Just some price refinements

- Stop loss is now $1335.80 on the lower boundary of yesterday's Band

- Target remains $1313.60 based entirely on risk reward metrics. This is not a technical number.

- We will close 100% of position at stoploss or 75% of position at target price

- if position remains at EOD we will close out by 9AM EDT Friday

- If position remains at EOD, Stop loss will move down to the lower Band boundary of today. Approximately $1332.40 so far

- If market washes out below target today, 75% will be covered and stop for remaining 25% will be placed at target on close. We will play with 25% on the Yellen speech and no target at that point

click HERE for interactive chart

Technical Report

DEC GOLD Resist: 1334-133550, 134820* ST Trend: Down(132730) Supprt: 1324-, 1316-1313, 1300+/- Obj: 1316- TRP: 1348.20Comment: The market is triggering a downturn from the congestion of recent weeks and targets a selloff to1316 with a chance to wash to 1300-. We may see minor corrective congestion in the lower half ofyesterday’s selloff, but tight congestion should bear flag. A close over 134820* is needed to trigger areversing turnaround.

Further reading

Morning Calls: Dollar Fades, Gold Bounces, Yellen LoomsClinton Hasn't Fully Grasped the Severity of Her Problem.

'F*ck Trump' - Silicon Valley Firm's MessageHumor: Our Friday Fed PrimerAssange Assassination Attempt? Cops Took 2 Hours to Respond to Embassy BreachHow Commodity Banks Make Money: Part 1At what price does BMO "buy the dip" in Silver?

SEP SILVER Resist: 1888, 19055-1909 ST Trend: Down(18505) Supprt: 1840-1836, 18165-1800 Obj: 1840 TRP: 1974.5Comment: The market is in a downturn and should reach for 1840. A close under 1836 could add a washalong 1800+/-. Any minor rebounds or corrective congestion will likely stall inside Tuesday’s sideways day.Narrow congestion should bear flag and setup for selloffs. Only a close over 19745* triggers a reversingturnaround.

SEP US DOLLAR Resist: 94845, 9501-085, 9557* ST Trend: Down(94747) Supprt: 9426-21, 9396-88, 9373- Obj: 9400-? TRP: 95.57Comment: The market is short term bearish and warns for a selloff leg to the starting levels of the last bullupturn under 9400-. Current minor flagging congestion should promote follow through selloffs into the endof the week. Any corrections below 95085 will stay setup for selloff. A push over 95085 stalls bear forces. Aclose over 9557* is needed to highlight a reversing turnaround

Good Luck

Read more by Soren K.Group