Technical Summary

Gold

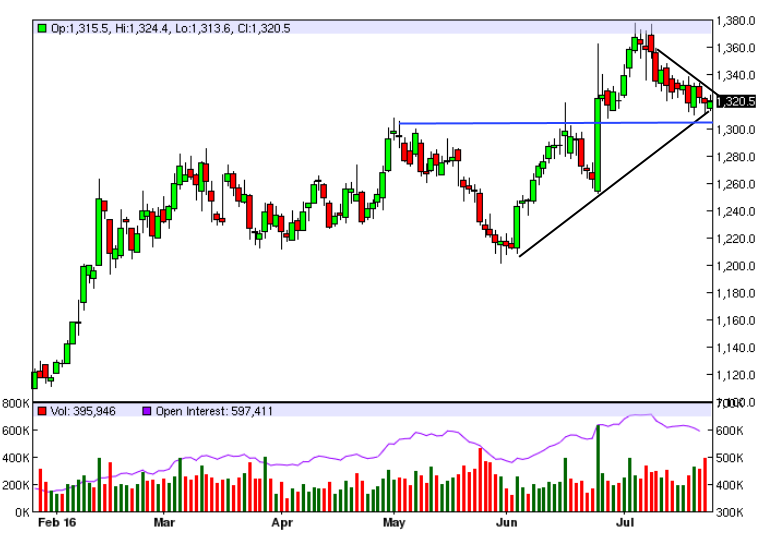

We have prepared ourselves for a test of the 1301 area and will be pleasantly surprised if the market does not get there as macro Gold bulls. However we must be realistic as micro Gold traders. The market remains in a near term peaking retracement, targeting a drop to 1301.00 (TRP) support. A drop under Monday’s low could propel selloffs. Any minor recovery should hang in sideways congestion in the 1320’s. Only a close over 1335 rekindles bull forces for another run at 138060* weekly resistance.

Silver

The market is still working through a correction. Last week’s trade tested key 19385* supportand held, keeping the general trend forces bullish, but a close over 2019* is needed to launch a secondarydrive back to the last spike high

Oil

The oil market is seeing the fundamentals assert themselves finally after months of movement tied to crisis and stimulus situations. Futures are below the 50 and 100 day moving averages with a down sloping trendline on the 100 day. The RSI is making new lows while the market is making new lows confirming the move is not done yet. The market is short term bearish and targets a retracement selloff to weekly support at 4188*. A close under 4188* alerts for a larger wash along 4000-. Any corrections should find bear forces checking rallies around Monday’s high. A close over 4549* is needed to mark a reversing turn for a multi-day correction phase.

- Soren K.

Read more by Soren K.Group