Market Summary: Stocks and Bonds rise as investors continue to chase yield. Global investors look outside their own nations for higher yielding Gov't bonds. Precious metals are higher on a bounce from the last couple days. The Dollar is mixed except against the Yen where it is slightly stronger- Soren K.

Comments:

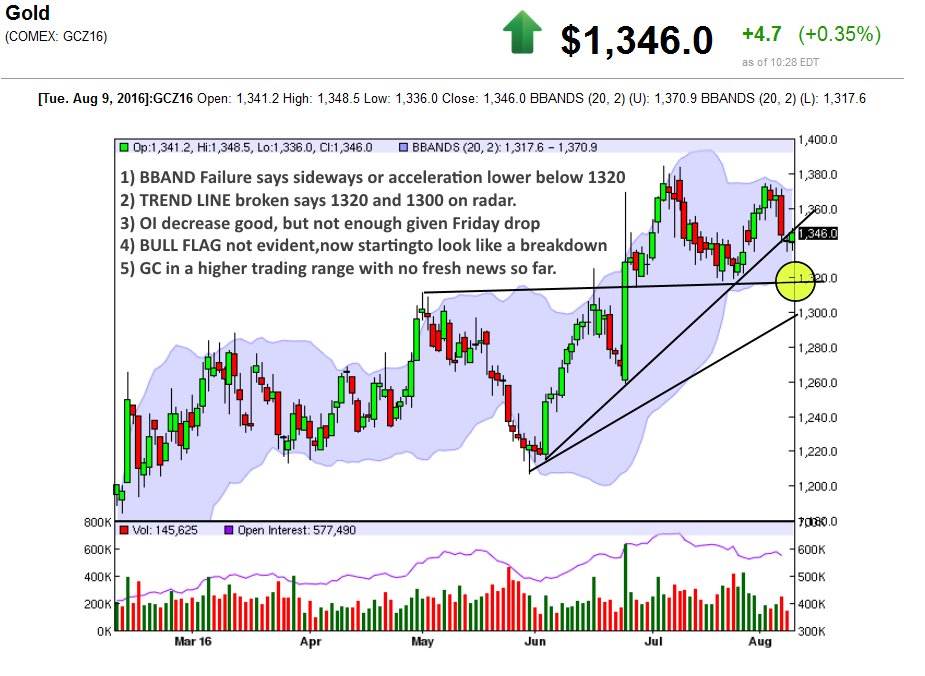

- GOLD: Rather see a test and hold of 1320 before buying on spec. Comments in graph below

- OIL: trade the range, don't get married to longs. A 4 day rally of $4 dollars is not a reversal in a market that averages $1.35 range a day h/t @chigrl

- STOCKS: the Fed is hoping for a sell-off to test drive its Helicopter. Our fed "radar" says abv 2200 more rate hike jawboning will happen with an actual possible hike and excuse to ease later. A drop below 2000 accompanied by some "crisis" will justify more stimulus. We also think the FOMC is being lobbied to not raise rates until post election.

DEC GOLD

click HERE for interactive chart

Resist: 134970, 1355, 135940* ST Trend: Sdwys/Down(134100) Supprt: 133980*, 1333-, 1307* Obj: 1331 TRP: 1359.40Comment: Friday’s break alerts for a short term peaking turn. The failed secondary rally cautions for aharder reactionary selloff. A close under the 133980* support point targets a bear wave to 1331 and likely1307*. Trade may try to recover off 133980* and congest within Friday’s downturn, but only a close over135940* rekindles bull trend forces to again reach for 138060*.

SEP CRUDE OIL

Resist: 4305+/-?, 4409* ST Trend: Sdwys/Down(4302) Supprt: 4224-, 4195, 4079* Obj: None TRP: 44.09Comment: Overall the market is short term bearish, but triggering a near term bottoming turn and suggestsfurther corrections the next few days to test 4409* resistance for a short term bottoming turn. Ralliesstopped by 4409* will allow residual bear forces to touch off secondary selloffs and likely prompt a shift intobasing congestion. A close under 4079* is needed to fully rekindle bear trending action.

SEP MINI S&P

Resist: 2181, 2200+ ST Trend: Sdwys/Up(217550) Supprt: 2170-, 2160-215850 Obj: 218100 ACHD TRP: 2135.00Comment: The market is bullish. A breakout over 2181 could launch a drive to 2200+. Monday’s back offfrom the 2181 target cautions for a 1-2 day flagging drop back to 2160. Only a drop under 2149- warns fora negative turn and retracement down to support at 2135*. A close under 2135* is needed for a criticalreversing turnover with potential declines along 2100+/-.

Popular on MarketSlant

- War with China: Thinking Through the Unthinkable

- Putin: You buy our Bonds, we buy your Gold, da?

- TRUMP: Time To Jump Start America & It Won’t Be Hard To Do

- all info will be kept confidential.

- we encourage use of an alternate account to ensure your comfort

- any info given will be independently corroborated before use .

Good Luck

Read more by Soren K.Group