Summary

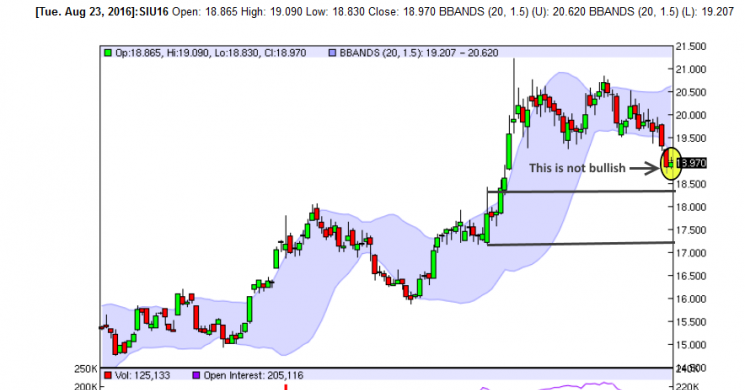

Apparently Silver does not care about our opinions and is defiant this morning.Yesterday a sell signal was triggered in Silver from a selloff accompanied by expanding volatility . Based on the criteria, a sale of $18.86 with a stop loss area of $19.32-19.46. The profit taking target is $17.84. The trade is right 50% of the time with a payoff of 2 to 1. Here is the execution recap: Also obvious as described here in, the markets do not care about Fischer's Hawkish speech the other day, as the Dollar gave back its gains, and is the reason why Gold bounced so nicely off its lows yesterday. - by Soren K.

UPDATE: BMO SAYS BUY THE DIP IN SILVER. We ask "AT WHAT PRICE?"

- Day 1: Short right here at 18.86

- Overnight stop losses are: 19.32 (settle)-19.46 (trade)

- Profit levels are 1.5 to 2x risk. 200% of 46 cent risk = 92 cents= 17.84

- Day 2: keep all stop and profit levels in place

- At EOD if mkt not below 18.86 then close position (momentum is false or delayed)

- If trade is ITM ( under 18.86), at EOD, move stoploss to entry price of 18.86

- Day 3: mkt comes in lower, consider trailing stoploss down the BBand lower level boundary.

- Disclaimer: think for yourself, and understand this is a shortterm volatility based trade that is wrong 50% of the time.

- Feel free to say "You were wrong" if market rallies and it makes you feel better. this is a swing trade and not a macro investment. Another trade in another market will come soon enough.

Silver is stubborn so far

Silver is higher, Now what?

Today Silver is higher, though the trade is not stopped out by any means. We would have liked a weak opening. The lack of one does not invalidate the trade. So far it's in the dead cat bounce area But it does give the first warning that follow through may not occur. The disciplined trader stays with the position until the stop is triggered or the market capitulates. And this is a very short duration trade. So for today, coming in short at $18.86 the only things that matter are the following

- The Stop loss is now $19.32- alternatively, it can be lowered ot yesterday's high of $19.25

- If Silver is not below $18.86 on the close, we cover the position.

- Target remains $17.84 and is based on risk/reward, not some technical support level.

- if intraday the market washes to 18.40 area, lower stop loss to entry point or lower depending on your own comfort.

- Do not take profits at $18.40 if you are a trader who understands that this will hurt you in the long run, though profitable today.

Technical Report is Bearish, but we do not care

SEP SILVER Resist: 19365-1940, 19825* ST Trend: Down(1887) Supprt: 1860-1840, 18165 Obj: 1840 TRP: 1982.5Comment: The market is signaling a downturn with Monday’s closing penetration under 1918* opening uptrade for a wash to 1840. Any minor rebounds or corrective congestion will likely fade up near 1940. Narrowcongestion just over 1900 should bear flag and setup for selloffs. Only a close over 19825* rekindles bulltrend forces to again reach for 2050+.

Pure technicals are bearish. Calling yesteday's action a breakdown, and saying rallies should be sold as the market is likely to establish BEAR-flags on its way to $18.40. That may very well be the case. But we do not care in this scenario. This is a momentum trade, not a grind it-out-trade. if you are bearish and wish to sell rallies, that is fine. And it could well be this current trade gets stopped out and the market proceeds to fall from one of those bear flags. That is a different trade. Note the report does say rallies could extend to $19.40 before resuming a move lower. That is no coincidence given our stop loss area (19.32-19.46) we think. And maybe you should short that area, selling strength instead of weakness. That is not our comfort zone.

Gold, the Dollar, and the half life of Fischer's Hawk Talk

Gold: Refused to selloff. This makes sense in the short term as range gyrations are expected pre Friday's Yellen speech. We also firmly believe Gold is being remonetized and that underpins the market. Silver will not be remonetized as its industrial uses grow again.

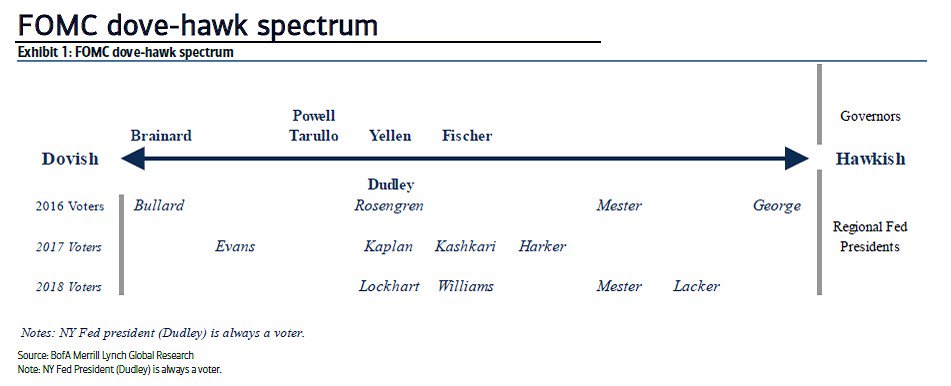

The Dollar and Fischer's Gambit: The Dollar started out the day stronger, and finished yesterday weaker. It would seem that Fischer's jawboning in the days prior of the Fed's willingness to hike was a trial balloon for Yellen to tweak her own comments. Note at first the market bought his words. Then... not so much.

First, Fischer's true bias on the Hawk-Dove scale is decidedly neutral. They sent a moderate to do a hawk's job?

How has the market reacted to Fischer's Hawk Talk?

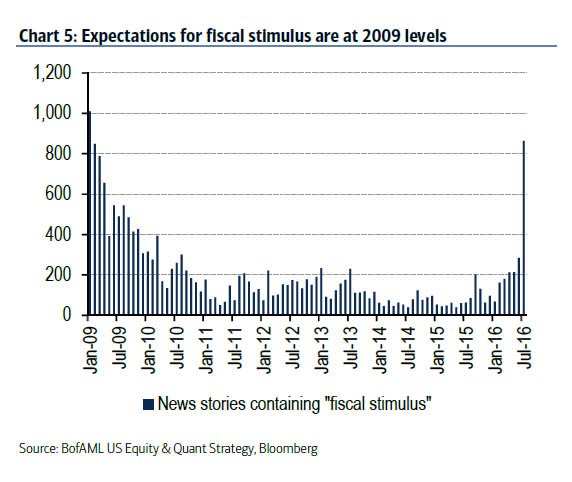

Meanwhile in easy money land, Expectations of Fiscal stimulus are at 6 year highs

Conclusion

This tells us, that if the Fed were to raise rates, the stock market would tank given expectations of more stimulus. So what exactly is the half life of a Fed that has no tools in its pocket except words to influence markets?

And this has to do with Silver how?

All of this info leads us to believe that our silver trade may get stopped out. But stay the course we must, for words and opinions are just that. And Fed words are meant to obfuscate and inveigle intentions. There are a million reasons to not be short Silver. The Dollar, Gold etc. But why hasn't Silver rallied given the rebound in the USD, increasing expectations of Fed Stimulus, and Fischer's ephemeral effect on the markets? Silver should be much higher today. So we remain short with a stop

Good Luck

Read more by Soren K.Group