Overview

Technical systems are calling for continued weakness in Gold and strength in the USD. Technical analysis being what it is, that is correct until it no longer is. What matters is the risk/reward scenarios presented by such analysis. As Statistical traders and Option geeks we do not claim to be technicians. But the tool is useful in conjunction with other factors after one has developed an opinion and is looking for an entry or exit point to implement that opinion.

-Soren K.

Brexit, Volatility, and Value

From our point of view, Gold has been relatively strong. It is among the last markets to go back into pre-Brexit mode. That is a pleasant sight given that hot money makes Gold more volatile on a daily basis than other mediums of exchange. Which also means it could have further room lower. As we said over the last week, our own VBS trade signal has given entries and non profitable 3 day exits to the downside in Gold and Silver. But if you ignored the volatility, as we do not on VBS signals, both markets have softened since. If you ignore the volatility as an investor you will be more comfortable. and yesterday's DB report gave us impetus to comment on that. If Gold can be $300 higher from where it is now based on one correlation, then why isn't it? Because of volatility. Price is not value. Price is a snapshot in time. Value is relative price over a period of time. We will elaborate on that more tomorrow in a fresh post

UPDATED 2:45- GC "Snaps" its range

Snap is a common term traders use on a range breakout in either direction. Today we saw a classic example right below what we thought was "weak resistance". Turns out, it was strong enough. The only "tell" in the rectangle area was the RSI. On each attempt to pierce the upper bound of the trading range shown, the RSI made lower highs. That was our only warning. And no we did not trade it. But we are sure technical bears (before the snap), and momentum shorts (after the snap), did

Our next trade in Gold will likely be a buy after the market bottoms and our VBS gives us a signal for increasing upward volatility. We say that becasue the OI is upticking as shorts are starting to pile in. They will likely be right in the short term. Assume the bottom is not in. It is when the market makes new lows without a the RSI makingnew lows. A nice Snap could come off a similar pattern at some point. Hopefully if you are a Gold inverstor just hearing someone agnostically say "The next trade on our system will likely be a buy" should tell you that volatiity is not risk. And Price Is Not Value.

But if you are trading Gold and area momentum fund, you will be selling dips now. If you are a technical bear, you will be selling rallies. If you are looking for a place to buy technically, one place would be when you can identify more sellers of weakness than sellers of strength. Weak hands selling for quick dayttrader type gains. Watching OI and RSI should help.

-interactive chart HERE

The Fed Can Raise Rates 10x in a Row- and other Yellen fantasies

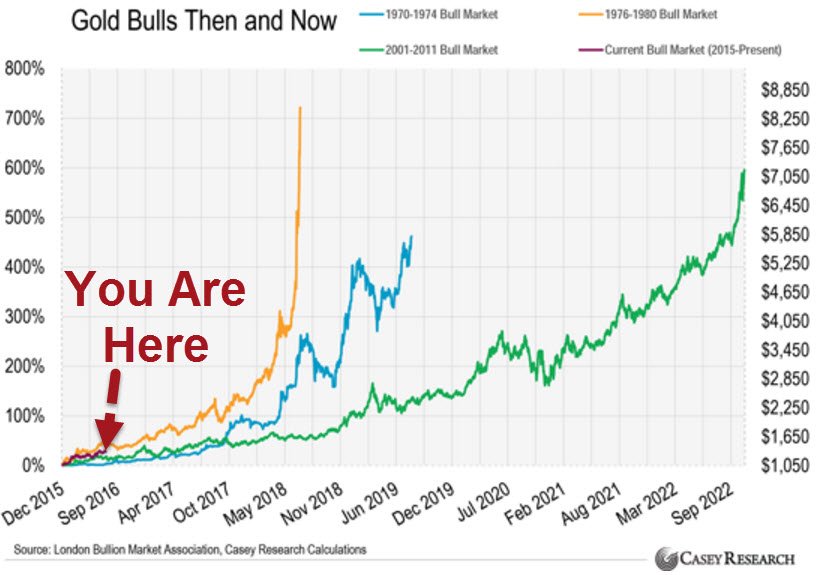

Is This Gold's 5 Year Plan?

DEC GOLD Resist: 1333-133670, 134590* ST Trend: Down(132670) Supprt: 1316-1313, 1300+/- Obj: 1316- TRP: 1345.90Comment: The market continues to signal a downturn from the congestion of recent weeks and targets aselloff to 1316 with a chance to wash to 1300-. Corrective congestion must stay under Friday’s high andtight congestion below 1335 should bear flag, using 1-2 days of choppy sideways action to prepare forselloffs. A close over 134590* alerts for a reversing turnaround.

DEC SILVER Resist: 19105, 19385-1940* ST Trend: Down(18945) Supprt: 18495, 18375, 1811- Obj: 1811 TRP: 1940.0Comment: The market is in a downturn and a close under 18375 could add a wash along 1811-. Anyadditional rebounds or corrective congestion will likely stall inside Friday’s range and use sidewayscongestion to bear flag and setup for selloffs. A pop over 1914 is near term friendly. However, only a closeover 1940* triggers a reversing turnaround

SEP US DOLLAR Resist: 9557*, 9600-9606, 9670+ ST Trend: Sdwys(95543) Supprt: 95225, 9594-90, 9472* Obj: None TRP: 95.57Comment: Friday’s outside bull reversal day leaves a failed downturn and should continue upside action toattack over 9557* resistance. A close over 9557* confirms a drive to 9670+. Friday’s strong close favorscontinuation rallies. Any corrections should be contained to tight congestion in the upper half of Friday’srally to bull flag. A close under 9472* is needed to rekindle bear trend forces.

Previous Technical Reports

- Gold Technicals: Weak longs spoofed out yesterday

- Technicals: USD, Gold, Silver Weak. VBS trade update

- Technical Recap: the Silver Short Autopsy

- Technical Brief: Silver defiant, Fischer Fails

Good Luck

Soren K.

Read more by Soren K.Group