Gold Yesterday- our bullish bias aside

Agnostically: Long Above $1333 ($1380 target)and short below $1325 ($1290 target)

Gold Today

Technicals and our assessment say lower before higher. But having been chopped up 3 times in 2 days being bullish, we are licking wounds and are passing on the Tudor Way. Which would say be short below $1325 and out above $1333-ish. Our Next Precious Metals trade will be based on Volatility, not price.

DEC GOLD Resist: 133180, 133350*, 134250* ST Trend: Sdwys/Down(132270) Supprt: 1319, 130950 Obj: 1306- TRP: 1342.50Comment: The current slide is signaling a short term reversing turnover and calls for further reactionaryselloffs to the failed upturn to drop trade around 1306-1294. A close under 1319 will help fuel selloffs. Anycorrections trapped to sideways congestion under 133350* should bear flag. A close over 134250* isneeded for a reversing upturn

Stocks Today

Equities are far more interesting today. Which makes gold interesting by proxy. But Stocks offer some compelling info. Get some popcorn because we feel the show is just starting.

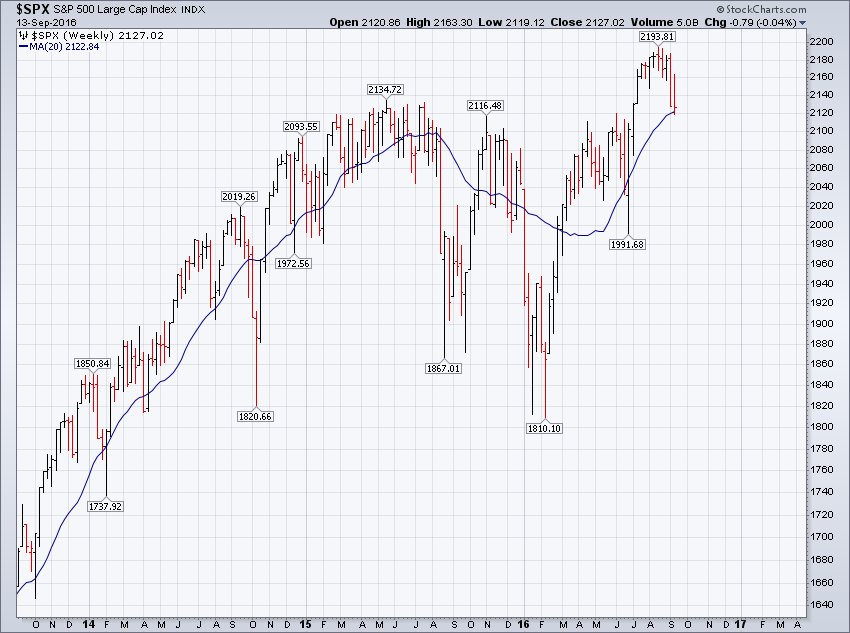

- The market rests on its 20 Week MA. -It does not do that often. See chart below

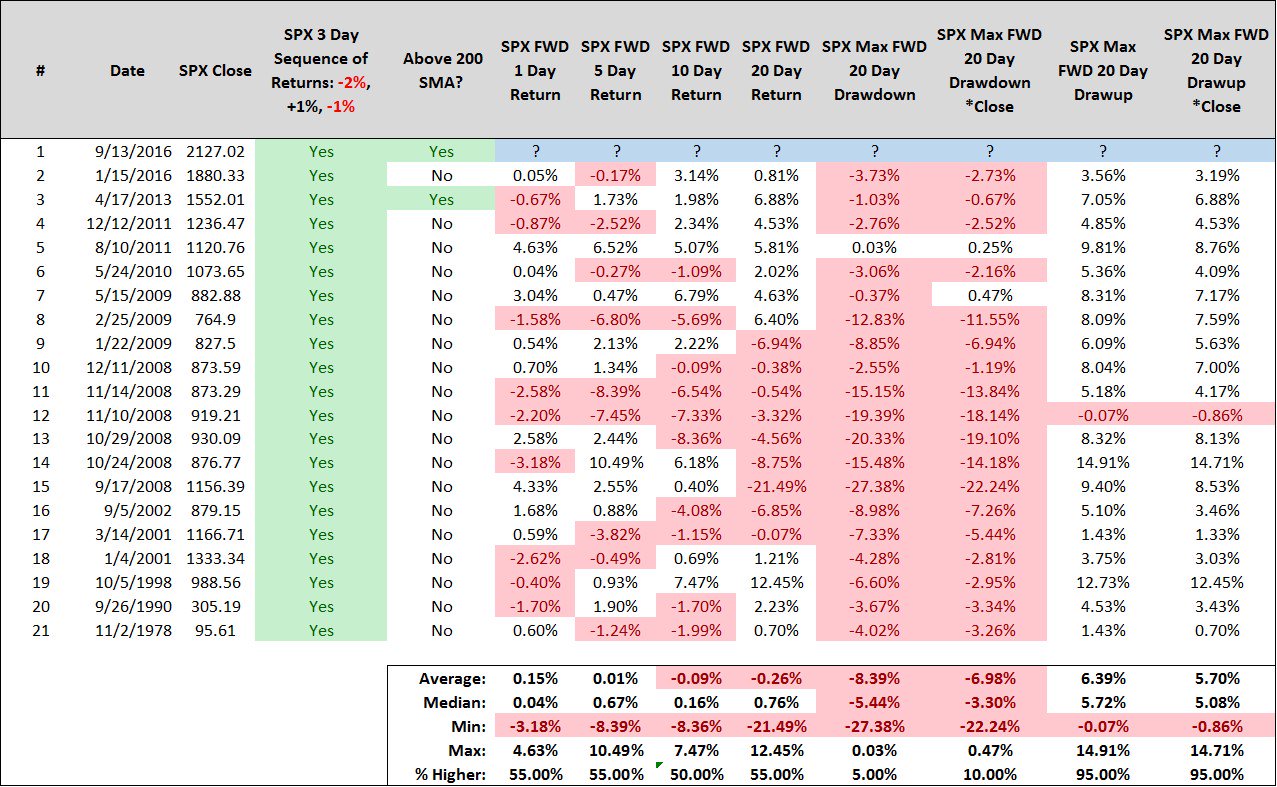

- The past 3 day sequence of -2%, +1% and -1% has occured only 1 other time since 1970

- Above the 200 DMA

- Correlation is not necessarily causation

- Traditional Technicals are Bearish- might be a counter indicator?

Follow: @SJD10304 for More Analysis

-2, +1, -1 Backtesting

Inflection points: Another example of "Which way will it go?

Sticking with our options competency and cold hand directionally:

- Buy a Call spread hedged

- Mkt drops- Stochastic Vol works in your favor as does hedge- profitable

- Mkt Rallies- Stochastic vol and change in Vol exposure works- possibly profitable if rally is quick

- Call spread deltas should be around +40 Delta/ -20 Delta

- Rally- you want that Call to become a Put on the vol curve (skew offsets change in vol lower)

- SellOff- Good gamma, good change in vol exposure

- Unwinding/ Taking Profits

- many choices with many accompanying risks

- This is not an easy/ clean trade

- If you do not understand options or aren't clear on how to exit, don't even think about this

We are at an Inflection Point. That is enough to know if you already have a position

DEC MINI S&P TRP: 2151.25

- Mkt remains in bear reversal after failing at TRP

- Follow through needed to 2100

- Under 2100 > 2065= capitulation

Suggested Reading Today

- Good Morning: Stocks, Gold Up Slightly, Trump takes 5% Ohio Lead

- Algorithms Are Spoofing Gold and Silver NOW

- Ron Paul: The Fed Plans for Its Next Crisis

- JPM Owns, Controls Approximately $9 BB in Silver-13F

- Top 10 Corps Have Bigger GDP Than Most Countries

Read more by Soren K.Group