Technical Brief: The Tudor Jones Way

Late last week we described a simple risk/ reward trade that presented itself in Gold. Here it is.

That trade was stopped out. For us, that trade is done. But if the risk reward is still there or improves there are traders who have made fortunes repeating the trade. Today's candle gives us such a set up.

- The first trade was stopped out

- The closing candle shows a potential hammer, implying that we will not be here

- Gold is sitting right in the area where our stop was

What do you do?

If you are Paul Tudor Jones you do it again with tighter stops. And you keep doing it intraday until something else changes.We have seen him repeatedly stop himself out in Gold and Silver 5 times in a day.

For example. He's Bullish

- Buys at his level

- Gold drops $3.00 and he sells out

- Gold goes back up to his level of closing support

- He buys again

- And so on.

Do it Again

"Do It Again"

He looks like he is getting chopped to death. But if the market was at his level on the close, he gets in and takes it home. And he is applying this approach in 5 markets daily. So his bankroll management is key. With that in mind, here are the trade levels again, but adjusted for the Tudor Style.

- Get long on a print above 1331.40 or a settle above 1327.40

- Calculate your stop based on these moving parts: risk capital, number of contracts you are comfortable holding, intraday volatility, and the number of times you can tolerate getting stopped out without harming your confidence

- Similar to a Poker player never losing more than 2% of his bankroll in a hand.

- This ensures 50 hands and lets the law of large numbers work in his favor

- Put the trade on

- The target is $1380 with a possible overshoot to $1420

- You take it home only if you are in the money on day 1.

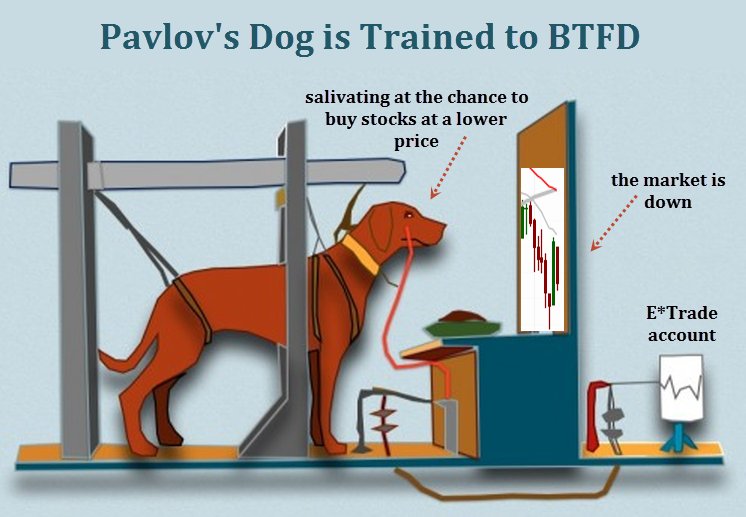

Just don't Turn Into one of These

What this forces you to do is lighten your volumes and let your profits really run. Risk 1.00 five times for the chance to make 50 in a week. We do not do this generally because it becomes hard to know when it is our own ego/ stubbornness getting in the way of our judgment. But this is the exact circumstance where we've wanted to do it, and have seen it done. It is just giving yourself permission to take another bite at the apple. And if you have the confidence of your convictions with a disciplined stop system, it is pretty straight forward.

DEC GOLD Resist: 134260, 134750*, 136430 Supprt: 133030-, 132520* TRP: 1325.20Comment: potential to test resistance in the low 1360’s. A breakout over 136430 targets a pressing bull move to reach back to 138060* weekly resistance. Near term pullbacks are trying to correct Tuesday’s rally. Friday’s weak actioncould prompt setbacks to 132520*, but only a close under 132520* marks a downturn. Suspect a bouncefrom 1330+/-.

Good luck

-Soren k.

Read more by Soren K.Group