Friday Stock Fallout- Play by Play

What Happened Friday?

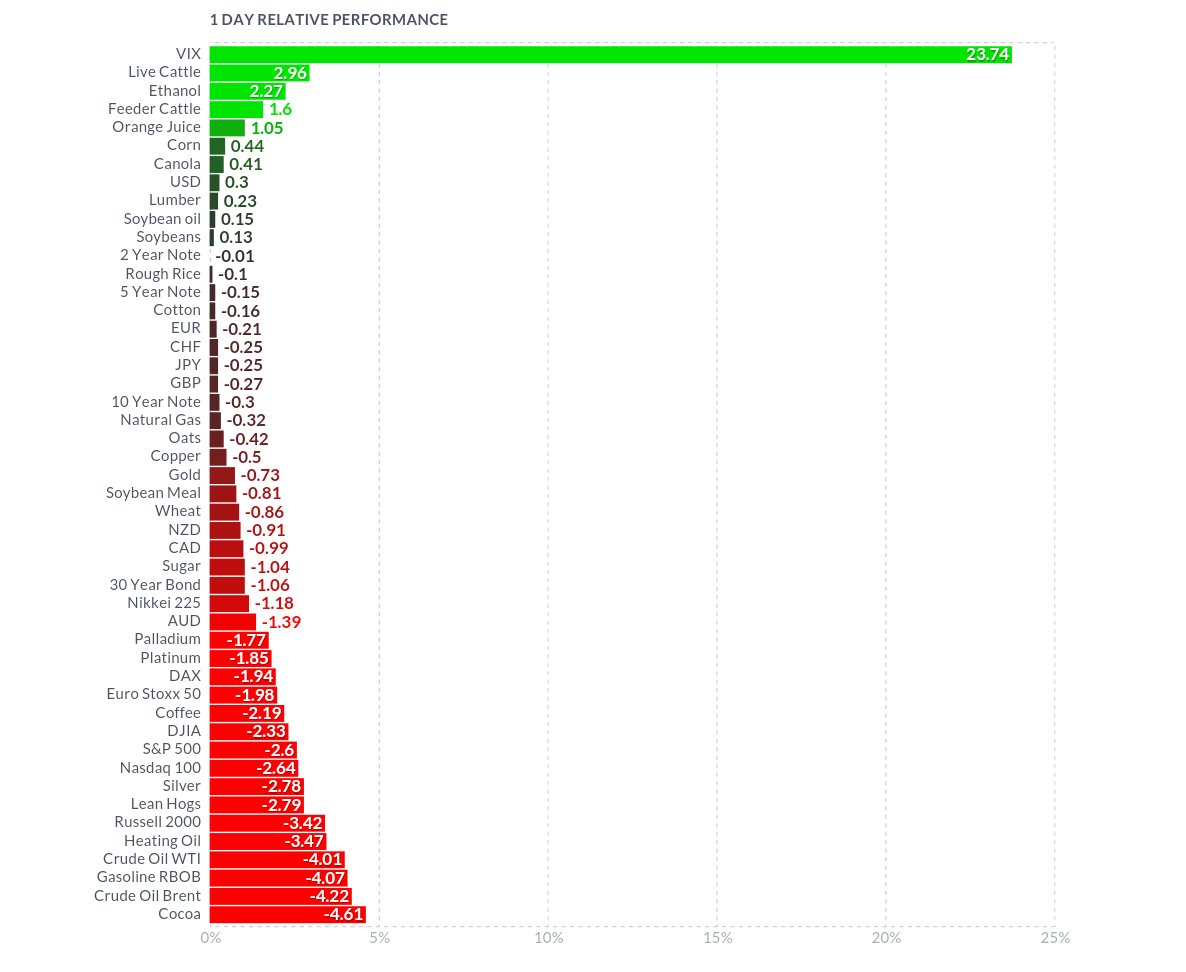

- Stocks and Bonds took a nose dive.

- The Dow closed down almost 400 points

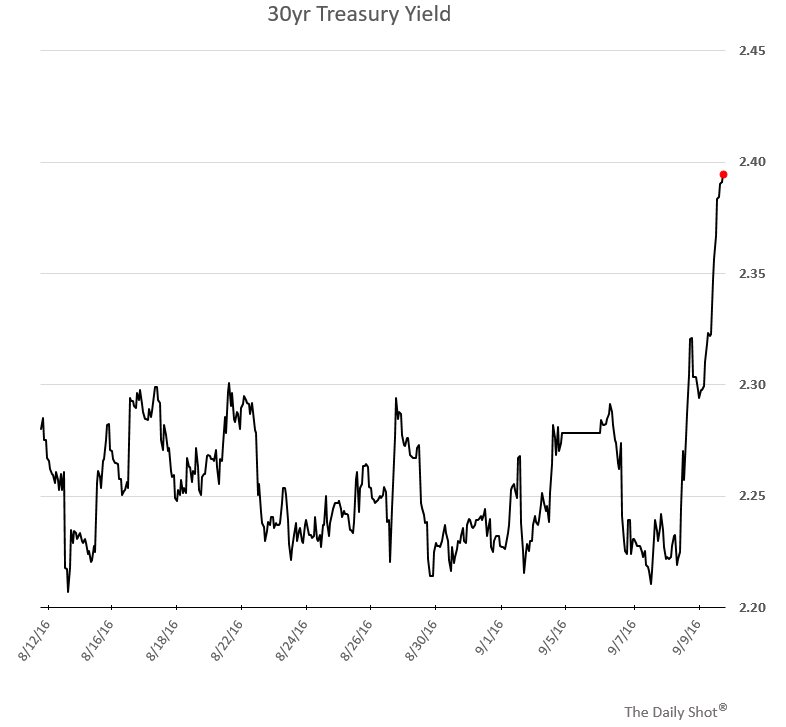

- The 30 Year Bond yield rose almost 10 basis points.

-Stocks

-Bonds

-Commodities

Oil and Gold were also casualties. To those who are long mining shares: operating leverage works both ways. And ebbing tides lower all boats.

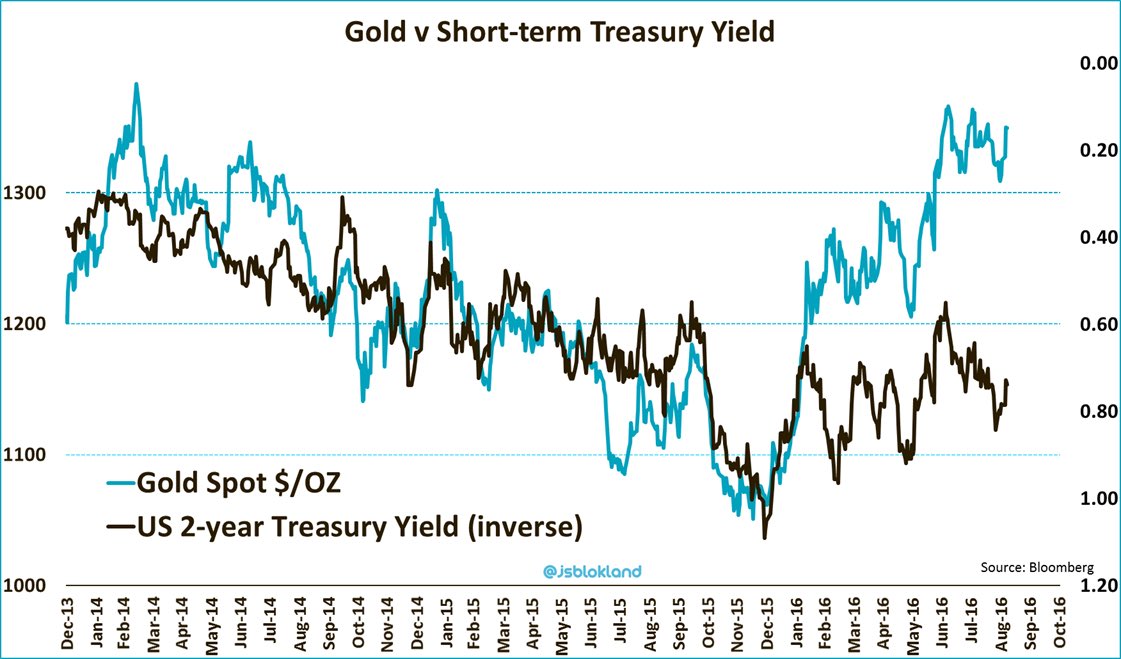

Gold is now a go-to indicator for Fed hike handicapping.

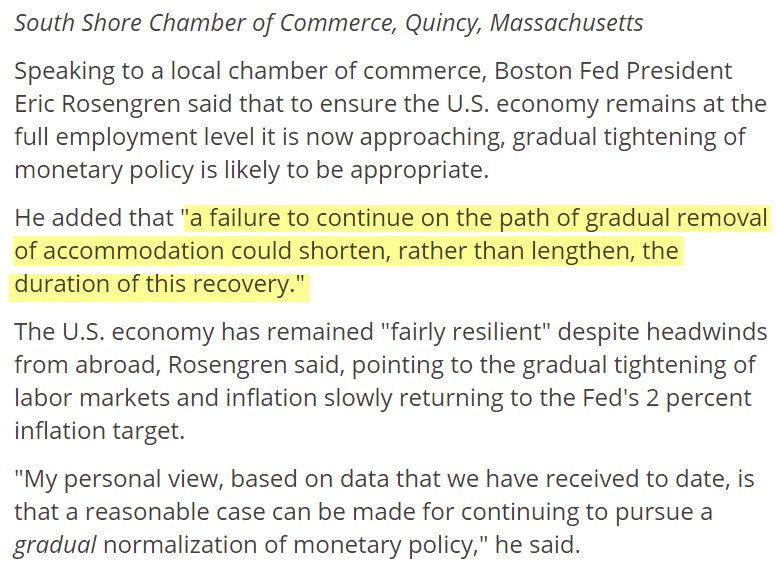

What Triggered it?

- Consensus is when mega-dove Eric Rosengren turned hawk during a speech

- Other less talked about reasons are :

- FRB limitations:

- They are in control but their effectiveness is waning

- They cannot raise because the economy is not recovering

- They can’t lower rates because the returns on stimulus are diminishing

- Market starting to Price in a Trump Win

- Hillary Clinton’s behavior Friday night

- Her fitness to act as POTUS can’t be ignored anymore

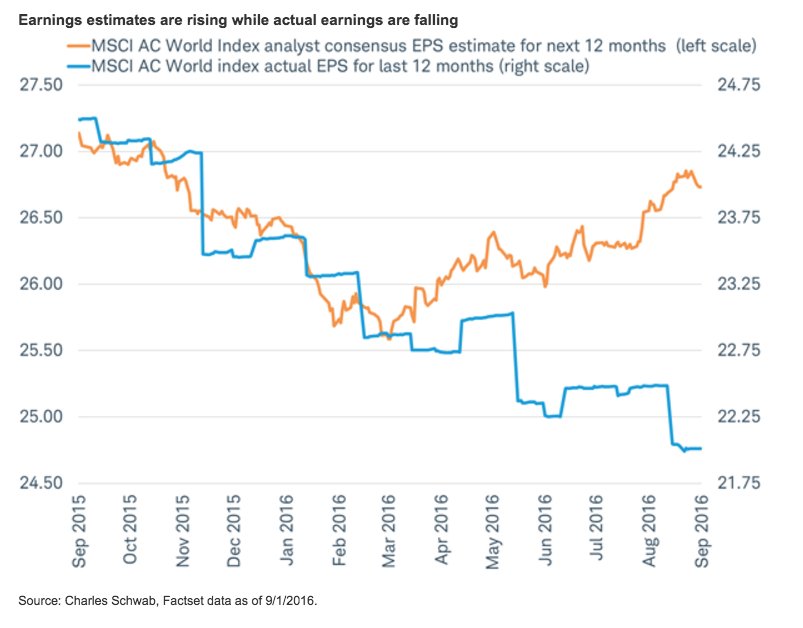

- Earnings disconnect from prices

- The divergence between EPS estimates and realized are growing

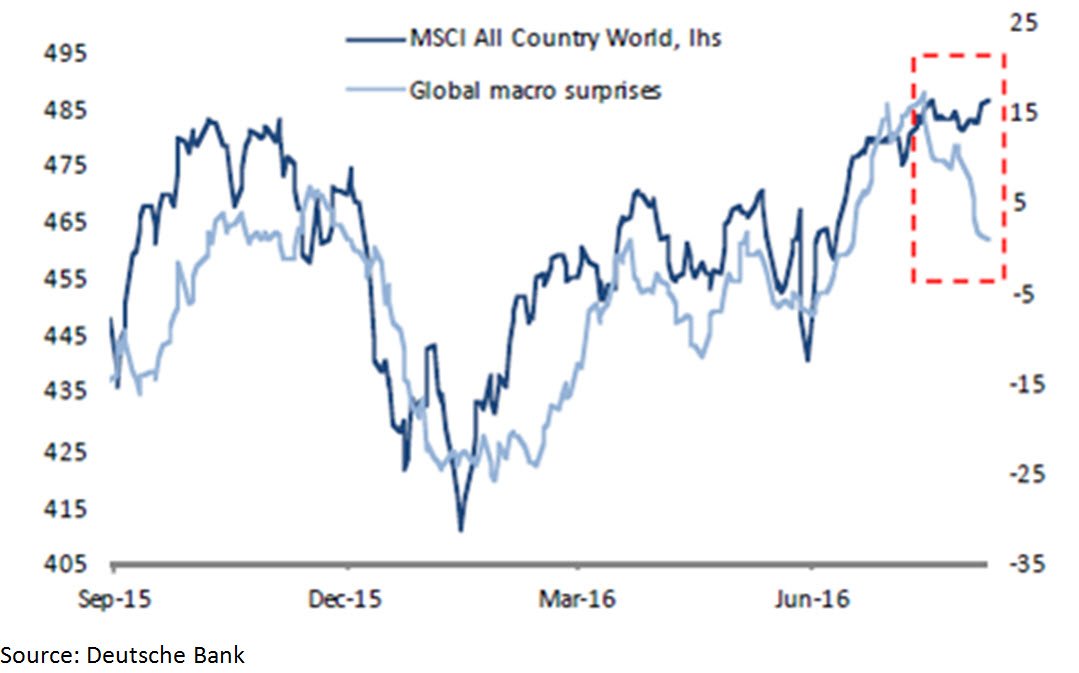

- Prolonged Disconnect from Global surprises like Brexit

- Global Markets continue to ignore global Macro Surprises

- Inflation is back on the Fed Radar

- The chart pattern shows a managed channel approaching their target

- We do not believe it and our wallets reflect that.

- FRB limitations:

Something Has to Give

Brexit, EU dissolving? What does that have to do with Prices?

Because 45 degree slopes are Perfectly Natural

Our Take

We think that the markets are starting to discount the Fed's inability to do anything productive right now. And left with an FRB relegated to Open Mouth (instead of Market) Operations, the focus is beginning to turn towards fundamentals. That is not a bearish statement. Who knows what rabbit the Fed can conjure to keep things afloat? We are just saying that the market is less mystified than it has been with their levitation act.

What is Likely to Happen This Week?

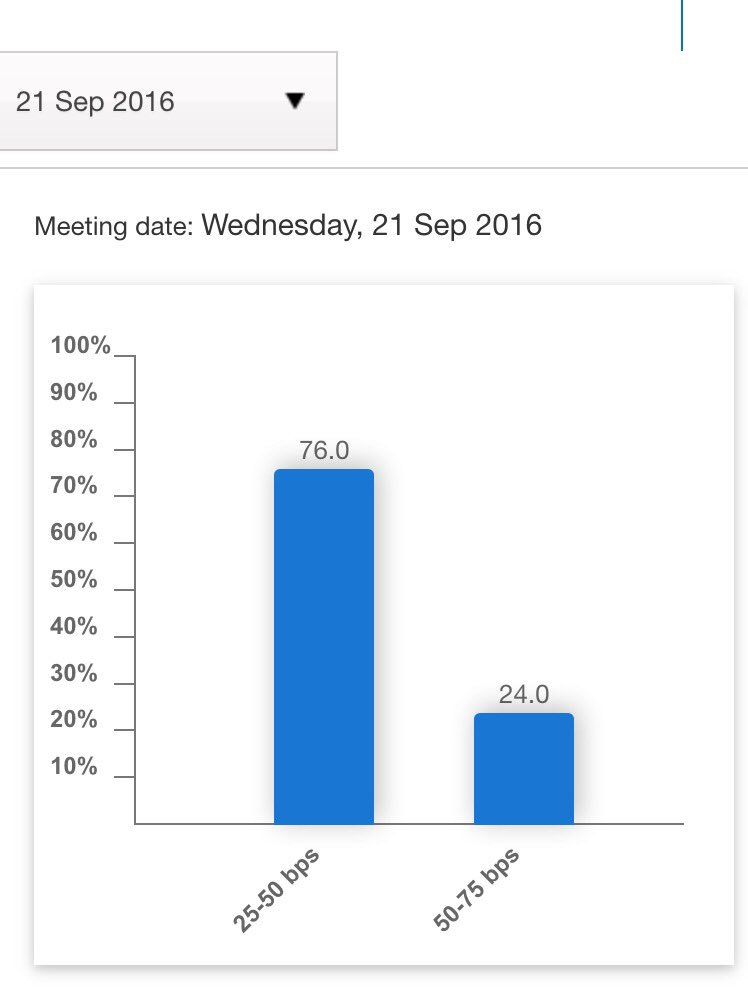

Fed Action

We do not believe the Fed can hike. The politics, economic data, and price action tell us they cannot do so at least until December. Conversely, we also feel they must hike before they do a QE4 or Helicopter money. Their effectiveness is waning, almost like the Emperor is doing a slow strip tease before our eyes. But looking at where we are now, how can anyone oppose Fed intervention, given that they are the cause of this? The lack of courage to take our medicine years ago has put us in a position where to take the proper dose now would kill us. So we are wed to the Fed.

- Did Hillary Just Push Stocks Over a Cliff?

- On Tap Sunday: Stocks might be in trouble, Hillary's in Jeopardy, and a Gold recap

Odds of a Sept Rate Hike

Market Action This Week

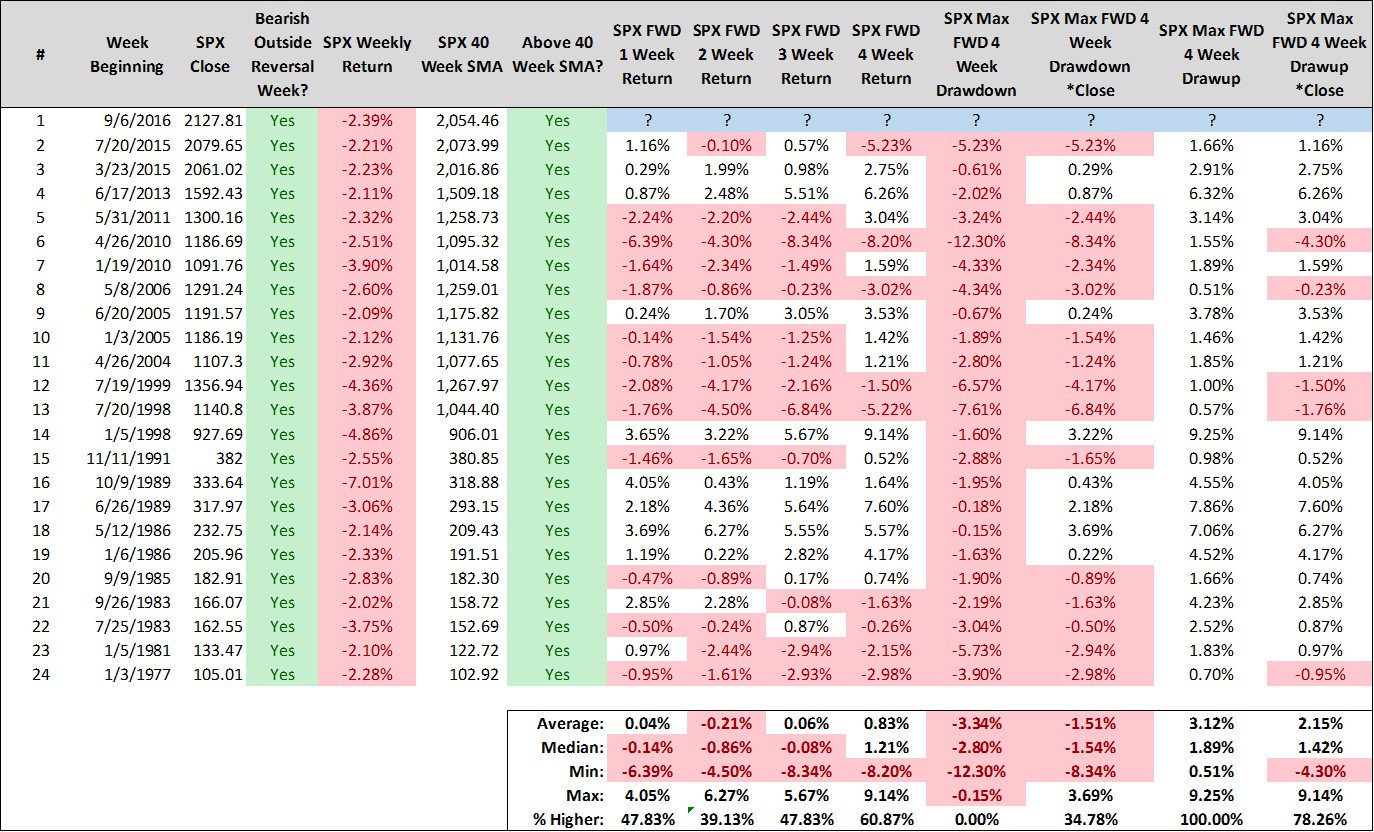

Bears will see a failed breakout and Bulls will see a pullback to buy

Notable:

- This is just the 26th week since 1970 where we closed on the week’s lows

- The 24th Bear Reversal week when the S&P fell 2% but closed above the 40 week SMA

- If you remove weeks where the market was not coming off of the highs (blowoff bottoms)

- Goldman and DB trotted out their Bearish reports faster than you can say BOO after the selloff. Almost daring the Fed to do something supportive

Historical Perspective- Another 4% to go?

H/T for the Chart and Recommend following these people for market analysis on Twitter

- @SJD10304-Proud Father x 3, Fee Only RIA, Stats & Chart Lover

- @anilvohra69- Retired UBS Rates Options trader.

We see a potential selloff range of another 4-8% at the extremes over the next month historically.

There are other factors to consider when looking at the data above. But the people who collaborated to create this are almost religious in their scientific approach to testing ideas. How one interprets that data is entirely subjective, as are we.

Final Thought

We were expecting a crisis after a Fed hike. This would give the Fed the bullets it needs to start QE4. But a selloff through the week will put a serious dent into that hypothesis. "Tangents within a framework" is our style. So maybe the Fed buys the market through proxies adnthen raises rates. Maybe it does nothing and the crisis just give sthem carte blanche to monetize our debt forever. Division by zero will be the last mathematical law broken.

FTA:Why Gold Bulls Should Want a Rate Hike- Analysis

How does it happen? We are not sure and are never married to the order of events. Being able to create tangents within a framework of concepts is easiest and keeps our thought process least biased. But right now it could go like this:

- Japan will start the ball rolling. Stocks and Gold will rally there in yen terms. Japan started this global deflationary cycle. They should be the first out of it

- China will have to further accelerate its Yuan depreciation against the USD. Remember their reaction to the Brexit vote? China potentially lost a favorable link to the EU via its relationship with the UK

- The UK and EU will also then consider more QE and helicopter money. Their reasons will be different, but their actions will be the same. For the EU it will be to rescue Italian banks. For the UK, it will be to help their exporting commerce.

- There will be a "whiff" of inflation but no-one will pay much attention

- The US will be forced to capitulate on its own Fiscal stimulus citing the damage done to our economy by a strong dollar etc.

- Stocks, bonds and Gold will rally with Stocks outperforming everything in what should be a massive blowoff top for them and Bonds

EDIT: Somewhere in here, the Fed will raise rates (9/11-OR MAYBE THAY CANT). Potential reasons are a soaring US Stock mkt post JCB Helo money, and/or a strong Aug Jobs report. Or later if neither happen for the Fed. Sometime Post Election, obviously- SK

Read more by Soren K.Group