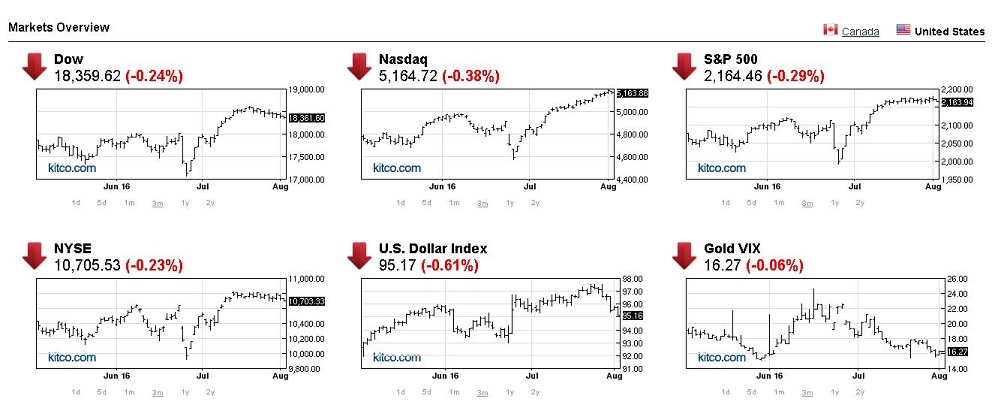

Stocks slipped Tuesday as investors await Friday’s employment data. The S&P 500 slipped 0.5%, the Dow Jones Industrial Average was down 0.4% and the Nasdaq fell 0.4%.

The U.S. stock market seems overheated and with a Goldman Sachs research report recently downgrading stocks to “underweight,” markets are looking expensive. is it time to get out?

“I think it's quite possible we could get a move up to around 10 percent lower, we thought for a long time that markets are stuck in what we described as a 'fat and flat' range," Peter Oppenheimer, chief global equities strategist for GS, told CNBC Tuesday.

"(Stocks are in) a sort of wide but volatile trading range with relatively low returns. And we think we're at the high end of that trading range and moving towards the lower end is quite likely given the rally that we have seen."

Meanwhile, gold prices hit a 3-week high Tuesday on the back of a slumping U.S. dollar. December Comex gold futures last traded near session highs, up $11.90 at $1,371.50 an ounce while the U.S. dollar fell some 0.6% on the day.

Read more by Wall St. Whisperer