Algorithms Are Spoofing Gold and Silver

" If you want someone to buy from you, you have to bid first to get them to join you. Then you smack their bids. Otherwise how will you get exit liquidity? "

Summary

submitted by Soren K.

Written by Vince Lanci - We have described the mechanics of spoofing markets many times over the years. During my 25 year trading career I have seen it in trading pits as an option marketmaker and on screens. What we have known for years but could only induce from evidence and Bayesian probabilities, Nanex founder Eric Scott Hunsader has made a science out of.

Today in Silver

Here are his observations on Gold and Silver today from twitter

Every single morning, I notice 100-lot orders suddenly appear, then disappear in COMEX (CME) gold futures

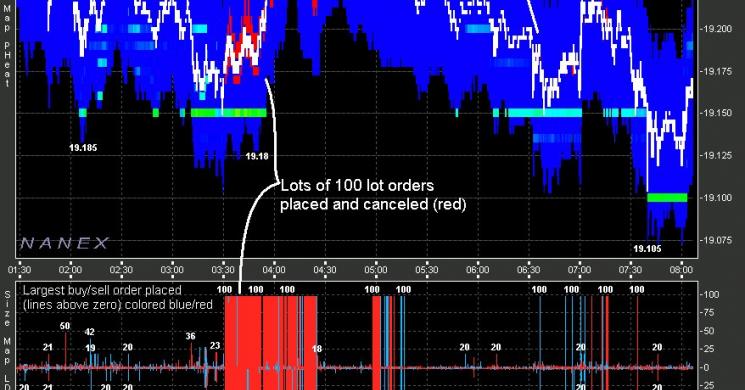

The 100-lot spoof pattern seen in Gold shows up in Silver too.

Between 3:30 - 4:30 ET in Silver futures today, a 100 contract buy order was placed/canceled 207 times.

During this same period, a 100 contract sell order was placed/canceled 246 times

Visual Proof

While we see imperfections in market structure, Nanex has pointed out exactly where they exist. Using the same inductive process but armed with the technology to recognize micro patterns in electronic trading, Michael has proven as far as we are concerned that spoofing markets is a far bigger problem than most people understand.

The 100-lot spoof pattern seen in Gold shows up in Silver too. More blatant than Sarao h/t @__i960 $SI_F pic.twitter.com/RnF3UknKci

— Eric Scott Hunsader (@nanexllc) September 13, 2016

Recommend following Eric for insights into market structure, spoofing, and HFT analysis

Twitter: @nanexllc

Website: Nanex.net

The Algorithms Have One Mission

Note this spoofing is to make money. It is not bearish or bullish manipulation. It is basically stop-fishing and front-running. So what is happening during time periods of these order flows?

Hunsaker Opines:

“Someone turns on a money machine. Really”

From our experience we believe he simply means that an algorithm that has been optimized for a certain time frame to maximize its profit potential is simply turned on. A switch is hit and the money is printed.

HFT Spoofing's Roots

HFT spoofing is rooted in old floor tactics and I've said as much in several interviews and articles on market manipulation. Here is an example on a screen, but the likely motivations are rooted in old Gold Bullion Banks behavior.

From the Aug 25th article: Why was $1.5 Billion in Gold dumped in a few minutes?

Sell to Buy?

What would make someone dump $1.5BB (10,000 contracts) of Gold into an illiquid market if not to spoof it lower or mishandle an order for an exiting client? What could the origin of sincere, general, urgency be for this to happen? That is not rhetorical. Mind you we are short and think this is nonsense.

Who Benefits From That Trade?

From the same article

How to Exit your Shorts in Precious Metals:

- Someone is short too big for their risk manager

- They want to cover before an event

- they sell a couple thousand lots in a thin market triggering sell stops of weak longs

- The original short covers their short position of anywhere from 8 to 10k lots.This is also why thin mkt is good, as the spoofer will likely be the only buyer.

- if not totally filled wait until the next thin mkt opportunity and do it again.

- Event happens and they either get short again, or get stopped in long on client resting orders

Also works when a Bullion Bank gets a large buy order and they are short. They spoof mkt lower and buy alongside the client, taking care to fill themselves first.- See PhiBro in its hey day

Full Article Here: Why was $1.5 Billion in Gold dumped in a few minutes?

Spoofing Moves Off Floor and On Screen

I had experienced it from floor to screen and was able to see patterns of abuse evolve at lightning pace. But a tuition had to be paid first to the bigger firms. Other marketmakers were not so lucky. Despite using top tier software, collocated server, and safety valves my firm still had been on the short end of the stick on spoofed trades in Oil, Gold, Natural Gas, Silver and other markets. That was until we realized our trades were getting throttled because of our i-link setup.

This was a whole new education for me. The actual technology was rigged to make me slower despite having the same hardware speed of major players. We had that changed and the spoofing stopped. We were lucky. But HFT algo fishing has killed genuine liquidity from marketmakers and replaced it with ephemeral liquidity. Market Flakers have replaced marketmakers.

What is Being Done About it?

When a cop wants to get a criminal leader, he will look to get underlings to roll over. They are easier and have weaker protections. But the real goal is to go up the food chain to the boss. Regulators use the same methods of going after the lower lying fruit. However, these are solo operators and do not report to the "boss". In reality they are the big players' competition. And some are eating the "Big Guys' " lunches.

So the regulator goes after the easiest prey, the solo operator. And they are successful. But instead of getting closer to the bigger offenders, the regulator merely alerts other offenders to their prosecutorial tactics. Enter Michael Coscia.

Michael Coscia Case

The Coscia case was the first criminal conviction against an HFT spoofer under the new Dodd-Frank laws. They were successful because they got to the programmer. When a person manipulates a market manually, it is almost impossible to establish intent because you do not have access to the person's brain.

However in the Coscia case they had the next best thing, his programmer. The programmer is told what needs to be encoded. That is the intent laid bare. The case is made by accessing the trader's brain through his programmer.

Result? A little fish who was beating the big fish at their game like he did on the floor for years was gotten out of the way. And the bigger players were shown the way to protect themselves if a case was ever pursued against them: Protect the Programmer. You will hear a lot more of "Sorry, that's proprietary information that we cannot disclose" if a regulator ever wants to depose a big firm's programmer.

Why Was Michael Successful?

We are not saying Michael was rightfully convicted. In fact we believe he was not based on the exchange's own rules. But we can say why he was successful pretty easily. He was a lower cost producer of the "spoof" trade than the banks. This allowed him to "get inside" the bigger spoofer's algos. This is not new. During my education at Cooper Neff & Associates we learned how to survive our competition, the big banks. And it applied to the reason Coscia was a threat to the Big guys.

- Big Banks had the 3 C's- Cash, Credit, Captive clients

- Their incumbency made them less likely to try new ideas

- Their protective moat was big enough to not worry about the Cooper Neff's of the world

3C Example- A banker once buried a trader in front of his peers who wanted a raise: "You don't make the money for us. The chair you sit in does. I can put anyone in it and the profits will be the same."

- Small trading firms had the 3 T's- Trading, Training, Technology

- Our people were better trained. They did not have order flow to front run

- We were better traders as a result, as managing risk was much more important

- Computer technology was leveling playing fields in every industry. A tool with which the little guy can compete and survive.

3T Example- Interactive Brokers was once Timber Hill marketmaking. Timber Hill itself was a Cooper Neff type firm, but with a centralized model for growth. Now they own the order flow after disenfranchizing the Banks with whom they competed.

Making Enemies

I used to make flat markets in NG Options and post them on the board. Then watch as the phones would ring and they'd ask who was on the market. "Sigi from Berard Capital" was the answer. And I traded both sides with any phone that was interested. For commissions they showed me their risk hand. My success and arrogance grew. They had to be reminded that they were not real traders!

Next I started posting inverted markets. like 7 BID, 6 OFFER. And the phones would ring as desk traders actually thought they could pick someone off. All because they had no flow to front run.

Then I honored the market: Tell your client I am 7 Bid At 6. When one side trades the other side is out. So sell me 7s or buy 6's from me. Noone traded either side. Reminding them of their utter lack of ability without orderflow was not politically smart in retrospect. That just might have been the beginning of my being a target. Michael Coscia was also on their radar I'd bet, for getting in the way.

Banks Lose their Moat, Get Tech Savvy

The three C's are no longer there

- Credit- is less important as risk is either collateralized and sold or exchanges are permitted to transact OTC with Clearport

- Cash- becomes cheap and Banks no longer are the only source of it in town

- Captive Clients- customers increasingly become free agents due to abuse of relationships, counterparty defaults, and need to diversify all risks.

As a result, big firms are forced to emulate hedge funds and adopt the 3T model. But the only T that matters is technology. Combining technology and lobbyists, they game the market structure to build a new franchise with a protective moat enforced by law.

If you are a small guy in their way you are in trouble. My own experience is a cautionary tale of letting my success get the better of me. All it did was put me on the radar of the big players. And if they couldn't squeeze me in trading like they did to so many others, they'd have no problem letting regulators know if something wasn't kosher. All it took was a single misstep for me.

And I believe it was with the tacit approval if not the active help of big HFT firms that the regulators successfully drilled down on Michael Coscia.

TBTF = Too Big to Exist

The Federal Government's policies post the 2007 crash have done nothing to reduce the concentration of systemic risk in our markets. They have in fact concentrated power in a smaller number of counterparties' hands. Price discovery is less reliable. Transparency of price is better, but less reliable. We like this statement made today on transparency, diversity in market participants and our growing systemic risk.

The Egress

It ends when the TBTF needs rescuing again. And then they become backed explicitly by the US Government. The Fed will be the marketmaker of last resort as a result of concentrating risk in the markets. The banks know this adn are spending your tax dollars to subsidize their behavior. In the mean time, spoofing is a tax on the common investor, real liquidity is an illusion once you remove the Fed directed order flow, and healthy competition has been wiped out. People now confuse volume with liquidity. But the market is increasingly becoming non-continuously liquid, like a house or capital good. You can get out until you need to.

From a public source

A top CME enforcement person told me their policy was to go after smaller traders "because they rollover, etc."

Other Articles and Interviews by Vince on Spoofing and Manipulation

- Elon Musk: How he played us

- What does JPMorgan need Physical Silver For?- MarketSlant

- The Mechanics of Global Confiscation- MarketSlant

- Guest Analysis: JPM Silver Decision Flawed by Vince Lanci

- Exclusive: A Deep Insider's Walkthru To Silver Market Manipulation- ZeroHedge

- RESET: Special Edition w/ Vince Lanci

A Former NYMEX Trader Explains "The Mechanics Of Silver Manipulation"- Zerohedge

Author's Background

During my career, I've been victim, observer, perpetrator, and now despiser of market manipulators and the market structure that rewards corporate greed at the expense of free markets. The little guy can no longer compete. Organizations that speak for him get shouted down because they dont have a PAC. Homogeneous counterparties will be the death of the markets.

As time passed I grew to despise manipulators but did not blame them per se. The market structures are the major culprit. Which in turn means the politicians who are lobbied by the corporations to alter market structure to protect Corporate interests are the culprits. In the end it is all about greed. Dodd-Frank was passed essentially blank.

My firm saw an arbitrage in 2006, borrowed money and took on the banks. Our counterparty's trader, BMO was (ironically) cooking their books. In the end I was a material witness in BMO's 2007 Nat Gas EOO scandal where they tried to sue the counterparties to their rogue trader. BMO settled the case days after my deposition involving manipulated settlements.

The markets need to be fixed.

Email: vlanci@echobay.com

Twitter: Vince Lanci @VlanciPictures

Read more by Soren K.Group